OKX, a prominent global cryptocurrency exchange, has decided to discontinue services in Nigeria. This move comes amidst a backdrop of increasing regulatory scrutiny in the country.

Starting from August 16, 2024, Nigerian users will no longer be able to initiate new trades or access other services provided by OKX. This decision marks a significant shift in the crypto space within Nigeria, where digital currencies have been a booming sector despite regulatory challenges.

Immediate Steps for OKX Users

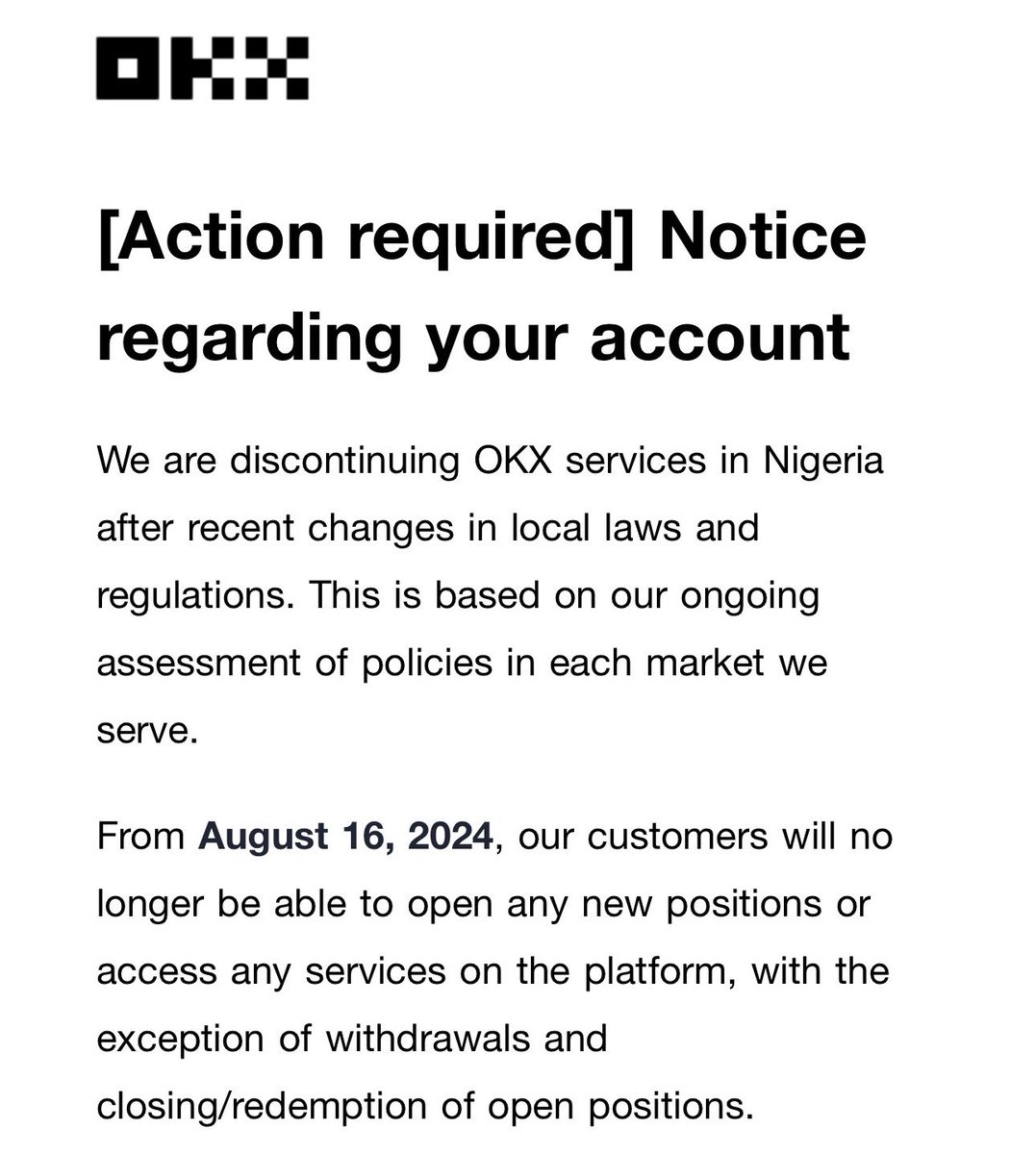

On July 17, 2024, at approximately 02:30 PM Nigeria time, OKX emailed this pivotal change to its Nigerian customers.

This message detailed the timeline and procedures for the gradual discontinuation of services, marking a sober final note on OKX in one of Africa’s big markets. The exchange’s exit from Nigeria is part of a broader withdrawal pattern by crypto services from regions with stringent regulatory frameworks.

The timeline has been communicated to be effectively immediate: from the 16th of August, Nigerian users will not be able to open new trades or use any services offered by OKX.

The only options available are withdrawing funds or closing any open positions. OKX has urged its users to complete their trading activities, including P2P, margin, perpetual, futures positions/orders and options before 12:00 am PST on the specified date.

Furthermore, customers are advised to redeem all assets from OKX’s financial products such as Earn, Loan, and Jumpstart, and transfer any remaining assets to a different wallet.

The final cutoff for withdrawing funds from the platform is August 30, 2024. Post this date, if anyone still has any funds left on the exchange, they will have to contact OKX support directly to recover their assets.

User Reactions

The decision by OKX to exit the Nigerian market has elicited mixed reactions among its users. Some express disappointment, sharing their concerns over the abrupt service halt on social platforms like X, where screenshots of the email announcement have circulated widely.

OKX discontinuing their service in Nigeria is a big disappointment.

This govt just wants to take food from our table but we wont panic. pic.twitter.com/xQjmd4JPo6

— King.sol

(@teddi_speaks) July 17, 2024

Others point towards alternative platforms like Bitget, which continues to offer decentralized services in Nigeria, as viable options.

#Bitget APP jumped to top 5 after #OKX left Nigeria market, showing how quickly the crypto exchange scene can change with new regulations and competition. pic.twitter.com/B7D0Gw378t

— CryptoPunker (@Crypto_Fans_ETH) July 18, 2024

OKX’s withdrawal follows a growing trend of crypto exchanges pulling out from Nigeria. Notably, Binance ceased its operations earlier this year following accusations of money laundering and tax evasion, eventually leading to its ban in April.

Featured image created with DALL-E, Chart from TradingView