The post Coinbase Takes a Stand: No Business with Anti-Crypto Lawyers appeared first on Coinpedia Fintech News

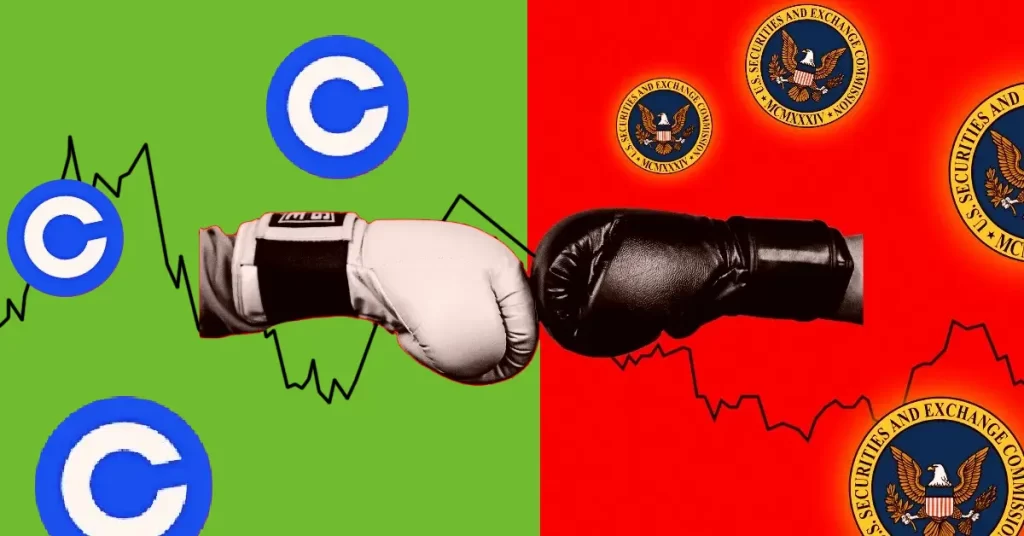

Coinbase CEO Brian Armstrong declared that the company would cut ties with law firms that hire lawyers with an anti-crypto stance. He specifically called out Milbank LLP for hiring Gurbir Grewal, a former SEC enforcement director, saying it was a “mess up.” But why is this such a big deal for crypto? Let’s dive in.

Grewal’s Record: Tensions with Crypto

Gurbir Grewal isn’t exactly popular in the crypto world. While he was with the SEC, he led more than 100 enforcement actions against major crypto companies. Along with Coinbase, other crypto exchanges like Binance, Kraken, and Gemini were all caught up in his actions. This is not a new problem for crypto firms. The SEC has been going behind them taking legal actions sometimes. They want the exchanges to follow rules when there are no rules established.

Coinbase’s Pushback

Despite the tension, Grewal defended his actions, saying the SEC wasn’t trying to target crypto, just enforce the law. But many in the crypto world aren’t buying it. They feel the rules are unclear, and that the SEC’s stance isn’t helping anyone. So, Coinbase decided to push back. The company even took the SEC to court, demanding clearer rules for digital assets. Eugene Scalia from Gibson Dunn & Crutcher is representing them in this fight.

Meanwhile, Coinbase’s Chief Legal Officer, Paul Grewal, took to social media to make one thing clear: any law firm that hires lawyers like Grewal is going to lose Coinbase’s business. It’s a bold move, and it’s clear that Coinbase isn’t backing down from this battle.

What Happens Next?

Coinbase’s warning to law firms is shaking things up. Legal experts are saying this could cost firms big money if they choose to work with controversial figures like Grewal. And with a possible shift in leadership on the horizon, the SEC’s tough stance on crypto might change. If that happens, it could change how crypto businesses and law firms approach the whole regulatory mess.