Data shows Chainlink has been seeing many social media discussions recently, which may be bullish for its price.

Chainlink Social Dominance Has Seen A Spike Recently

In a new post on X, the analytics firm Santiment has talked about how the Social Dominance has been looking like for Chainlink recently. The “Social Dominance” here refers to an indicator based on the Social Volume metric.

The Social Volume tells us about the total amount of discussion that a given topic or term receives on the major social media platforms. The indicator determines this by reviewing posts/threads/messages on these platforms and noting which mentions the term.

This metric doesn’t count up these mentions itself, but rather the unique number of posts that contain them. The reason behind this methodology is that the pure number of mentions can sometimes be deceiving of the actual amount of discussion across social media.

This happens, for example, when only niche circles are talking about the term. They may partake in much discussion, but these high mentions don’t reflect the rest of social media. By counting only the unique number of posts, the social volume spikes when the talk is spread out more.

Social Dominance, the actual metric of interest here, keeps track of the percentage of the Social Volume related to the top 100 cryptocurrencies coming from a given coin.

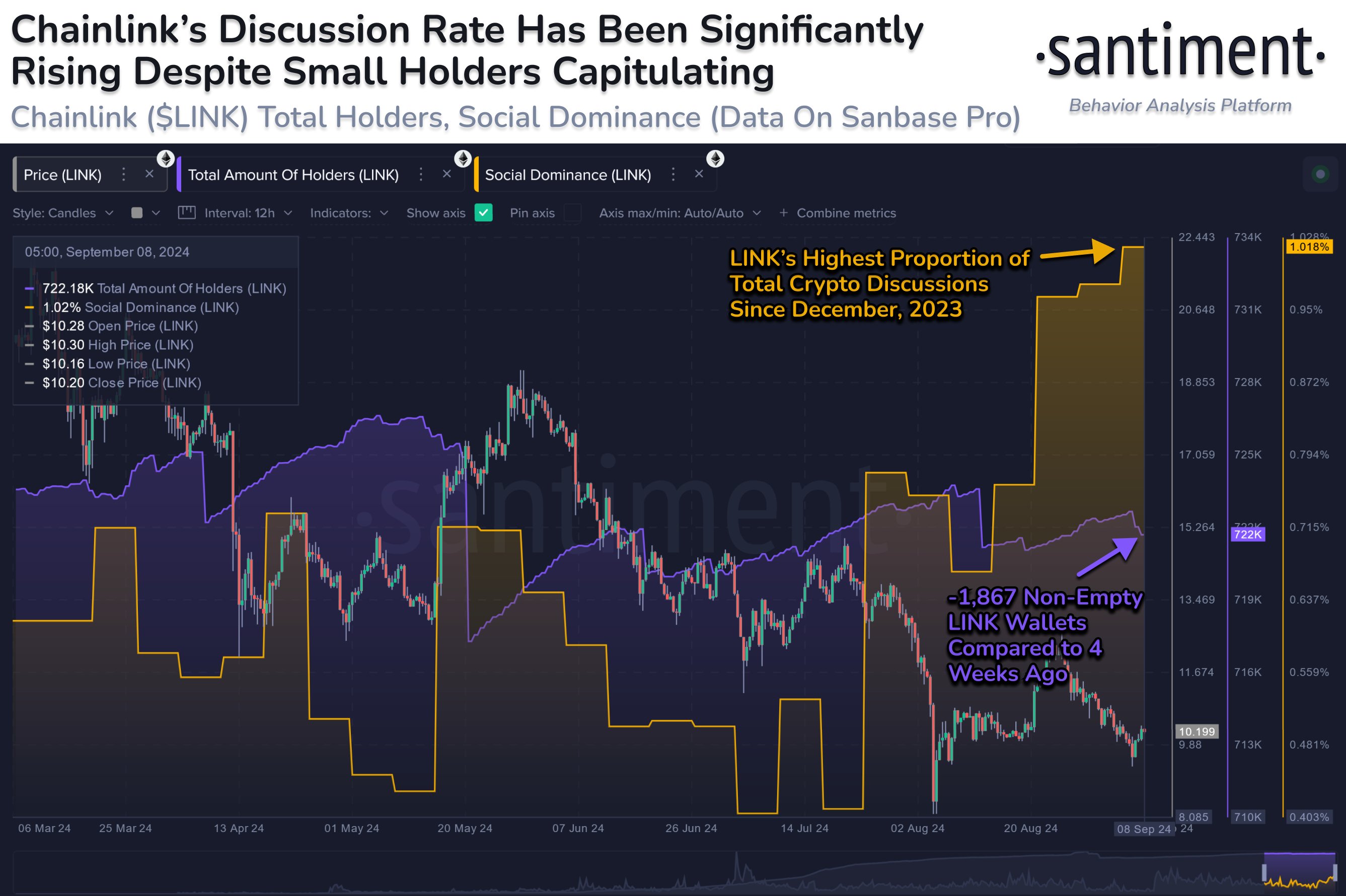

Below is the chart shared by the analytics firm that shows the trend in the Social Dominance for Chainlink over the last few months:

As is visible in the graph, the Chainlink Social Dominance has been rising over the last few weeks, suggesting that the asset’s share of discussions on social media has been increasing.

Following the latest continuation of this uptrend, LINK’s mindshare on social media has grown to around 1% of the total Social Volume of the top 100 digital assets by market cap, which is the highest for 2024.

In the same chart, Santiment has also attached the data for another indicator: the Total Amount of Holders. As its name suggests, this metric measures the total number of LINK addresses carrying a non-zero balance on the network.

Interestingly, while this social dominance increase has come, the total number of holders has decreased. More specifically, around 1,867 addresses have emptied themselves over the last four weeks.

According to the analytics firm, this decrease is caused by capitulation from the small holders. Santiment notes that the Social Dominance trend combined with this FUD from the retail investors is “generally a bullish signal if markets stabilize this upcoming week.”

LINK Price

At the time of writing, Chainlink is floating around $10.6, up more than 3% over the last 24 hours.