The post Coinbase Relaunches Bitcoin Loans: Can They Succeed? appeared first on Coinpedia Fintech News

Coinbase is giving Bitcoin-backed loans another shot. Their last attempt didn’t go as planned. It ended in 2023, partly due to low demand and regulatory hurdles. But they’ve returned with a fresh approach, powered by DeFi technology. This time, they’re betting it’ll be safer, smoother, and more appealing to everyday users. But will it succeed this time?

Why Coinbase Failed Earlier

Coinbase once allowed users to borrow up to $1 million by using 30% of their Bitcoin as collateral. It sounded great, but the program didn’t last long. By July 2023, Coinbase had to shut it down.

The exchange blamed a lack of demand, but there was a bigger issue. The SEC had filed a complaint accusing the company of operating without proper registrations. This added legal pressure might’ve pushed them to end the program earlier than planned. The plan is back, but this time, they’ve learned from those mistakes.

A New Safer Model

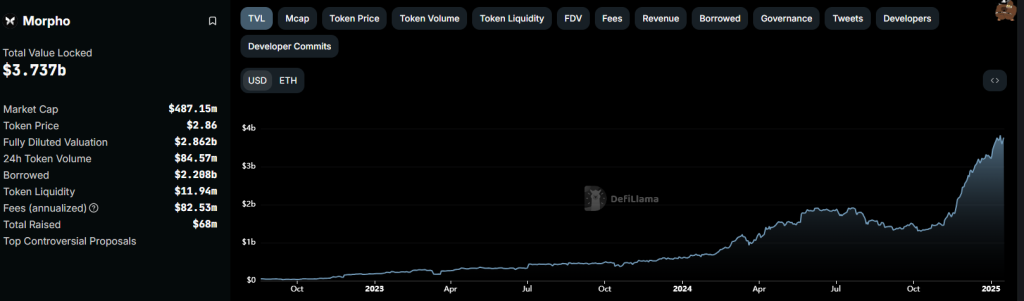

With the relaunch of loan service, Coinbase isn’t the one lending you money directly. Instead, they’ve teamed up with Morpho, a decentralized finance (DeFi) protocol handling $3.7 billion in deposits. Morpho’s system lets Coinbase keep control of the program while avoiding the unpredictable nature of DAOs (decentralized autonomous organizations).

This setup combines Coinbase’s easy-to-use platform with the advanced tech of DeFi. It’s a clever way to make borrowing against Bitcoin less intimidating for users. According to Morpho’s CEO, Paul Frambot, this partnership gives Coinbase more flexibility and security than most DeFi systems.

But it’s not for everyone just yet. Residents of New York are excluded for now, although Coinbase plans to expand its reach soon.

Can It Win Back Trust?

Crypto lending hasn’t had the best track record. The 2022 crypto crash wiped out billions when companies like Celsius and BlockFi went bankrupt. Those failures left people wary of lending platforms.

Coinbase is clearly aiming to do things differently this time. By blending traditional finance simplicity with the cutting-edge tech of DeFi, they’re hoping to win back trust. Will users give it a chance? Only time will tell.