Quick Take

The futures market has always been a significant barometer of investor sentiment and speculation in the cryptocurrency arena. Recent data analysis suggests noteworthy trends in Bitcoin futures, particularly on the Chicago Mercantile Exchange (CME).

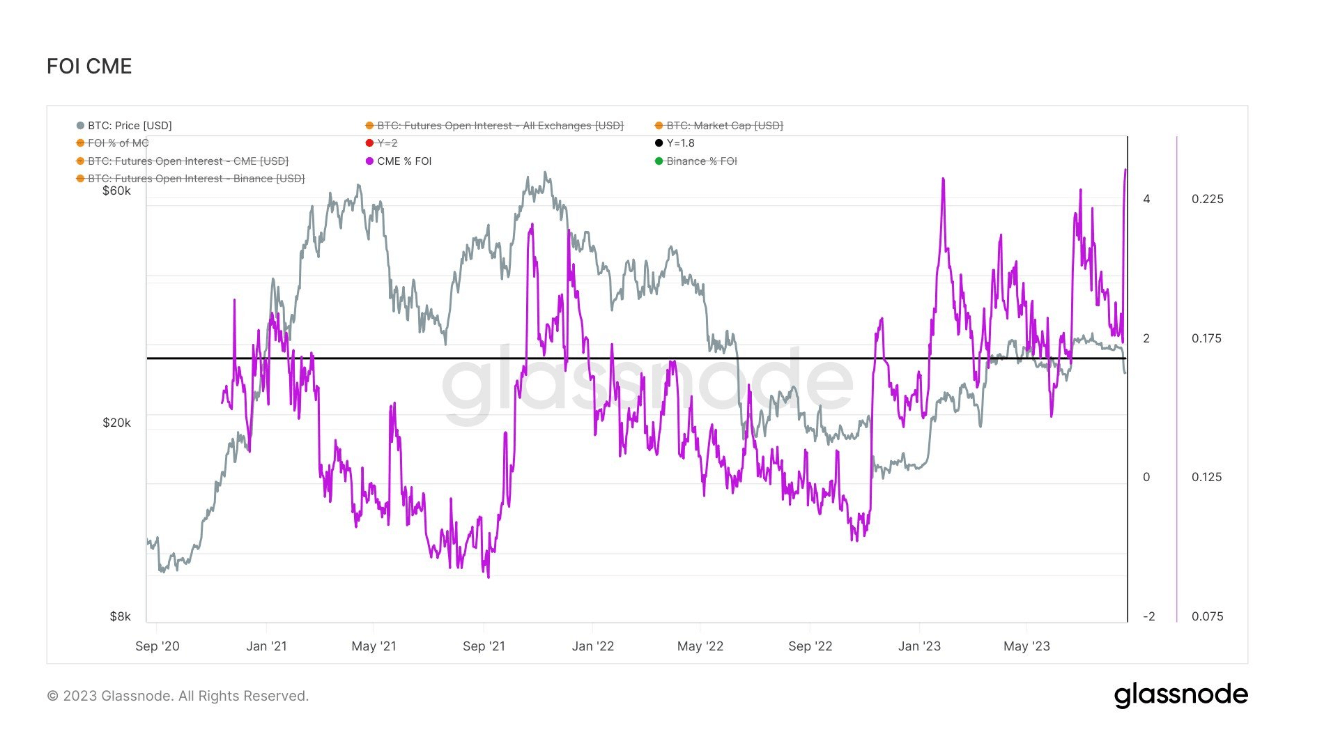

Open interest, the aggregate of outstanding futures contracts yet to be settled, has seen the CME’s share in Bitcoin futures spike to an unprecedented 23% (equivalent to 85K BTC). This is the highest percentage ever recorded for the exchange, indicating a possible shift in institutional preference or strategy.

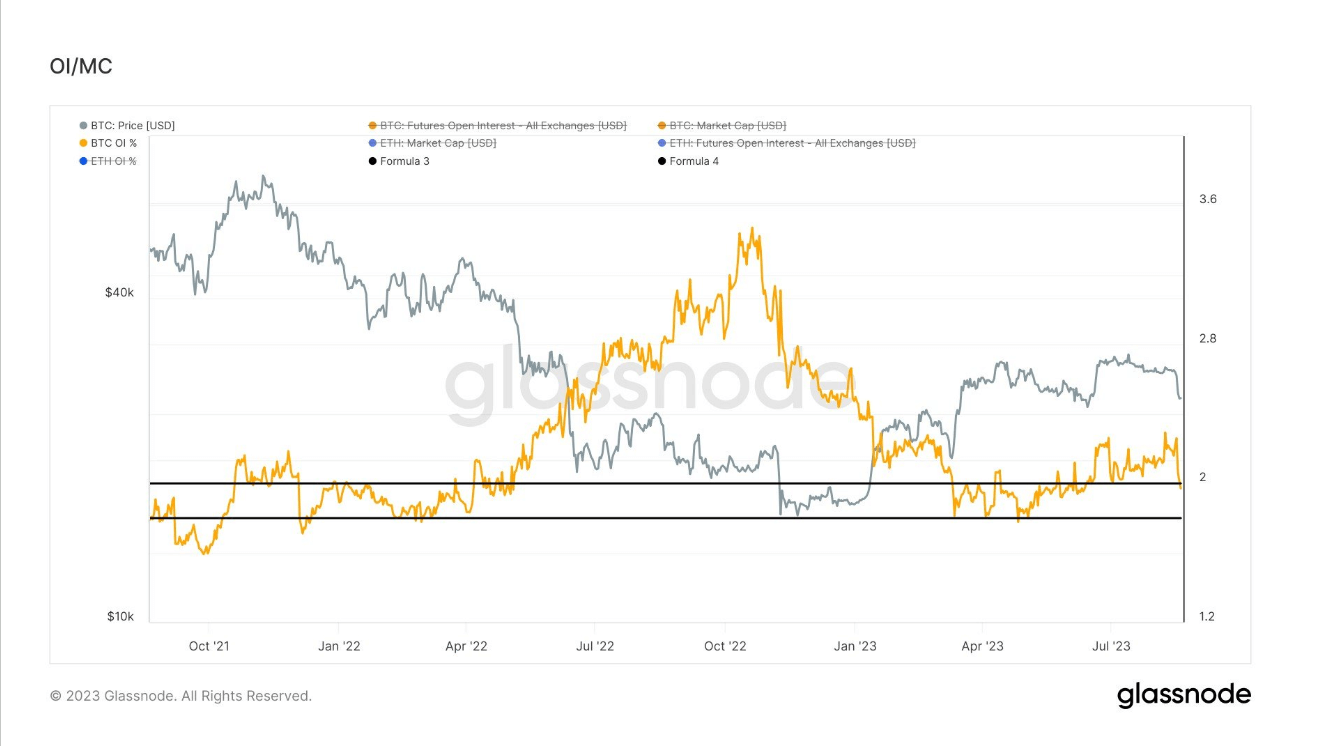

Contrarily, open interest as a percentage of the Bitcoin market capitalization has dipped below the 2% threshold. This is a significant respite, considering this metric has consistently been above 2% since May/June.

This lowered ratio reflects a healthier, less leveraged market, reducing the likelihood of large-scale liquidations that could destabilize the market. This shift suggests a more sustainable engagement of investors with Bitcoin futures, possibly pointing to a maturing market.

Despite the surge in CME’s market share, the overall reduction in open interest relative to market cap is a positive sign, indicating that the Bitcoin futures market might be moving towards more balanced and less risk-prone operations.

The post CME Bitcoin futures spike to unprecedented 23% amid overall market de-leveraging appeared first on CryptoSlate.