In recent trading sessions, Chainlink (LINK) has exhibited a bullish trend. It experienced a significant rebound from its $5 support level and has since continued on an upward trajectory.

Over the past week, LINK has surged more than 12%, although its daily chart indicates a slowdown in gains. The coin formed a bullish reversal pattern, driving a substantial price surge.

The technical outlook for LINK reflects bullish strength, albeit with a slight decline in demand and accumulation on the chart. In recent trading sessions, LINK has formed a pattern that suggests a potential reversal in price direction.

To prevent this reversal, it is crucial for LINK to maintain its upward movement and surpass immediate resistance levels. Additionally, a slight decline in market capitalization indicates a decrease in buying strength.

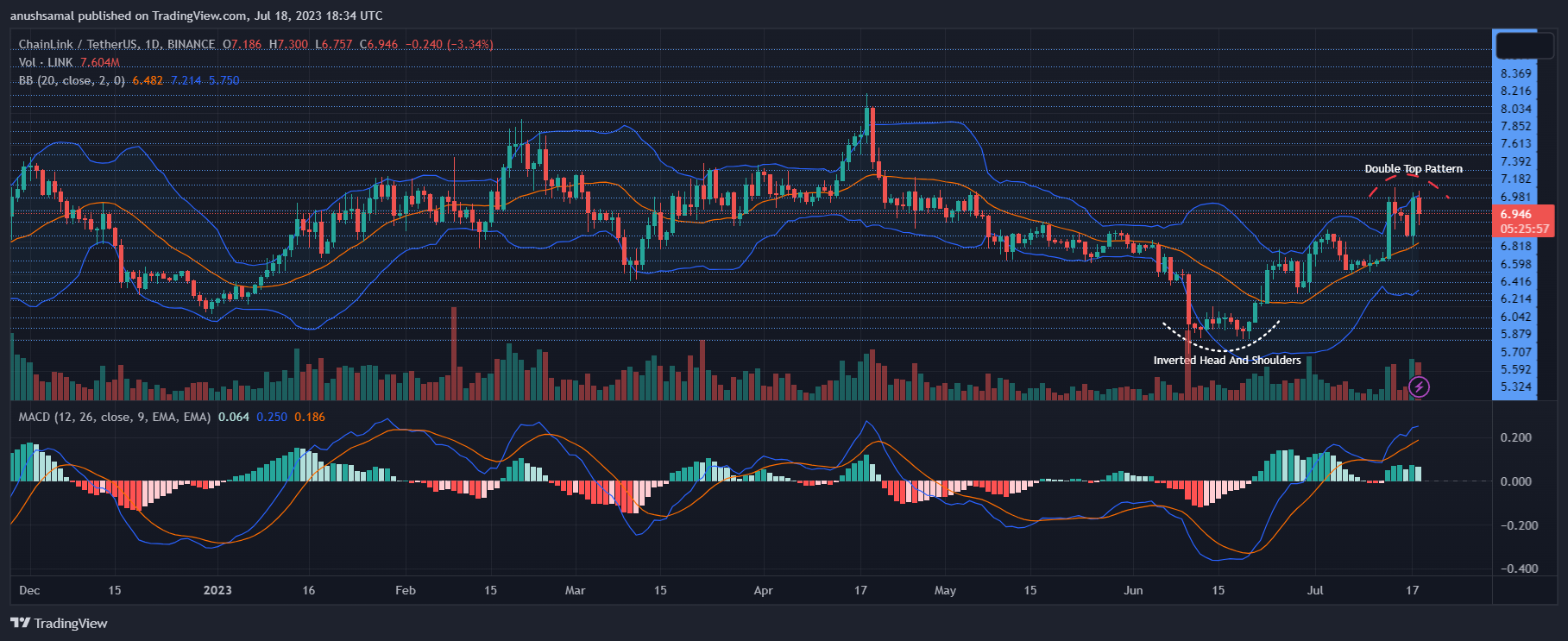

Chainlink Price Analysis: One-Day Chart

At the time of writing, Chainlink (LINK) was trading at $6.90. The coin has demonstrated significant bullish strength following its recent reversal from the $5 level, driven by the formation of an inverted head and shoulders pattern in the last week.

However, despite the upward surge, LINK may encounter resistance around the $7.30 mark, which has historically acted as a strong ceiling for the coin.

This resistance is further supported by the formation of a double-top pattern (marked in red), which is considered a bearish signal.

As a result, there is a possibility that LINK may experience a decline towards the local support level of $6.60 and potentially even further to $5.80 before attempting a recovery once again.

Technical Analysis

During the formation of the double-top pattern, there was a notable decline in buying strength, suggesting an impending bearish price movement. The Relative Strength Index (RSI) indicated a bearish divergence, indicating a decrease in demand.

Although the RSI remained above the half-line, readings indicated a fading buying strength. Despite this, LINK has managed to stay above the 20-Simple Moving Average (SMA) line, indicating that buyers still have control over price momentum.

However, if there is a drop from the current price level, it could lead to LINK falling below the 20-SMA (red), which could bring sellers back into the market.

On the one-day chart, the altcoin has exhibited buy signals, although these signals have been experiencing a slight decline.

The Moving Average Convergence Divergence (MACD) indicator, which reflects price momentum and trend reversals, has formed declining green histograms, suggesting a potential decrease in buy signals.

Additionally, the Bollinger Bands, which indicate volatility, are wide open, indicating the potential for significant price volatility in the upcoming trading sessions.