Coinbase

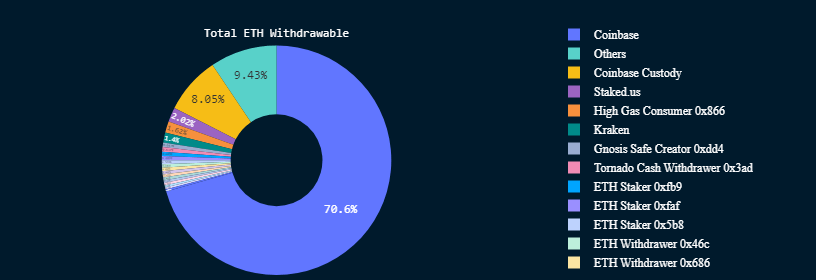

The exchange wants to withdraw 70,057 ETH (roughly $129 million) of the 88,121 ETH tokens pending withdrawals as of press time.

Coinbase has consistently maintained that it would continue its staking services.

Meanwhile, this is not the first time regulatory pressure forced a U.S.-based entity to process staked ETH withdrawals. In February, Kraken ended its staking service for U.S. users and automatically unstaked their assets following the completion of the Shanghai upgrade.

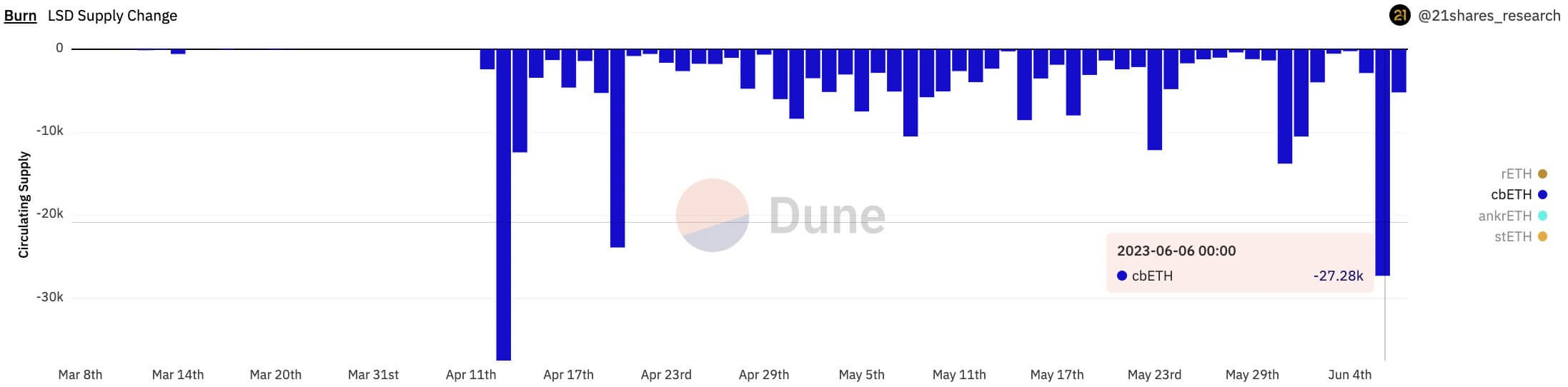

Coinbase redeemed 2% of cbETH on June 6

Evidence of the SEC’s pressure can be seen in Coinbase Wrapped Staked ETH (cbETH) burning. According to 21Shares researcher Tom Wan, Coinbase burnt 2% of its cbETH supply, around 27,280 cbETH tokens, on June 6 following the lawsuit.

Data from Dune analytics showed that the trend continued to June 7, when the exchange burnt 8,530 cbETH tokens, taking its total redemptions to over 35,000 tokens within two days — its fastest rate in over a month.

Meanwhile, Coinbase remains the second-largest entity for ETH liquid staking, behind only Lido. The total value of assets locked on the crypto exchange is $2.1 billion (1.14 million ETH tokens), according to DeFiLlama data.

Will decentralized staking service providers profit?

With the SEC maintaining pressure on centralized entities providing services, a contributor at Alpha Please, Pickle, said the move might lead to an “increased migration to other decentralized providers” like Lido and others.

Under Chair Gary Gensler, the SEC has urged crypto exchanges offering staking programs and interest-bearing products to comply with securities laws.

The post Coinbase to withdraw over 70k staked ETH amid SEC lawsuit appeared first on CryptoSlate.