Bitcoin started the year with a strong price rally, surging by 5% on January 6th to reclaim the $100k mark for the first time in weeks. The asset’s price continued its run up to $102,760 before undergoing a healthy correction, pushing it back below $100k. As of press time, Bitcoin trades between $96k and $102k, with total trading volume hitting $6.58 billion.

While Bitcoin’s recent price performance looks healthy, the asset’s funding rate data tells a different story. Based on Glassnode’s data, Bitcoin’s current average funding rate dropped to 0.009%, below its neutral level of 0.01%. Lower-than-usual funding rate data suggests a cautious long-term trading sentiment for investments, including Bitcoin.

After peaking at 0.026% in mid-December, the weekly MA of perpetual funding rates has cooled to 0.009% – just below the neutral 0.01%: https://t.co/CORjRx0X2k

This suggests a cautious positioning, with speculators showing limited willingness to pay premiums for long… pic.twitter.com/JwSPpZRpeG

— glassnode (@glassnode) January 7, 2025

A Look At Bitcoin’s Average Funding Rates

The average funding rate is just one of the technical indicators used to assess the market’s sentiment on Bitcoin and other investments. A funding rate, expressed in percentage, is set by crypto exchanges for their perpetual futures contracts. If this rate is positive, long positions periodically settle short positions; when it’s negative, short positions periodically settle long positions.

According to data, the funding rate’s weekly moving average dropped to 0.009%, below the neutral score of 0.10%. This week’s updated funding rate reflects a steep decline from the 0.0026% mid-December, suggesting a cautious investor sentiment for long positions.

Is Bitcoin’s Price Rally Sustainable?

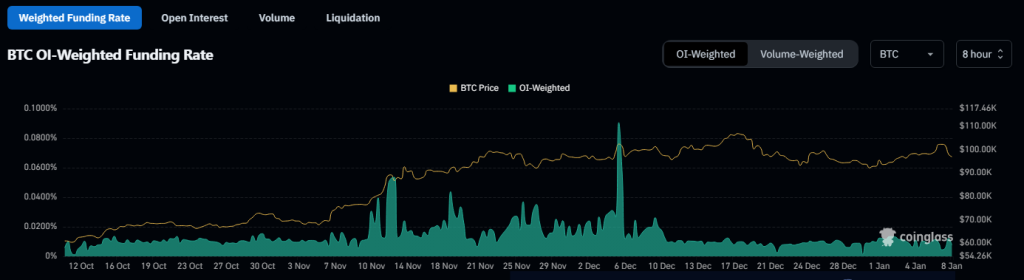

Coinglass also shared that the assets’ Open Interest-Weighted Funding Rate increased to 0.0058% but was still below January 5th’s high of 0.0113%. Then, Coinshares also revealed that the Volume-Weighted Funding Rate increased to 0.0051%, but still way below a previous high of 0.0111%.

Interestingly, the decline in funding rates indicates that most traders are cautious as Bitcoin struggles to hit and keep the $100k mark. Their reluctance to put their money on leveraged exposure means they’re not confident in Bitcoin’s ability to sustain its price surge soon.

What’s Next For Bitcoin?

Still, investors can find good news in the market this week. The asset’s derivatives trading activity increased, with its daily trading volume increasing to $85 billion, or a surge of 42%. Open interest saw a modest increase of 2%, and the asset’s Long/Short ratio is set at 1.0243, which makes investors’ sentiment neutral. Also, Bitcoin’s Chande Momentum Index (CMI) increased to 58.71 during the price rally, which topped $100k, but this slowed down as the price settled below $100k.

Featured image from The Independent, chart from TradingView