Data shows the cryptocurrency futures sector has gone through a mass liquidation event in the past 24 hours as Bitcoin has witnessed a sharp crash.

Crypto Futures Liquidations Have Added Up To $659 Million In Past Day

The cryptocurrency market has seen sharp price action during the past 24 hours. As is usually the case during such volatility, chaos has occurred on the futures side of the sector.

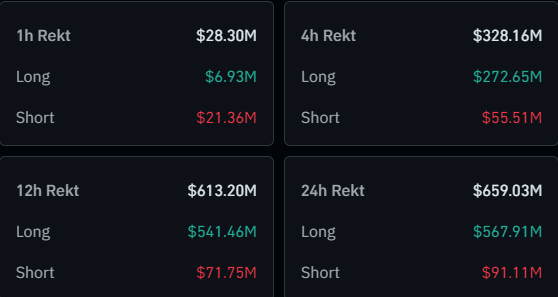

According to data from CoinGlass, almost $660 million in futures contracts have found liquidation on the last day.

“Liquidation” here naturally refers to the process that any contract undergoes when it racks up losses equivalent to a specific percentage of the position (which may differ between platforms). The exchange has to close it forcibly.

The above table shows that the longs took the brunt of this liquidation flush, as they saw contracts worth about $568 million decimated. This equals about 86% of the total liquidations in the past day.

The forceful closures have been so lopsided due to the sector observing a sharp drawdown following Bitcoin’s crash that took its price to as low as $41,500.

It’s also visible in the table that about $613 million of the total liquidations came during the last twelve hours alone, which again lines up with price action as that’s when the market was most volatile.

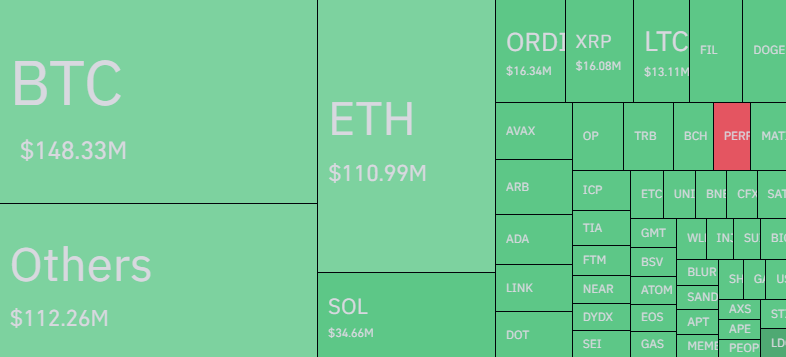

Regarding the individual contributions from each of the different symbols, it’s no surprise that Bitcoin-related contracts occupied the largest share of the liquidations at about $148 million.

Generally, though, BTC makes up for a huge part of the total market liquidations, but this time, the asset’s percentage share isn’t too extraordinary. Ethereum (ETH) and Solana (SOL) are the next biggest contributors to the squeeze, with about $111 million and $34 million in liquidations, respectively.

Historically, mass liquidation events like the one seen today haven’t exactly been a rare sight in the cryptocurrency sector due to the high volatility that most coins display on the regular and extreme amounts of leverage being easily accessible in many exchanges.

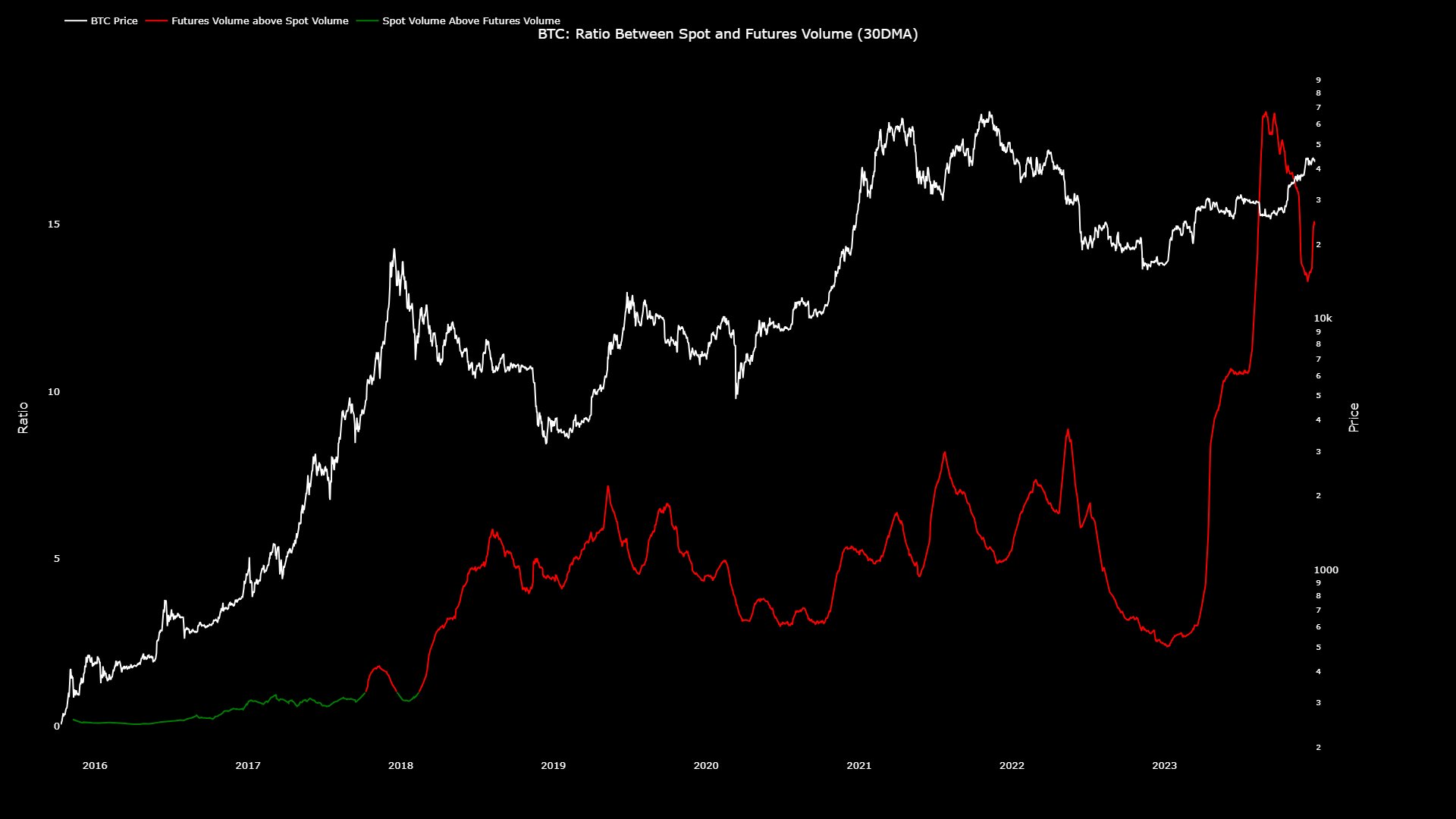

Recently, the interest in the derivatives side of the sector has become especially pronounced, as CryptoQuant Netherlands community manager Maartunn has talked about in a recent post on X.

As displayed in the graph, the Bitcoin futures volume has generally been higher than the spot volume during the last few years, but the gap between the two especially widened during the second half of 2023.

The indicator’s value saw some decline in the last couple of months of the year, but the recent values of the metric have still been quite high compared to the norm in the past.

Bitcoin Price

Bitcoin has seen some recovery since its initial crash, as the asset is now trading around the $42,700 mark.