The SEC appears to be clamping down on crypto services offering yield-bearing products to U.S. citizens. Celsius Network is the latest in a series of crypto services that have had to close their doors to U.S. customers who do not qualify as accredited investors.

An announcement on their website states:

New transfers made by non-accredited investors in the United States will be held in their new Custody accounts and will not earn rewards.

Current users of Celsius’ Earn products who are not accredited investors will continue to receive rewards for their coins. However, any new coins or new customers will hold their coins in custody but earn no rewards. Whether Celsius will be able to stake these coins themselves is not currently known.

Gatekeeping wealth building

An accredited investor is a specific term in the U.S. for high net-worth individuals. To qualify, you must have either $1 million in assets; earn over $200,000 per year; be a private corporation with at least $5 million in assets, or be a registered professional investor.

The goal of the definition is to protect people who lack the knowledge and understanding of complex financial products from investing in products that they do not understand. However, it is hard not to view this as gatekeeping when only the wealthy are deemed suitable to invest in some of the most attractive yield-bearing products.

Moreover, how having a high net worth qualifies you as having a solid understanding of financial instruments is questionable.

By restricting individuals who do not meet the criteria for accredited investments, there is an argument that the SEC is hindering the middle and working class from improving their positions in life.

Without access to compounding interest products offered by companies like Celsius and BlockFi, it is hard to see how unaccredited investors can build their savings outside of long-term products such as pensions and 401Ks.

One of the central tenants of crypto is to empower everyday people to take control of their future by breaking away from the traditional financial system. But unfortunately, the SEC is closing off some of the most mainstream crypto savings products by forcing these companies only to serve millionaires and professional investors.

Other examples within crypto services

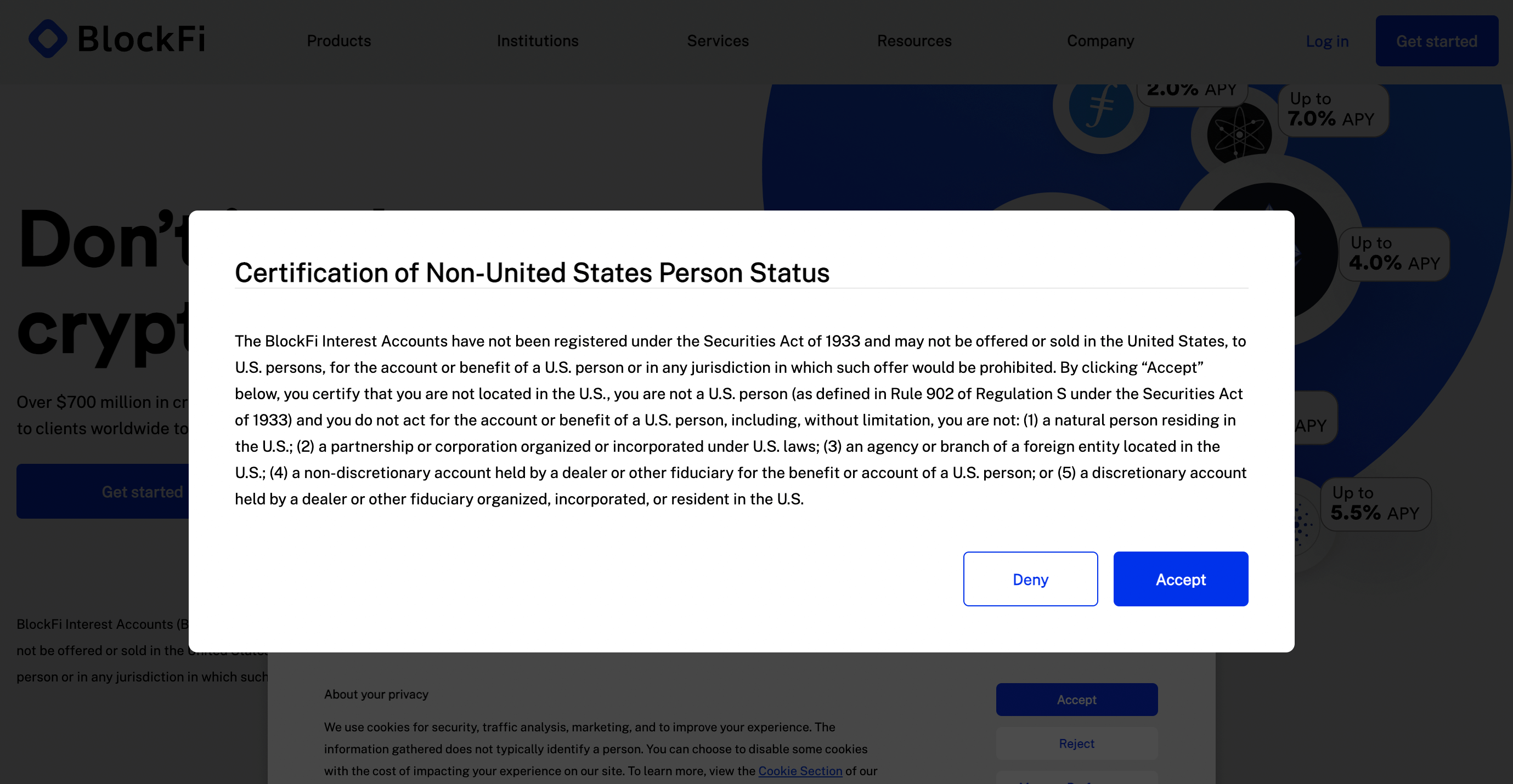

Following BlockFi’s $100 million fine for offering “unregistered offers and sales of the lending product, BlockFi Interest Accounts (BIAs),” the company recently ceased offering its products to U.S. investors.

A disclaimer pop-up on the BlockFi website requires users to confirm that they are not U.S. citizens before entering the website. However, a community manager on Reddit, Brandon_BlockFi, confirmed on April 12 that the company still offers its BlockFi Personalized Yield to eligible high net-worth U.S. clients, which is a separate product from BlockFi Yield.”

However, any U.S. person who does not qualify as a “high net-worth” individual no longer has the right to use any of BlockFi’s services.

Advocating for financial freedom

Following the changes, Celsius said it remains committed to crypto and decentralized finance principles. It added that:

“[We] will never stop advocating for financial freedom, and we thank our community for their ongoing support. We will continue to provide updates as we engage with regulators and ensure the delivery of our services to our users globally.”

It seems that Celsius is, at least on paper, attempting to “engage” with regulators to re-enable its services to the general public potentially. However, given the current regulatory landscape in the U.S., it is understandable that they would be careful with any statements that may appear too adversarial.

However, it is unlikely that Celsius will reverse the move anytime soon. Biden’s recent executive order promised innovation and progress in the digital assets space. However, forcing companies to stop serving those who need their products the most seems contrary to this vision.

The post Celsius stops offering new products to non-accredited investors in US appeared first on CryptoSlate.