The post Chainlink (LINK) Could Fall by 20%, Key Levels to Watch appeared first on Coinpedia Fintech News

The market sentiment across the cryptocurrency landscape is quite bearish. Amid this, Chainlink (LINK) turns bearish and is poised for a notable price decline but is currently at a strong support level.

This negative outlook may be due to LINK’s recent price action and traders’ bets over the last 24 hours.

Chainlink (LINK) Technical Analysis and Upcoming Levels

According to expert technical analysis, LINK appears bearish and is on the verge of breaking down the inclined trendline of its ascending triangle price action pattern on a daily time frame. Since the beginning of August 2024, LINK has been supported by this inclined trendline, experiencing buying pressure and upward rallies each time.

However, due to the negative outlook and traders’ bearish sentiment, the asset now appears at risk of breaking down from this support level.

Based on the historical price action, if LINK breaks out and closes a daily candle below this crucial support level of $10.65, there is a strong possibility that the asset could decline by 20% to reach the $9 level in the coming days.

Currently, LINK is trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend. In trading and investing, traders often use the 200 EMA on the daily chart to determine whether an asset is suitable for the short side or the buy side.

LINK’s Bearish On-Chain Metrics

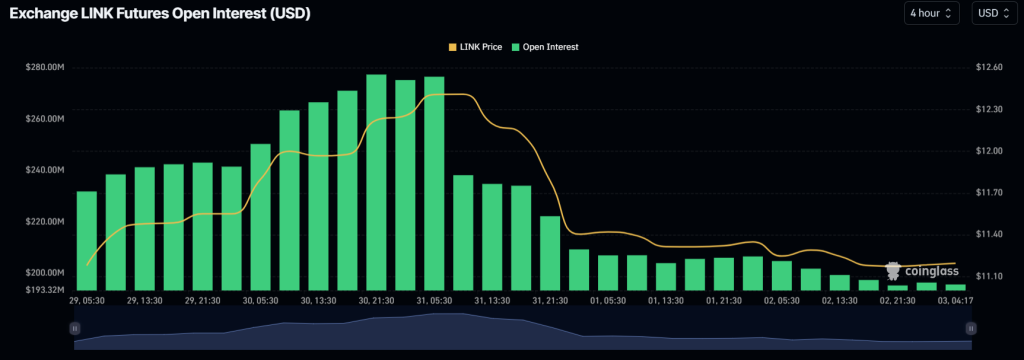

LINK’s negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, LINK’s Long/Short ratio currently stands at 0.94, indicating bearish sentiment among traders. Additionally, its open interest has dropped by 4.5% over the past 24 hours and jumped by 1.5% over the past four hours.

This drop in open interest for LINK suggests declining interest among investors and traders.

Current Price Momentum

At press time, LINK is trading near $11.20 and has experienced a 1.1% price decline in the past 24 hours. During the same period, its trading volume dropped by 34%, indicating reduced participation from traders amid a broader price decline across the crypto market.