Due to the chain reaction of events following the FTX collapse, the leading exchange Coinbase felt the need to clarify that it has a ‘strong capital position’ amid market turmoil, and has zero exposure to Genesis.

2/ We won’t comment on every event in crypto, but for the sake of clarity: Coinbase has zero exposure to Genesis Trading.

— Coinbase (@coinbase) November 16, 2022

The exchange Tweeted its document explaining its approach to transparency, risk management, and consumer protection to remind its precautions against implosions. It said that its priority is to promote a safe, responsible crypto economy and protect its customers.

Genesis

Like the Terra-Luna collapse, FTX’s implosion led to a chain of events that also affected the crypto exchange Gemini and the crypto-lending platform Genesis.

On Nov. 16, the crypto lender announced that its halting all withdrawals due to the FTX’s collapse.

Genesis had already taken a hit after the collapse of Three Arrows Capital (3AC) following the Terra-Luna crash. The collapse of FTX pushed the lender to the point of halting withdrawals.

Coinbase’s approach

Coinbase published its document on Nov. 8 and posted it on Twitter on Nov. 16.

The document explains why there can’t be a “run on the bank” at Coinbase, lays out its capital position, and gives details on its risk team. Coinbase says that it avoids the risk of illiquidity by holding customer assets 1:1 and backing all institutional lending by collateral.

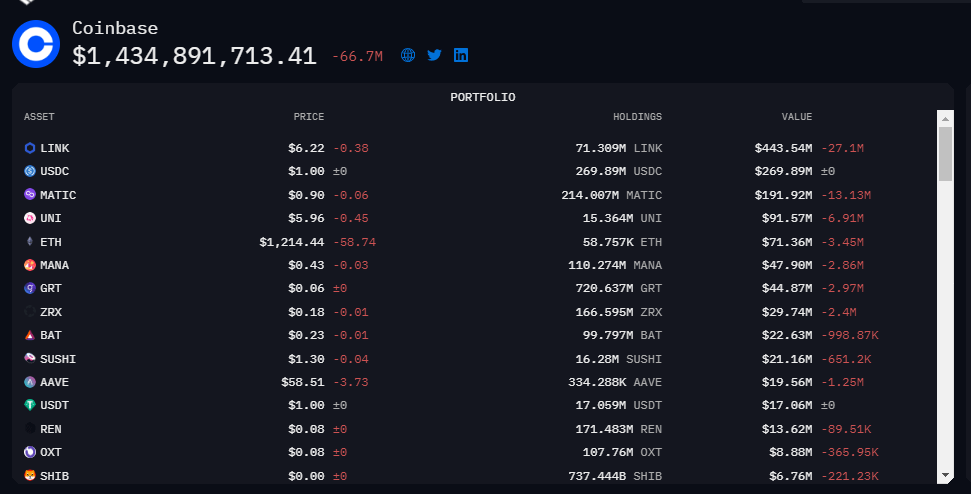

In terms of its capital, Coinbase currently has $1.5 billion of assets, half of which is on chainlink. The remaining amount is held as Bitcoins (BTC).

In addition, Coinbase states that its risk management team has decades of experience in the field, and prioritizes healthy liquidity management, credit, and counterparty risk.

The post Coinbase says it has no exposure to Genesis, touts ‘strong capital position’ appeared first on CryptoSlate.