Celsius (CEL) entered the list of top 10 gainers in the last 24 hours after posting the eighth highest gain for the day at 13.41%.

Celsius developments

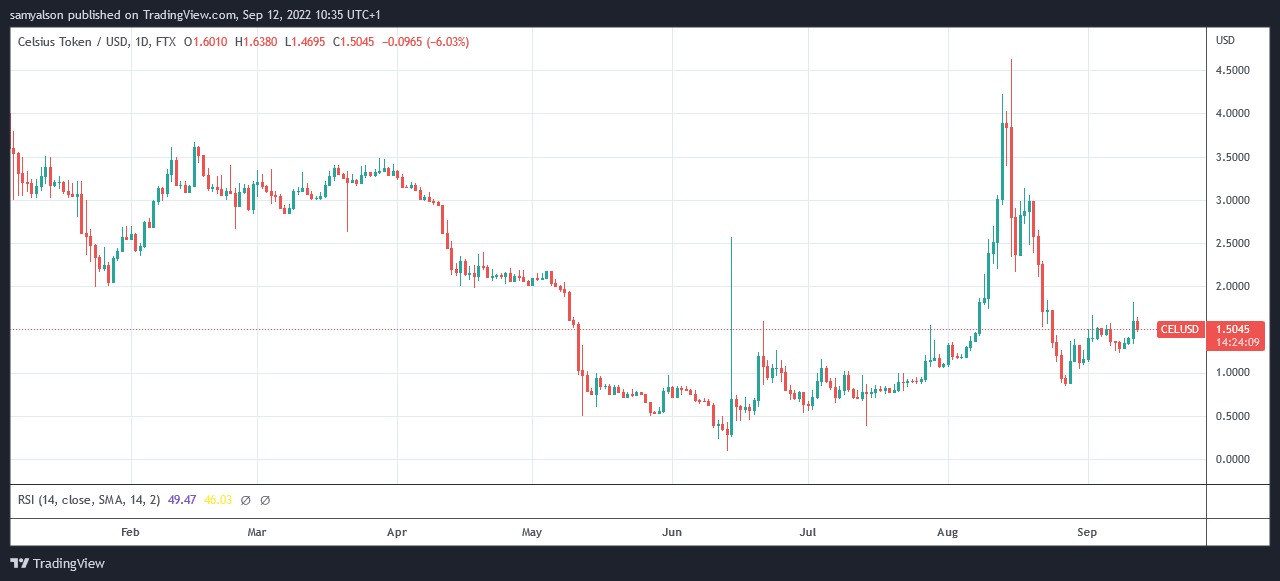

Since forming a local bottom of $0.86 on August 27, CEL has been closing a series of higher lows on the daily chart.

Following the CEL price peaking at $8.05 on June 4, 2021, the token has been trending downwards to bottom at $0.08 on June 13. Since then, CEL ran up as high as $4.62 on August 15. But given the uncertainty of the company’s situation, it is unclear what drove this spike.

On June 13, the company announced a pause on withdrawals due to “extreme market condition.” Weeks before the announcement, rumors were circulating that the company was insolvent. Some Celsius users had reported difficulties in withdrawing funds, fueling the speculation.

Numerous allegations have since emerged that center around poor, even fraudulent, management of user funds. This included high-risk, high-leverage trading that came unwound as the Terra ecosystem imploded.

After several DeFi loan repayments, Celsius filed for Chapter 11 bankruptcy on July 13. Court filings and whistleblower statements have revealed the company’s inner workings, including claims of CEL price manipulation.

The last communication from the company’s official Twitter was on September 1. The post mentioned progress on “streamlining” the claims process in the coming weeks and a court request to redact personally identifiable information from “select materials.”

What is behind the move?

The lack of positive fundamental developments suggests speculative forces are behind CEL’s recent price spike.

Twitter account @CELCATOFFICIAL posted that the hashtag #CelShortSqueeze is currently trending. However, some would argue this is a manipulated effort rather than organic interest.

#CelShortSqueeze is Trending because we're UNSTOPPABLE!!!

LETS GOhttps://t.co/kWvq7XJHse

— 𝗰𝗲𝗹 𝗰𝗮𝘁 🅒° (@CELCATOFFICIAL) September 12, 2022

Short squeezes alone do not typically provide sustained price increases, as speculation rather than underlying fundamentals fuel the move higher.

Another “dead token,” Terra Classic (LUNC), has recently posted 280% gains over the last 30 days. However, this was attributed to efforts to revive the token through new features, including token burning and high APY staking.

The future of CEL is unclear at this time.

The post Celsius token among top ten 24 hour gainers, up 13% appeared first on CryptoSlate.