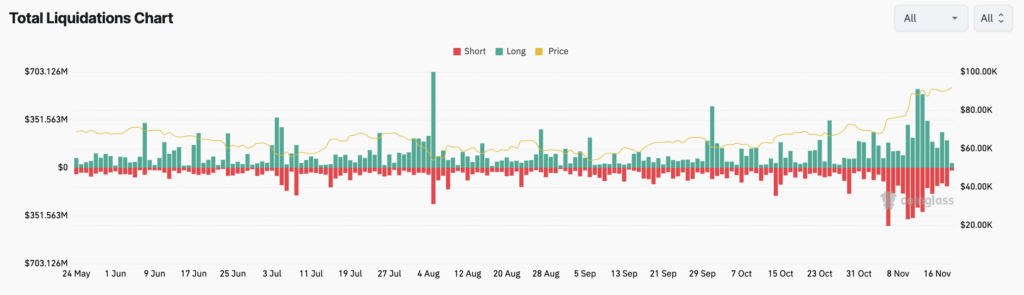

Over the past 24 hours, with Bitcoin holding between $89,700 and $92,500, $317 million has been liquidated. Long positions lost $210 million, while shorts lost $106 million.

Crypto liquidations have continued to exceed $300 million daily since Nov. 6 as Bitcoin’s price continues to climb. The highest levels were recorded on Nov. 12, when over $800 million was liquidated when Bitcoin reached $87,900.

Data from Coinglass shows that long positions accounted for approximately 66% of total liquidations. Binance led the exchanges with $139.72 million in liquidations over the past 24 hours, followed by OKX and Bybit.

Despite low volatility—Bitcoin has experienced a maximum 6% price swing within 24 hours since Nov. 6—traders are engaging in leveraged positions that are getting liquidated. The liquidation levels suggest traders are using high leverage or low collateral, leading to losses for both longs and shorts.

These liquidation levels coincide with Bitcoin’s bull run following the U.S. election results. Traders appear to be making leveraged bets on market movements, resulting in liquidations even with minor price fluctuations.

The post Crypto liquidations become elevated hitting highest persistent level of 2024 amid Bitcoin rally appeared first on CryptoSlate.