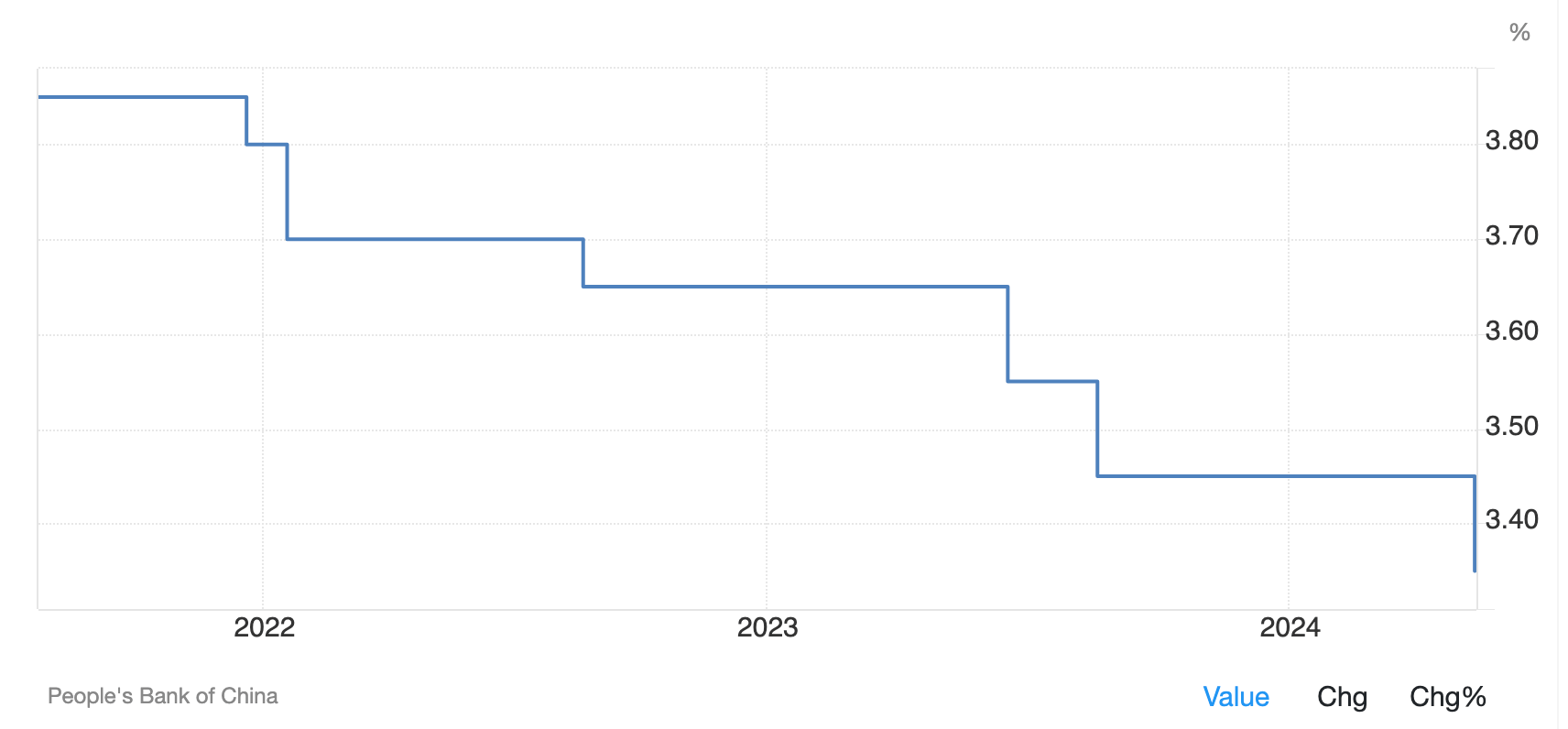

China’s central bank, the People’s Bank of China (PBOC), has cut key interest rates to stimulate economic growth amid ongoing challenges in the property sector and the broader economy. The seven-day reverse repo rate was reduced from 1.8% to 1.7%, the one-year loan prime rate (LPR) from 3.45% to 3.35%, and the five-year LPR from 3.95% to 3.85%.

These cuts follow weaker-than-expected second-quarter GDP growth of 4.7% and aim to address weak consumer demand and deflationary pressures. The property sector remains troubled, with major developers facing financial difficulties. Market reactions were mixed, with muted responses in Chinese stock markets but some positive movement in Hong Kong’s Hang Seng index.

Following Bitcoin’s rally on the initial news of Biden dropping out of the US presidential race from $65,800 to $68,500 hours later, the top digital asset retraced to around $67,800 by the time of the Chinese announcement. It rose around 0.5% as the news of the rate cut broke but has since declined around 1% to $67,400 as of press time.

The effectiveness of the rate cuts remains uncertain, and further policy actions may be necessary for sustained economic recovery.

The post China rate cuts elevate Bitcoin momentarily before retracement appeared first on CryptoSlate.