Chainlink’s LINK native token has soared by more than 60% over the past month to a yearly high of $12.65, according to CryptoSlate’s data.

During the reporting period, LINK broke through critical resistance levels, hitting highs not seen since April 2022.

Why is LINK rising?

While the broader crypto market has enjoyed a strong rally over the past month due to the optimism surrounding a Bitcoin spot exchange-traded fund, Chainlink is also quietly enjoying some strong narratives driving its price performance.

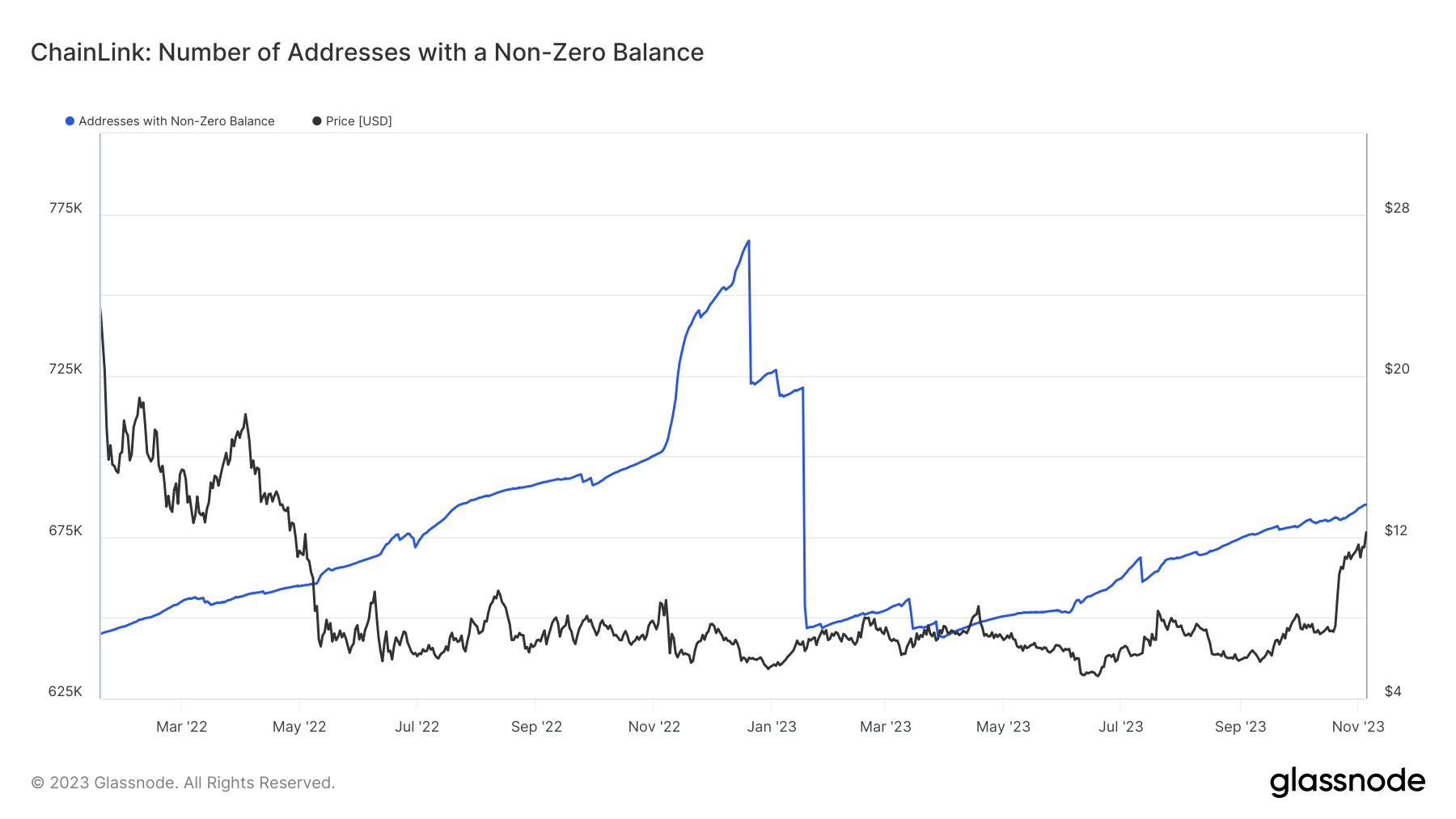

Data from Glassnode shows that LINK’s upward price movement was aided by the increase in the number of addresses with non-zero balances, reaching a new high for this year at more than 685,000.

This signals that the digital asset is seeing increased adoption from investors heavily acquiring the crypto token. For context, on-chain analyst Lookonchain reported that a whale address acquired 312,901 LINK valued at around $3.81 million on Nov. 5.

Chainlink’s planned Staking v0.2 upgrade drives new interest into its ecosystem. The upgrade will introduce flexible withdrawals, liquid rewards, modular architecture, and dynamic rewards. These innovations aim to enhance user experience and incentivize participation in the network.

Besides, the digital asset’s Cross-Chain Interoperability Protocol (CCIP) is enjoying heavy adoption from major traditional institutions.

In Aug., CryptoSlate reported that the global financial messaging network Swift revealed that it was collaborating with Chainlink and several financial institutions for tokenization experiments involving the transfer of tokens across multiple blockchains.

The CCIP technology would also be adopted by South Korean gaming giant Wemade to power an interoperable Web3 gaming ecosystem in Oct. At the time, the gaming company also made Chainlink Labs the first member of a consortium focused on the development and innovation of an omnichain ecosystem.

Furthermore, Hong Kong revealed that it was using the CCIP technology for value exchange in its Central Bank Digital Currency (CBDC) trials.

These developments have made Chainlink’s LINK one of the best-performing digital assets within the crypto ecosystem this year. Data from TradingView shows that the asset is up 125% on the year-to-date metrics.

The post Chainlink’s LINK reaches a new yearly high amid string of market narratives appeared first on CryptoSlate.