Chainlink (LINK) is showing signs of strength, trading 27% above its March 11 low and hinting at a potential recovery if broader market conditions improve. Despite recent volatility and ongoing macroeconomic uncertainty, LINK has managed to hold its ground better than many altcoins, giving hope to investors who believe the worst may be over. While some analysts remain cautious and warn of further downside, others see this consolidation as a healthy reset before the next leg up.

Top analyst Ali Martinez shared insights on X, noting that Chainlink is currently testing a critical support level around $13, which aligns with the lower boundary of a long-standing price channel. According to Martinez, if LINK holds this zone, historical patterns suggest a strong rebound could follow.

As market sentiment remains divided, all eyes are on LINK’s ability to maintain this support. A successful defense could position Chainlink as one of the altcoins leading the next rally. For now, traders are watching closely, waiting to see if this price action marks the beginning of a new upward trend.

Chainlink Holds Crucial Support As Bulls Eye A Breakout

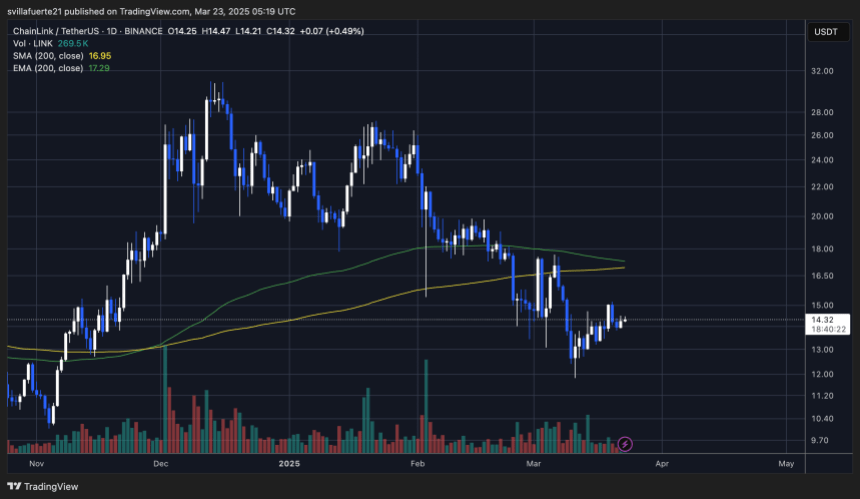

After losing the critical $17–$18 support zone, bulls have struggled to regain control. Chainlink trades at a pivotal level as it attempts to reclaim higher prices amid ongoing market uncertainty and volatility. LINK has fallen over 61% since reaching its mid-December high of around $30, reflecting the broader market’s bearish sentiment fueled by macroeconomic instability and risk-off behavior from investors.

However, there is growing optimism that LINK could be preparing for a recovery. Martinez’s insights highlight that Chainlink is now sitting on a key support level at $13, which marks the lower boundary of a well-defined trading channel.

Martinez suggests that holding this zone could set the stage for a major rally. If LINK confirms a stronghold above $13, historical price action indicates that a move toward the mid-range target of $25 is likely, with a potential extension toward $50 if bullish momentum strengthens.

The coming days will be critical as bulls must defend the $13 level to prevent further downside. A bounce from this zone could trigger renewed investor interest and accelerate momentum, positioning Chainlink as one of the altcoins leading a broader market recovery. For now, all eyes are on whether LINK can hold the line and reignite its bullish structure.

LINK Price Battles Key Resistance

Chainlink is currently trading at $14.30, sitting just below a crucial resistance zone that could determine its short-term direction. The $15 level has become a key battleground for bulls and bears. If LINK manages to break above this resistance with strength, analysts expect a swift move toward the $17 region—another significant level that previously acted as strong support before the recent downtrend.

The recent price action shows that bulls are regaining some momentum, especially after bouncing from the $13 zone. However, the market remains fragile amid broader macroeconomic uncertainty and cautious investor sentiment. A confirmed breakout above $15 would likely attract more buying interest, setting the stage for a short-term rally.

On the flip side, if LINK fails to reclaim $15 and faces rejection at this resistance, it could slide back toward lower support levels. A drop below $13 would weaken the bullish case and expose the token to further downside, with the $12 mark acting as a possible next support zone.

The next few sessions will be critical for LINK. Traders are watching closely to see whether bulls can build enough momentum to break out—or if bears will regain control and push the price lower.

Featured image from Dall-E, chart from TradingView