Quick Take

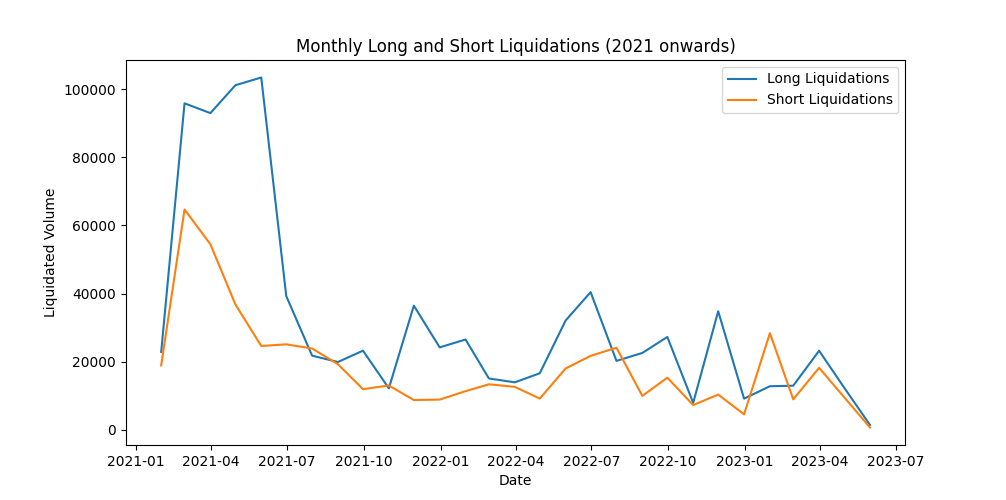

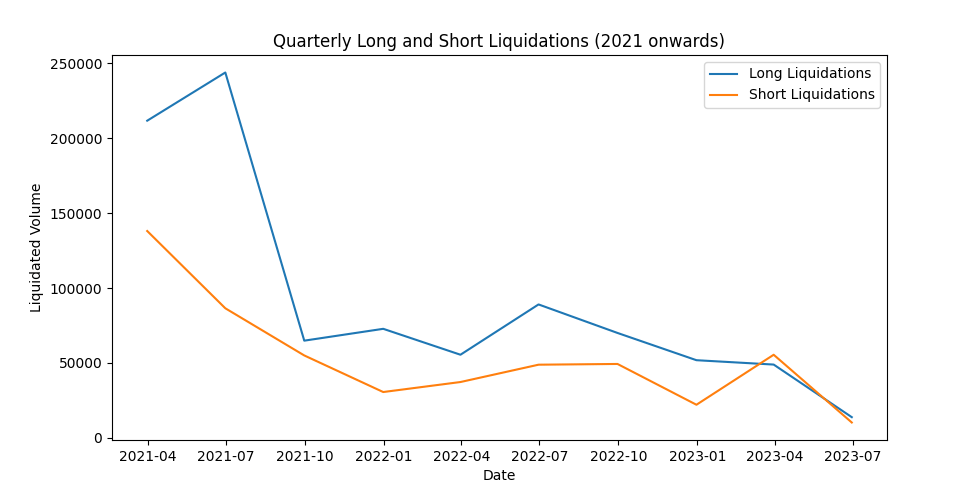

- Liquidations were one of the main talking points during the 2021 and 2022 cycles — long being liquidated for the better two years.

- Many reasons liquidations were plenty in 2021 compared to 2022 were due to leverage, whale activity, and market sentiment.

- As 2021 was a bull market, market sentiment was strong to the upside, and prices continued to increase. Hence, long liquidations on small pullbacks were obliterated.

- Into 2022, a bear market, and prices continued to go down 75% from their all-time high, investors wanted to go long at any moment; however, they continued to get burnt.

- Into 2023, it has been a mix of short and long liquidations; shorts did take pole position in 2023 and were on the wrong side. But now you can see liquidations are very similar in size, suggesting a neutral market.

The post Caught in the crossfire: how long and short liquidations shape the crypto market’s future appeared first on CryptoSlate.