Bitcoin liquidations passed $464 million in the past 24 hours as the price declined to $92,500, resuming the downward trend from yesterday’s $700 million liquidation event.

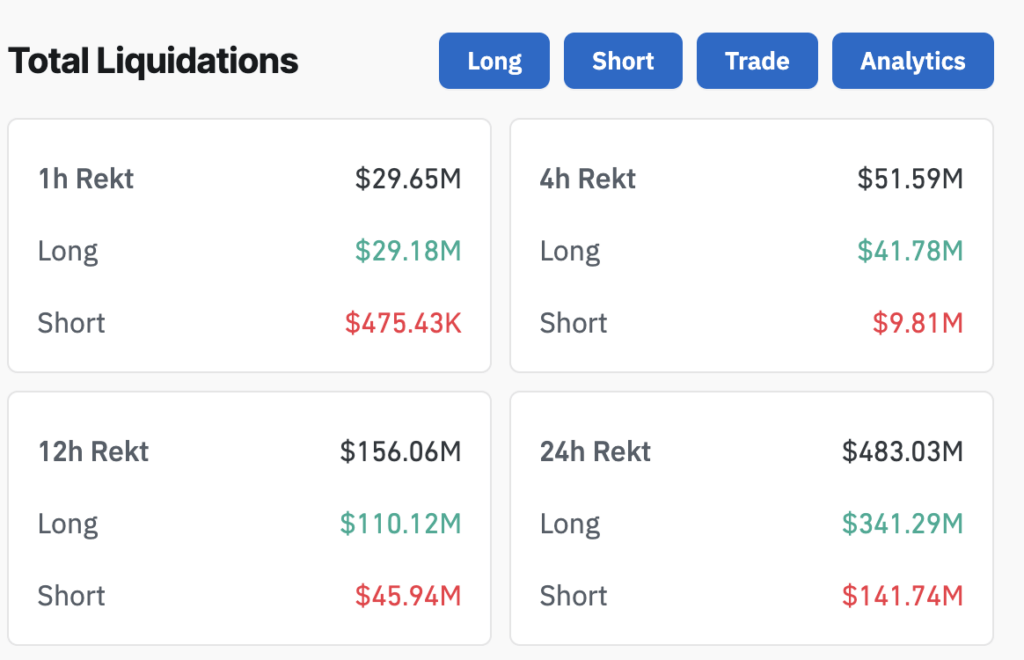

Per Coinglass data, long positions dominated the liquidations, accounting for nearly 70% of the total, with $324 million cleared compared to $141 million in short positions. The trend suggests traders remained heavily bullish despite market signals indicating a potential correlation with traditional equity markets.

Binance led exchange activity with $190 million in liquidations, followed by OKX and Bybit, which contributed $144 million and $85 million, respectively. A significant $15.30 million single liquidation order on OKX’s BTC-USDT-SWAP highlighted the severity of the market movement.

The data reveals a pattern of cascading liquidations, with the 12-hour period showing $156 million in cleared positions before accelerating to the 24-hour total. This acceleration pattern typically indicates a snowball effect where forced liquidations trigger further price decline, leading to additional positions being liquidated.

Market data suggests the recent price action stems from Bitcoin’s continued correlation with US equities, which saw a significant downturn earlier this week.

The post Crypto liquidations stay elevated at $483 million as Bitcoin continues decline to $92.5k appeared first on CryptoSlate.