Crypto analyst CryptoCon stated in his recent market analysis that the Bitcoin current price action is reminiscent of December 2016. He further explained what he meant and provided insights into what to expect from the flagship crypto going forward.

“It Is September 2016 All Over Again For Bitcoin”

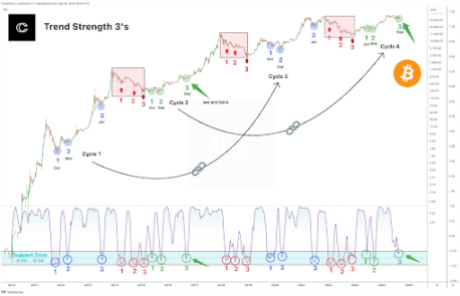

CryptoCon mentioned in an X (formerly Twitter) post that it is September 2016 again for Bitcoin. In line with this, he remarked that the “Bitcoin trend strength prophecy” has been fulfilled. He explained that just like in September 2016, Bitcoin has dipped into the support zone after the mid-top.

To further support his stance that the flagship crypto is mirroring past trends, he noted that all months had been the same for support zone entries for alternating cycles. He also asserted that the “pattern of 3’s” has not failed yet, both in the mid-cycle or bear market. His accompanying chart showed that Bitcoin is currently at the last part of its reaccumulation zone, just before it hits a cycle top, just like in the 2016 market cycle.

Following his analysis, CryptoCon boldly stated that the cycle is not over, providing belief that Bitcoin will still hit new highs and surpass its current all-time high (ATH) of $73,000, which it hit in March earlier this year. Before now, the crypto analyst assured that Bitcoin’s price dips are just a minor setback and that the crypto will still rise to as high as $160,000 at the peak of this bull run.

CryptoCon also noted how Bitcoin experienced such choppy and “boring” periods in previous halving cycles just before reaching new ATHs the following year after the halving event. The crypto analyst had previously predicted that the cycle top would come sometime in November 2025. This projection is also based on Bitcoin’s price action in previous halving cycles.

More Hope For BTC Investors

Crypto analyst Mikybull Crypto also recently gave Bitcoin investors hope that the worst was almost over for the flagship crypto. In an X post, he stated that a Bitcoin parabolic rally is looming as DXY is about to break down from the macro bear flag. The analyst also noted that the same scenario occurred in 2017 and 2020.

In another X post, Mikybull Crypto stated that Bitcoin’s next expansion will raise its price to $95,000. He added that Bitcoin is displaying a bull flag while the DXY is on a bear flag on a macro chart. However, the crypto analyst is confident that macro disbelief and fear are ending, with Bitcoin set to enjoy its parabolic run when that happens.

At the time of writing, Bitcoin is trading at around $56,300, down in the last 24 hours, according to data from CoinMarketCap.