The founder and CEO of the analytics firm CryptoQuant has pointed out how the latest Bitcoin rally saw buying from the Coinbase exchange whales.

Bitcoin Coinbase Premium Index Saw A Sharp Green Spike Alongside Rally

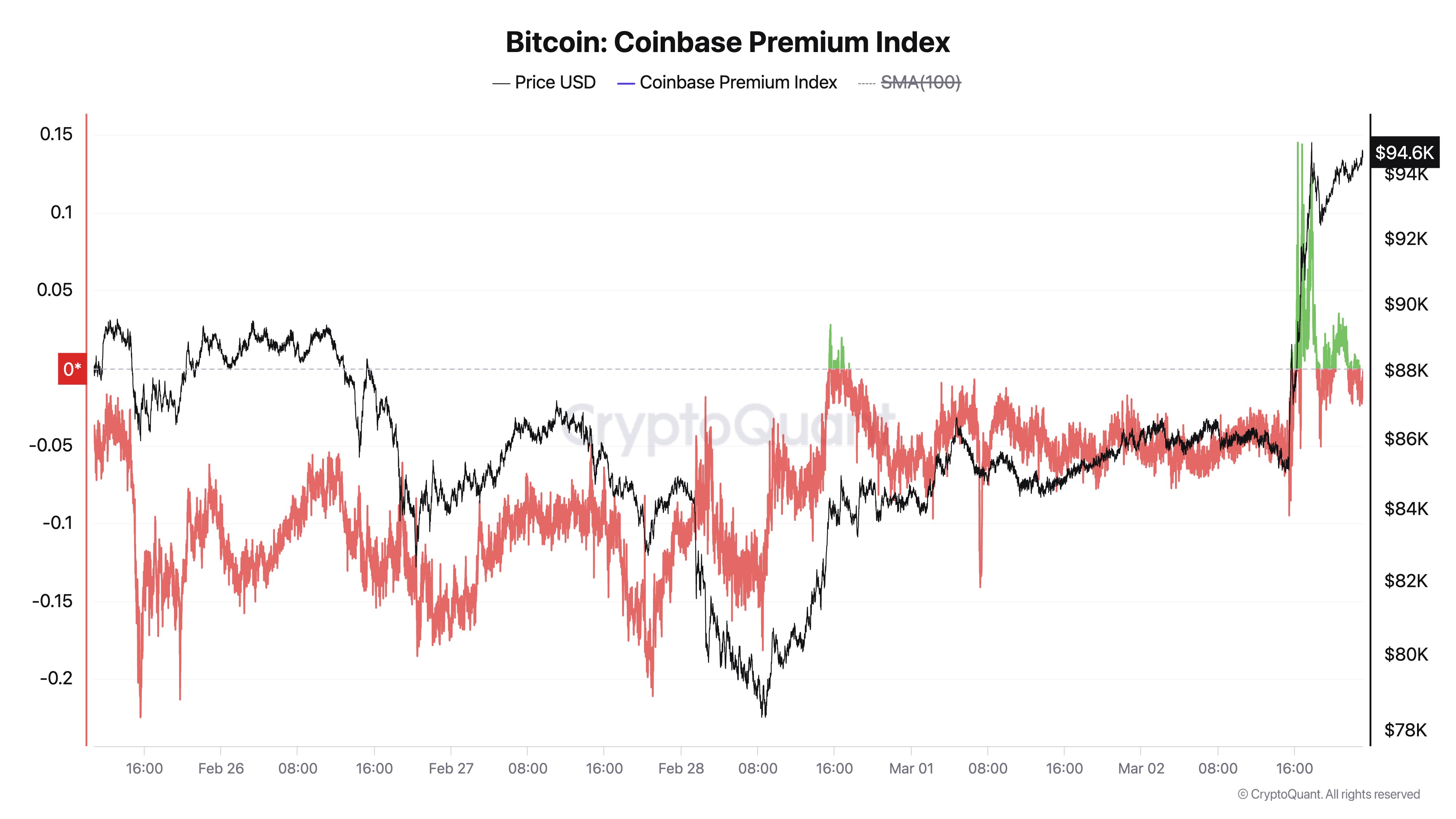

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about the latest trend in the Bitcoin Coinbase Premium Index. The “Coinbase Premium Index” is an indicator that keeps track of the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

When the value of this metric is positive, it means the asset is trading at a higher rate on Coinbase as compared to Binance. Such a trend implies the former is receiving a higher amount of buying pressure (or lower amount of selling pressure) than the latter.

On the other hand, the indicator being negative suggests Binance is the platform witnessing the more accumulation as traders are willing to pay a higher rate for the asset on there.

Now, here is the chart shared by Young Ju, that shows how the Bitcoin Coinbase Premium Index has changed during the last few days:

As displayed in the above graph, the Bitcoin Coinbase Premium Index was negative heading into March, meaning selling pressure was dominant, but yesterday, the indicator observed a sharp jump into the positive territory.

This surge came following US President Donald Trump’s announcement of a Crypto Strategic Reserve including Bitcoin, Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA).

Coinbase’s main traffic consists of the US-based investors, especially the large institutional traders, while Binance serves the global investors, so it makes sense a US-centric piece of news like this one would induce a strong wave of buying on the former.

From the chart, it’s apparent that the positive spike in the metric coincided with the price recovery back above the $94,000 level. “Coinbase whales led this Bitcoin surge,” notes the CryptoQuant founder.

Throughout 2024, the behavior of the Coinbase investors had a significant effect on the cryptocurrency’s trajectory and so far, 2025 has been following a similar pattern, with this latest instance being another confirmation of the role the American institutional traders have in the market.

Since the aggressive buying, the metric has calmed back down to the neutral level, which suggests uniform investor behavior across Coinbase and Binance right now. Changes in the indicator could now be to watch for, as where it goes next could carry hints for BTC’s next move, considering the pattern.

BTC Price

At the time of writing, Bitcoin is trading around $93,400, up more than 9% over the last 24 hours.