XRP is back in the limelight once again, catching a rising tide of bullish vibes in the cryptocurrency marketplace. The token went steadily up last week but managed to make an even bigger leap over the weekend.

This resulted in an increase in its value by a whopping 13%. The price jumped from $0.5889 to $0.6622 and reached a six-month high. Quite a lot of buzz has been seen in the crypto world, and the community feels this rally might just be the beginning for Ripple’s native currency.

While the rest of the crypto market has cooled down a bit, XRP continued in its movement and was greatly noticed by investors and traders. Despite having pulled back a bit, the token still remains strong and is trading at $0.6518 at the time of writing.

According to CoinCodex, a cryptocurrency analysis tool, XRP will continue its bullish path and gain by around 19.60% in the coming quarter. On the basis of this optimistic outlook, which reflects growing market confidence in the token, the price may reach $0.743019 by the 31st of October in the year 2024.

Big Things Coming For XRP

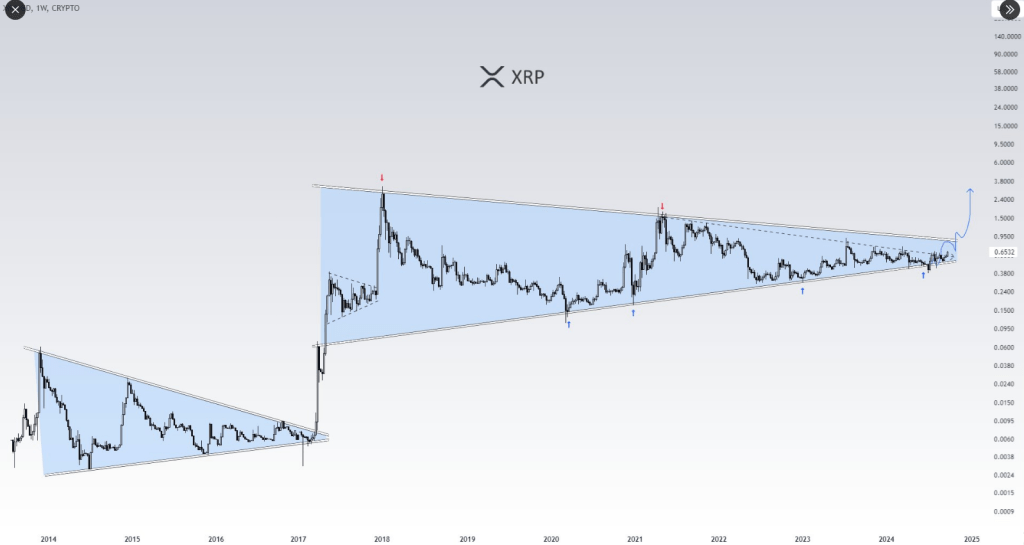

Well-known trader Anup Dhungana recently hyped up the excitement with his statement that XRP may be set to see some major price actions in the coming months. On X (formerly Twitter), he said he believes that XRP is placed for a proper breakout.

Big things could be happening for $XRP soon!

#XRPHolders https://t.co/XHAaVRwXwB pic.twitter.com/QM7ChskTNv

— Anup Dhungana (@CryptoAnup) September 29, 2024

According to Dhungana’s research, the coin might reach the $3 mark in the midterm—a price level XRP has not seen in almost seven years.

Other experts shared Dhungana’s enthusiasm and projected XRP would reach $3 before Christmas. The token would have to skyrocket 360% from its present value if such is to occur. More analysis, however, holds the belief that the $3 mark will not be a top but a new floor to continue the move upwards into 2025.

Price Forecast Points To Growth

Technical study supports XRP’s forecast. CoinCodex predicts a 20% growth by October, boosting hope on this platform. XRP has had 16 of 30 green days in a month, demonstrating momentum.

Given a Fear & Greed Index of 50, which denotes a neutral market attitude, there is possibility for more consistent development as the market negotiates its present state.

In addition, the price volatility for XRP has been pretty low in the last 30 days at 4.80% and thus traders have chances to gain from slight fluctuations in prices. Such moderate volatility paired with increasing market confidence highlights the perspective on long-term developments.

Featured image from Moneycontrol, chart from TradingView