The post Coinbase Leaves Turkey Amidst Tight Regulations appeared first on Coinpedia Fintech News

It’s not every day you see a giant like Coinbase walk away from a booming market. Yet, that’s exactly what happened in Turkey. Coinbase, which had big plans for the country just three months ago, suddenly called it quits. So, what went wrong? The answer lies in Turkey’s increasingly tough stance on crypto regulation, and Coinbase isn’t the only one feeling the heat.

Turkey’s New Crypto Rules Are Shaking Things Up

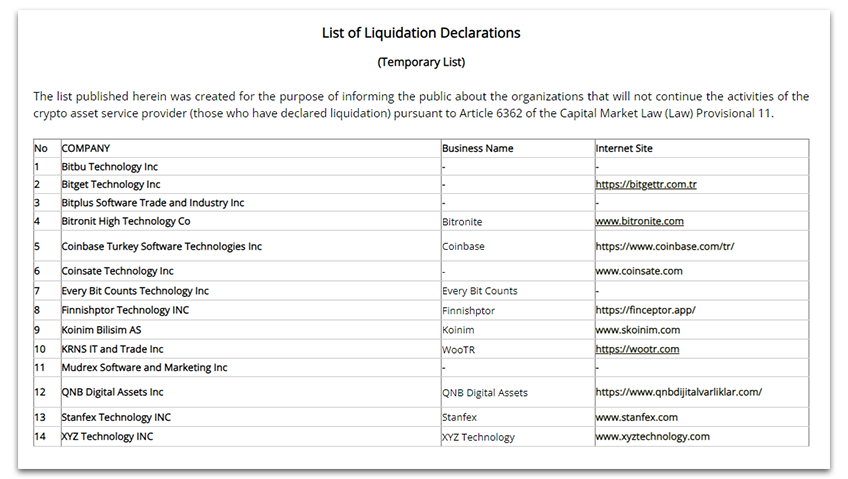

Turkey’s regulators recently tightened the rules for cryptocurrency firms, making life a lot harder for companies like Coinbase. The country’s Capital Markets Board listed Coinbase as one of 14 companies liquidating their operations. At the same time, some big names like Binance and KuCoin are still pushing through the process, though they’ve had to scale back.

To comply, Binance and KuCoin removed Turkish language support and cut marketing to local users. That’s a pretty big deal when you think about it. Imagine running a global business but having to pull back in one of your key regions. It seems like the exchange decided it just wasn’t worth the hassle.

Coinbase Has Other Problems to Tackle

This isn’t the only challenge the exchange is dealing with right now. Over in Europe, they stopped offering USDC yield programs, blaming new EU regulations. On top of that, Coinbase plans to delist Wrapped Bitcoin (WBTC) by December 19, 2024. That decision surprised a lot of people, considering their other token, cbBTC, is doing great in the DeFi world with a $1.44 billion market cap.

Back in the U.S., Coinbase CEO Brian Armstrong is focusing on policy. He’s reportedly been chatting with politicians about appointing crypto-friendly leaders, including suggesting Hester Peirce as a replacement for SEC Chair Gary Gensler. Whether that will change anything is anyone’s guess, but it shows the exchange is playing the long game.

What’s Next for Coinbase?

Here’s the thing: Bitcoin’s rally is bringing retail investors back in droves. In November, Coinbase’s app ranking jumped to ninth place globally. That’s a big win for the exchange, even as they face regulatory challenges.

For Coinbase, leaving Turkey might be more about focusing on easier markets. But will this strategy help them stay on top? Or will these constant hurdles take a toll? One thing’s for sure—crypto’s never boring, and neither is Coinbase.