Crypto expert Willy Woo has predicted that Bitcoin will still make significant moves to the upside. He made this claim based on an indicator that suggests crypto investors are still willing to buy the flagship crypto at higher prices.

Bitcoin Still Has “A Lot Of Room To Run”

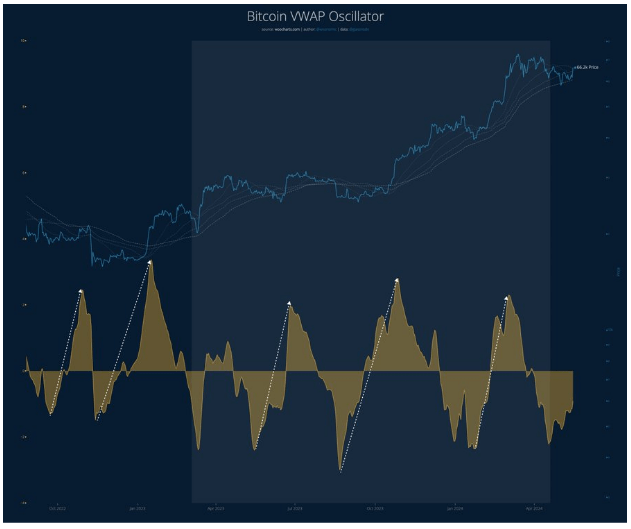

Woo mentioned in an X (formerly Twitter) post that Bitcoin still has a lot of room to run before the flagship crypto experiences a reversal or consolidation. To support his bullish sentiment, he shared a chart highlighting Bitcoin VWAP (Volume-Weighted Average Price). The crypto analyst further suggested that bulls were firmly in control, stating that he would hate to be a “trapped Bitcoin bear right now.”

The VWAP measures the average price of Bitcoin over a specific period and factors in the volume at each price level to determine the current sentiment in the market. The chart Woo shared showed that Bitcoin’s VWAP was currently on an upward trajectory. In a subsequent X post, Woo highlighted Bitcoin’s risk signal to further reinforce his bullish sentiment.

He noted that Bitcoin is still in the early stages in its liquidity cycle and is still doing “warm-up exercises.” He added that Bitcoin’s long-term frame risk signal is relatively low as it is still consolidating under all-time highs. He claimed that this risk “only starts climbing after the floodgates open,” meaning that the best is yet to come for Bitcoin.

Meanwhile, the wave of profit-taking by Bitcoin investors (since the crypto hit a new all-time high in March) looks to be done, which indicates that Bitcoin may be ready for its next leg up.

Woo confirmed that profit-taking has been completed as he provided an update on Bitcoin’s Spent Output Profit Ratio (SOPR). He noted that Bitcoin is undergoing a “very healthy reset, against a backdrop of capital flows into the network climbing again.”

Other Bullish Indicators For Bitcoin

Crypto analyst Crypto Jebb recently highlighted an inverse heads and shoulders pattern that had formed on Bitcoin’s chart. The analyst claimed this bullish pattern could send Bitcoin’s price to $100,000. The analyst also noted several other indicators currently signaling a bullish outlook for Bitcoin.

One is the Moving Average Convergence/Divergence (MACD), which he claimed had turned very bullish on the daily chart and indicated that the bulls were regaining control. He also highlighted a ‘green red green’ formation on the daily chart, which, according to Crypto Jebb, shows that Bitcoin is “doing very well.”

Meanwhile, crypto analyst Mikybull Crypto highlighted a striking similarity between Bitcoin’s 2020 post-halving price action and its price action after this halving. From the chart he shared, Bitcoin looks to be at the point of takeoff if it continues to mirror the price action from 2020.

Featured image from Pexels, chart from TradingView