A new analysis by crypto strategist Ali Martinez suggests that Cardano (ADA) might be on the cusp of a significant upward move—potentially reaching the $15 price mark, which would represent a staggering 1,850% rally from current levels near $0.76. “If historical data is any guide, Cardano could be at the very beginning of a monster parabolic rally!” Martinez writes via X.

Cardano Fractal Analysis Points To Major Upside

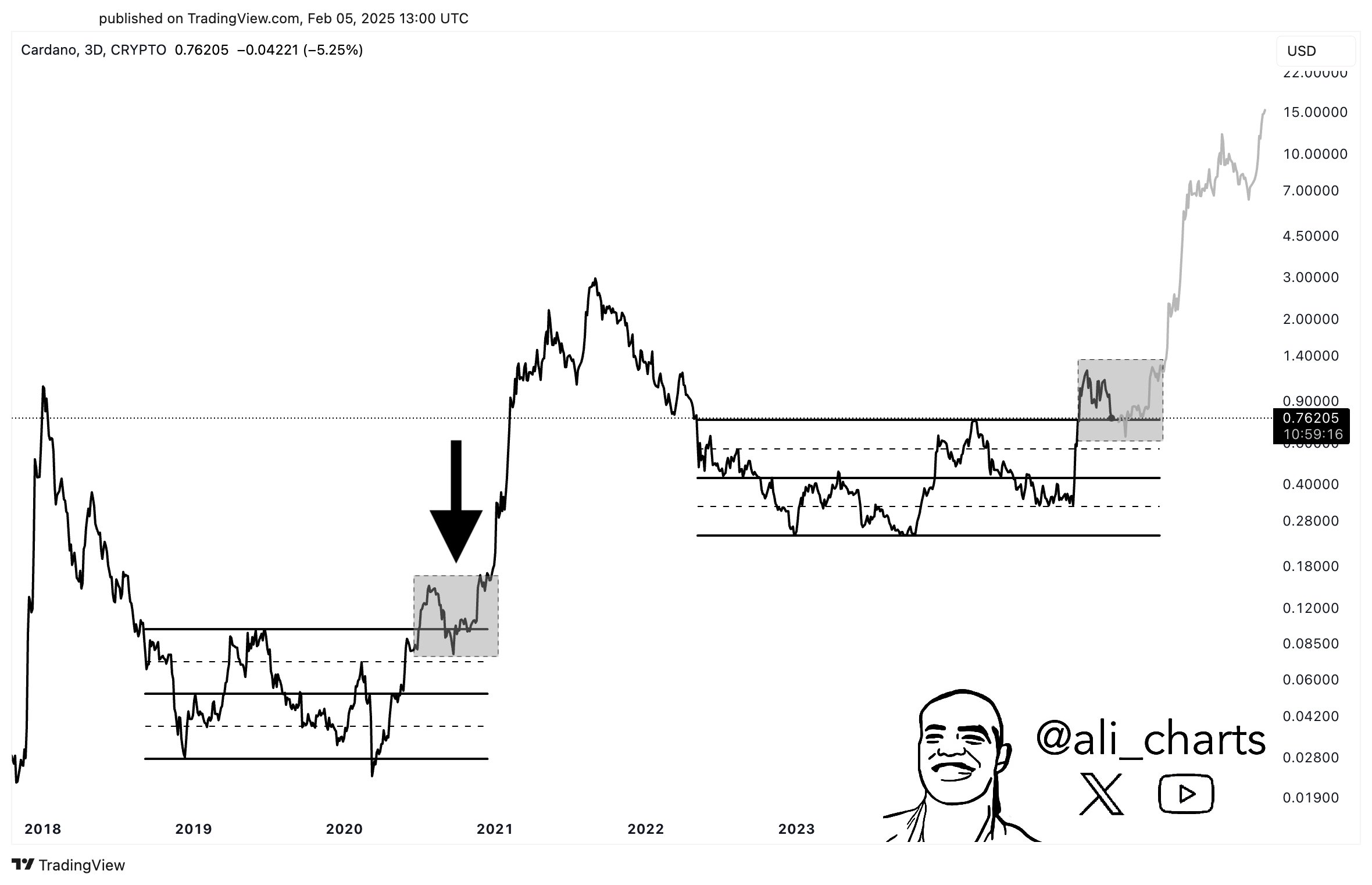

Martinez’s chart (published on the 3-day timeframe) draws a parallel between Cardano’s price action in the 2018–2021 cycle and its present structure, highlighting a near-identical fractal pattern. In the previous cycle, ADA consolidated for several months within a defined horizontal range before staging a decisive breakout and retest of the upper boundary. That retest then led to a parabolic ascent spanning late 2020 into 2021.

In the current cycle, Cardano appears to be retesting a similar support line, shown on Martinez’s chart as a horizontal band around $0.76–$0.80. If ADA were to follow the same trajectory that transpired in its last major rally, Martinez’s “monster parabolic rally” fractal implies a surge toward $15.

Immediate Support is currently at $0.76–$0.80. According to the chart, ADA is hovering just above a critical support zone—its role in the previous cycle was to provide a springboard for the bull run that followed.

The next significant resistance level is around $1.60, aligning with the upper boundary of the grey-highlighted zone on the chart. Notably this price level also aligns with the 0.5 Fibonacci retracement level drawn from the last bull market peak to the bear market bottom.

In the long term, the grey extended price line in Martinez’s chart illustrates the fractal-based projection, indicating that ADA could ultimately surge toward the $15 region. If ADA continues to follow this trajectory, the area between the 0.618 Fibonacci level ($2.00) and the 0.786 Fibonacci level ($2.47) could act as a temporary resistance zone, potentially causing a brief consolidation before the rally resumes its upward momentum.

Martinez’s view hinges on the idea that crypto markets often exhibit cyclical behaviors. In Cardano’s last major cycle, once a key horizontal level was reclaimed and successfully retested, momentum accelerated sharply, culminating in an explosive move. With the current market once again retesting a crucial support zone, Martinez posits that the table is set for another extended bull phase.

Of course, fractals are not guarantees of future performance; rather, they are visual aids that highlight how price structures can echo past market behavior. Whether Cardano follows this script depends on broader market conditions and investor sentiment. Still, the analyst’s forecast underscores why $0.76 is a level to watch.

At press time, ADA traded at $0.74.