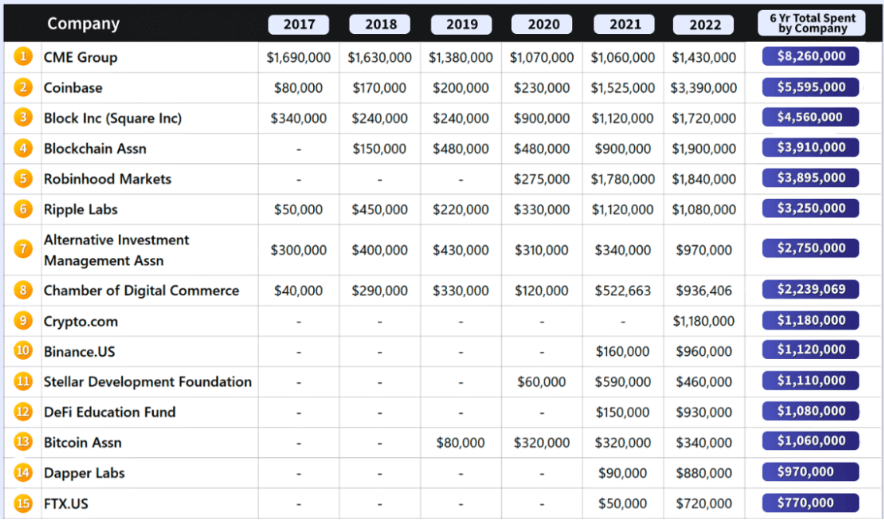

Coinbase spent $3.4 million on lobbying activities in 2022, ranking second, while Binance US and FTX US ranked ninth and 13th, respectively, according to a recent report by Money Mongers.

The exchange’s 2022 lobbying spend marks a 122% increase from 2021’s $1.52 million, according to the Money Mongers report.

Binance U.S. grew its budget for lobbying by 500% and spared $960,000 in 2022 compared to $160,000 in 2021. This placed Binance U.S. in ninth place in the ranking. FTX.U.S., on the other hand, ranked 15th and spent $720,000 for lobbying in 2022, marking a 1340% increase from $160,000 in 2021.

Lobbying activities since 2017

Blockchain Association and Robinhood followed Coinbase as the second and third largest spenders on lobbying activities by sparing $1.9 million and $1.8 million in 2022, respectively.

Coinbase, Blockchain Association, and Robinhood also rank among the top five biggest lobbying spenders since 2017, sparing over $5.59 million, $3.9 million, and $3.89 million, respectively.

On the other hand, CME Group holds the leadership in the ranks by having spent over $8.26 million on lobbying activities in the last six years. Binance U.S. and FTX U.S. spared a budget for lobbying activities in 2021 and 2022, placing them 10th and 15th in the ranking, respectively.

The post Coinbase spent $3.4M on lobbying in 2022, while FTX spent $720k appeared first on CryptoSlate.