Crypto analyst Rekt Capital has provided insights into the Bitcoin future trajectory. Based on his analysis, the flagship crypto might not yet be ready for its next leg up, which could see it climb back above $70,000.

Bitcoin Not Yet Ready To Establish $65,000 As New Support

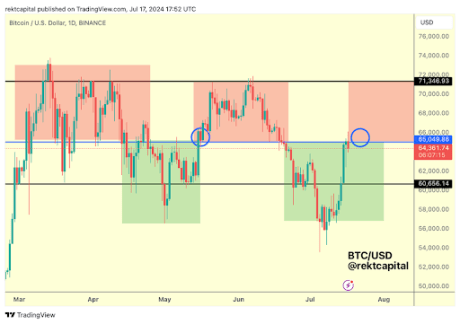

Rekt Capital claimed in an X (formerly Twitter) post that Bitcoin is not quite ready just yet for a successful retest of the $65,000 level as new support. For the crypto to establish $65,000 as the new support level, the analyst stated that it would need a similar restest like the one which happened sometime in May earlier this year. According to Rekt Capital, this will confirm a break back into the $65,000 to $71,500 region.

Bitcoin establishing $65,000 is crucial as that will also confirm that the downtrend is over as the flagship crypto still risks dropping to the $60,000 range while still below $65,000. Meanwhile, as Rekt Capital noted, Bitcoin holding above the $65,000 support would mean that it is ready to revisit its previous top above $70,000.

Bitcoin rising above $70,000 and reaching as high as $71,500 will inspire confidence among investors that the bull run is well underway again. Crypto expert Michael van de Poppe had before now highlighted the $70,000 range as the level for Bitcoin to beat in order to surpass its current all-time high (ATH) of $73,750.

Crypto analyst Altcoin Sherpa also recently highlighted three scenarios that could play out for Bitcoin from its current price level. He claimed that the flagship crypto could dump to $63,000 and “return the pump,” dump to $60,000, and return the pump or dump to $60,000 while enjoying some relief bounces and then “die” after it dumps to $60,000. However, the analyst is most hopeful that Bitcoin just break above this level without any pullback and rise to $70,000.

What To Expect From BTC Heading Into The Latter Parts Of The Cycle

Crypto analyst Dann Crypto shared his expectations for Bitcoin heading into the latter parts of this bull run. He claimed that Bitcoin will enjoy a run-up heading into the US Presidential elections due to the easy narrative of a potential crypto President and Vice President. He expects this rally to also happen thanks to a potential first-rate cut and just the “overall excitement” after Bitcoin had ranged for about four months.

Daan Crypto also alluded to the Spot Ethereum ETFs, describing them as a “bit of a wildcard” since they could “accelerate the rally,” but it all depends on how much demand these ETFs enjoy. Once this Bitcoin rally is done, Daan Crypto expects that the market will experience another local top with this likely to happen during the new year.

The crypto analyst predicts that the final rally in this bull run will come in the latter half of 2025, as part of the 4-year cycle. Daan Crypto noted that this 4-year cycle has always worked and that there is no reason why it shouldn’t work this time around. He warned market participants to not get fixated on a particular target as the market top for Bitcoin and instead, advised them to be fluid.