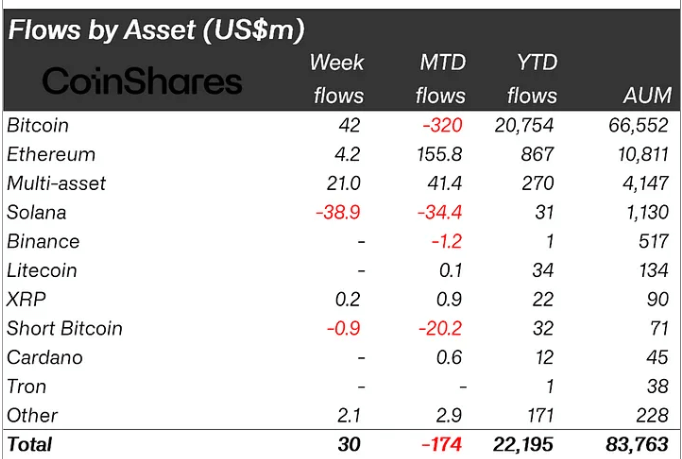

Crypto investment products experienced a lukewarm performance last week, with modest inflows of $30 million, according to CoinShares weekly report.

The weekly trading volume for these products also plummeted nearly 50% from the previous week, dropping to $7.6 billion.

James Butterfill, CoinShares‘ head of research, explained that these numbers were the market’s reaction to recent macroeconomic data that implied the Fed was less likely to cut interest rates by 50 basis points in September.

Solana sees record outflows

Bitcoin regained its dominance, attracting $42 million in inflows. However, its month-to-date flow remains negative, with a deficit of $320 million.

Similarly, Ethereum continued its multi-week streak of inflows, drawing in a modest $4.2 million, bringing its total monthly flows to nearly $166 million.

Additionally, Multi-asset products also saw positive momentum, with $21 million in inflows. Other altcoins, including XRP, reported gains as well.

Solana, however, faced significant outflows, with investors pulling a record $39 million from the asset. This was largely due to declining network fundamentals and a sharp drop in memecoin trading. Solana’s price reflected this bearish trend, falling 6% over the past week to $141.

Meanwhile, Short Bitcoin products recorded nearly $1 million in outflows, marking their second consecutive week of decline. This indicates that investors remain optimistic about Bitcoin’s short-term price potential.

BlackRock usurps Grayscale

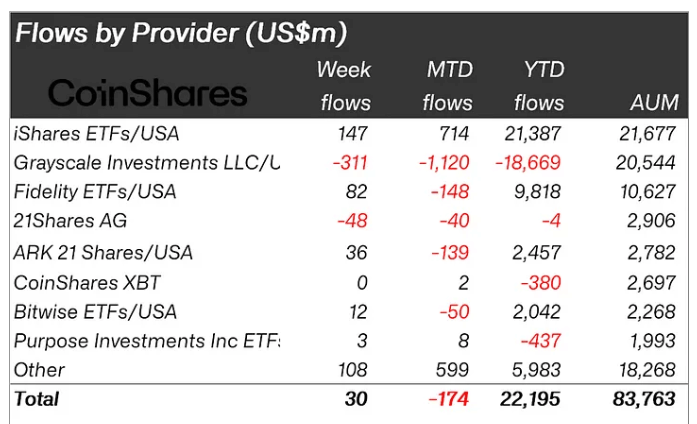

Butterfill also explained that the modest inflow figures concealed the fact that established ETP providers like Grayscale were losing market share to issuers of newer investment products like BlackRock.

A closer look at specific providers reveals a more nuanced picture. Grayscale, a well-established provider of Bitcoin and Ethereum ETFs, saw continued outflows last week, with over $300 million exiting its products. This brought its month-to-date flows to a negative of more than $1 billion and dragged the total value of assets under its management to $20.5 billion.

In contrast, new entrants like BlackRock iShares and Fidelity’s FBTC reported strong inflows. Notably, BlackRock’s ETF saw inflows of $147 million last week, and its AUM has now risen to $21.677 billion, the highest in the sector.

The post Crypto ETPs trading volume plummets 50% as BlackRock surpasses Grayscale appeared first on CryptoSlate.