In a period marked by extraordinary polarization, market participants find themselves torn between two opposing camps: one steadfastly predicting that the current dip is merely a setup for an impending altcoin rally, and the other resolute that the broader crypto bull run has already reached its conclusion. In a post on X, Koroush Khaneghah, Founder of Zero Complexity Trading, stated, “Right now is the most divided timeline I’ve ever seen. Bulls believe this is the last dip before an Altseason. Bears think bull run is over.”

According to Khaneghah, “It’s becoming more challenging to ‘predict’ cycle stages as crypto matures.” He highlights developments that did not appear in previous cycles, including a shift from a traditional altseason to a memecoin season, Ethereum (ETH) still not breaking its all-time highs, and Bitcoin (BTC) surpassing its ATH and moving beyond $100K+ (an outcome absent in earlier cycles)

Two Scenarios For Crypto

1. This Cycle Is Different From Others

Khaneghah points to growing institutional involvement—an element noticeably absent in earlier bull markets. He cites data suggesting that BlackRock is currently holding nearly $52 billion worth of BTC (via Arkham). In his view, this significantly boosts the long-term buy pressure for Bitcoin, leading to potentially shallower pullbacks since “institutions will keep buying.”

Because of heightened institutional interest, Khaneghah expects BTC dominance to continue rising. This dynamic could change how capital rotates into altcoins: “In this cycle, altcoins have seen Capital Dispersion. Meaning, more assets are in the market and liquidity is spread across multiple sectors, stopping any ONE sector from pumping hard.”

He contrasts the memecoin market with DeFi. In the previous cycle, the memecoin market was roughly half the size of DeFi. In this cycle, memecoin market capitalization has equaled that of DeFi.

If this scenario holds, Khaneghah believes BTC will remain the focal point for major moves while altcoins experience more fragmented, micro bull runs. “This means previous bull run playbooks won’t apply and you simply have to trade rotations,” he notes.

2. The Bull Run Is Not Over

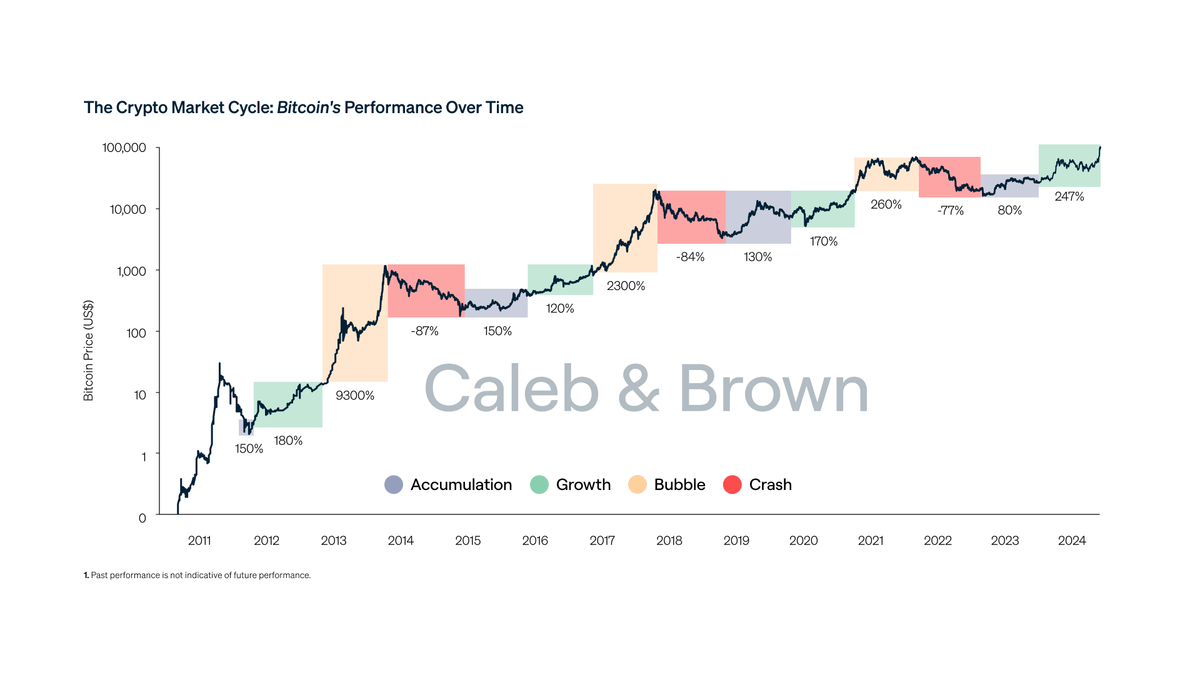

Khaneghah observes that BTC has only run 1.6x above the previous cycle highs before pulling back, calling it “not what a normal blow-off top/bubble looks like.” From a historical standpoint, BTC has frequently retraced by 40-50% from its ATH prior to surging higher. In the current cycle, BTC has only retraced about 26% from its peak, suggesting the possibility of more upside if past patterns repeat.

A common bull-run trigger, according to many analysts, is ETH surpassing its prior cycle high—something yet to occur, given that ETH has not yet breached $4,000. Khaneghah posits that this lag might indicate a delayed altseason and a much longer overall cycle than expected.

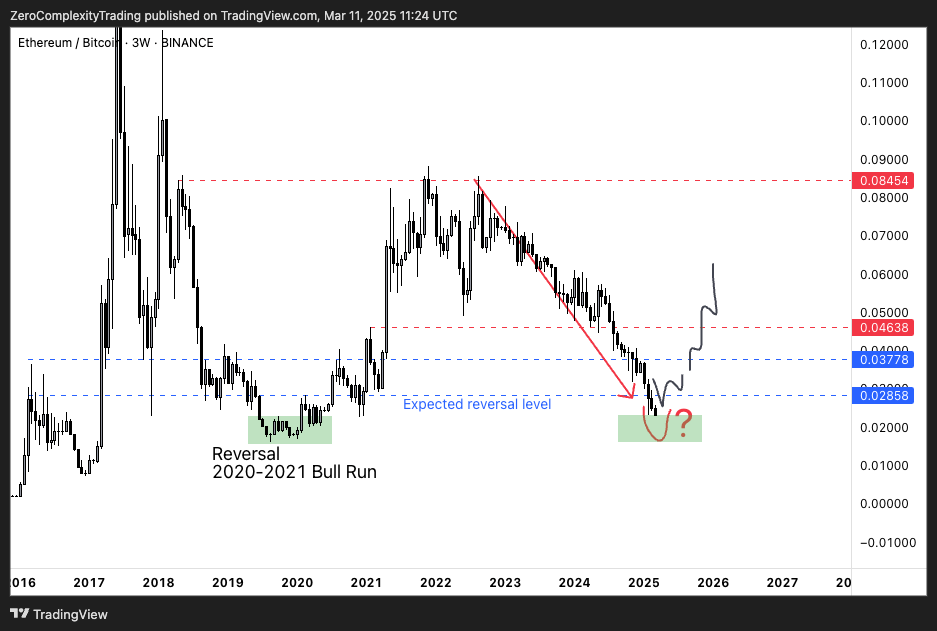

For altcoins to regain momentum, Khaneghah sees the ETH/BTC pair as a critical indicator. A bottom in ETH/BTC, combined with a rotation of capital from memecoins into other utility sectors such as DeFi and RWA (Real World Assets), could reignite altcoin rallies.

Khaneghah concludes that traders need not be fixated on either the bull or bear side: “If you’re a trader, you don’t have to marry a bias or commit to scenario 1 or 2. If BTC dominance continues, trade BTC by longing strength and shorting weakness. -If alts start to bottom, shift capital there and buy the strongest coins.”

At press time, BTC traded at $81,786.