The cryptocurrency market has taken an interesting turn in the last few days, with the price of Bitcoin enduring an intense amount of bearish pressure. On Thursday, July 4, the premier cryptocurrency broke below the $60,000 mark, falling as low as $57,000.

BTC continued its price descent on Friday, with the market leader traveling down below $54,000 at some point. This disappointing price run has been linked to various events, including government selloffs and potential selling after news of the Mt. Gox payout.

Government Bitcoin Selling Is Overestimated: CryptoQuant CEO

In a new post on the X platform, CryptoQuant CEO and founder Ki Young Ju has weighed in on the recent reports of nations’ governments offloading seized BTC assets. Most notably, the German government has been executing various transactions involving significant amounts of Bitcoin in recent weeks.

The FUD (fear, uncertainty, and doubt) from the recent selloffs is believed to be one of the major drivers of the current downward pressure on the Bitcoin price. However, the CryptoQuant CEO believes that the impact of the government selling seized BTC assets is being over-inflated.

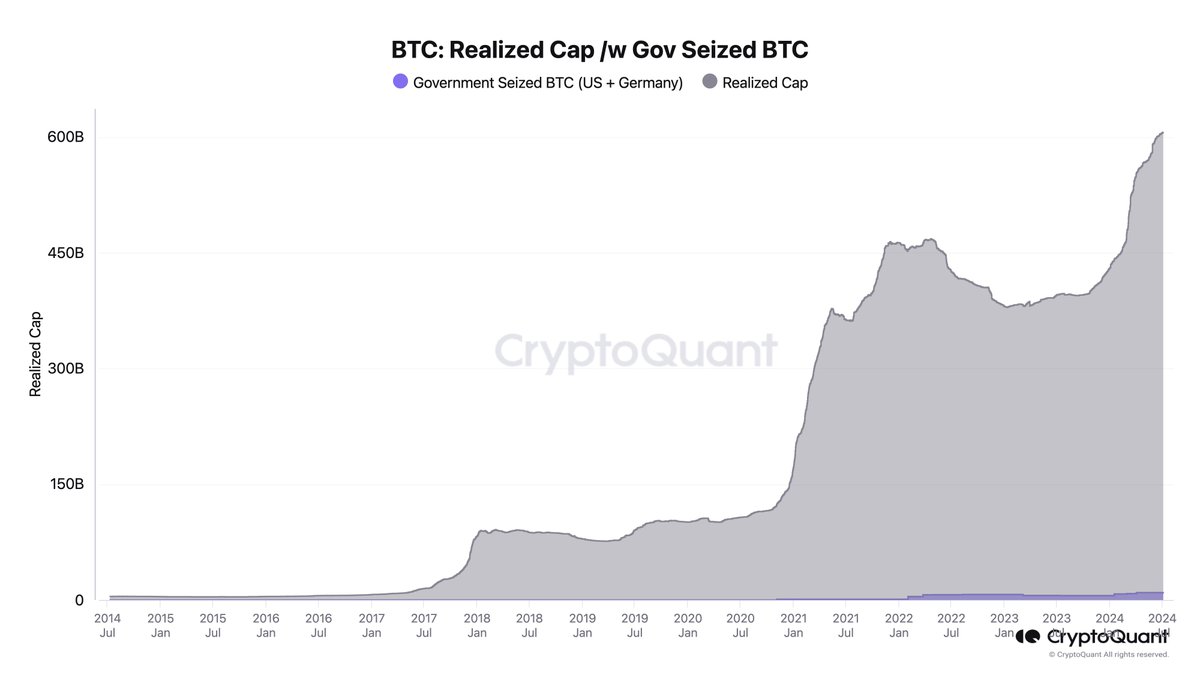

This evaluation is based on the realized cap of Bitcoin in about a year. According to CryptoQuant data, $224 billion has moved into the market since 2023, but only $9 billion (less than 5%) is from government-seized BTC. It is worth noting, though, that this data only accounts for Bitcoin seized by the United States and German governments.

Young Ju noted in his post that the realized cap here represents the total capital that has flowed into the market since 2023. The “realized” cap differs from the more traditional “market” cap in that it is based on the price of each coin when it last moved.

In a separate post on X, the founder reiterated faith in the long-term promise of the premier cryptocurrency, stating that the Bitcoin bull cycle is not over yet. According to the blockchain firm CEO, the bull run will likely continue until early next year.

What’s more, Young Ju was able to pinpoint the potential top of the Bitcoin cycle using the realized cap metric. The CryptoQuant founder expects the premier cryptocurrency to reach its peak in this cycle around the $112,000 price level.

BTC Price At A Glance

The price of Bitcoin recovered above $56,000 in the late hours of Friday, July 5, and is trading at $56,400 as of this writing. Nevertheless, the market leader is still down by nearly 6% in the last seven days.

Featured image from iStock, chart from TradingView