The post Crypto Market Today: Analyzing the Impact of Trump’s Speech and BOJ Rate Hike appeared first on Coinpedia Fintech News

Since January 22, 2025, the total market cap of the cryptocurrency market has dropped by 3.64%, the total altcoin market cap by 2.72%, and the market cap of the crypto market, excluding the top ten cryptos, by around 5.2%. In the last 24 hours, almost all the top ten cryptos have experienced a decline; Bitcoin and Ethereum have slipped by 3% each, XRP by 2%, Solana by 2.5%, BNB by 1.9%, Dogecoin by 3.5%, and Cardano by 3.5%. Let’s examine the key reasons why the crypto market has experienced a significant fall.

Key Reasons Behind The Latest Crypto Selloff

Trump’s Speech Disappointment

The crypto community expected that Trump would mention his Bitcoin reserve plan during his inaugural speech. Contrary to expectations, Trump made no comment about the crypto industry during the speech. Naturally, the speech has caused great disappointment to the community. However, as a small relief, the US SEC has decided to create a Crypto Task Force to develop a clear regulatory framework for the cryptocurrency sector.

Bank of Japan Rate Hike Impact

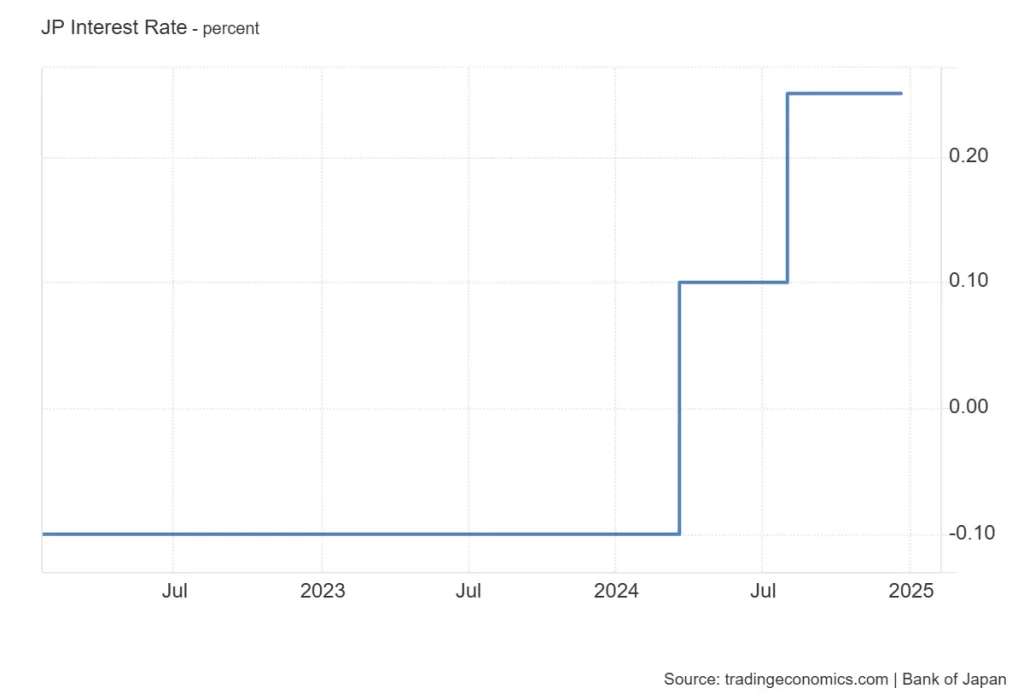

There are rumours that the Bank of Japan may increase interest rates by at least 25 bps to 0.5% tomorrow. At the start of January, 2024, it was around -0.1%. In March, it was lifted to 0.1%. In July, it climbed from 0.1% to 0.25%. Since then, it has remained unchanged. If increased to 0.5%, it would take the rates to the highest in at least 18 years.

US Federal Reserve Meeting

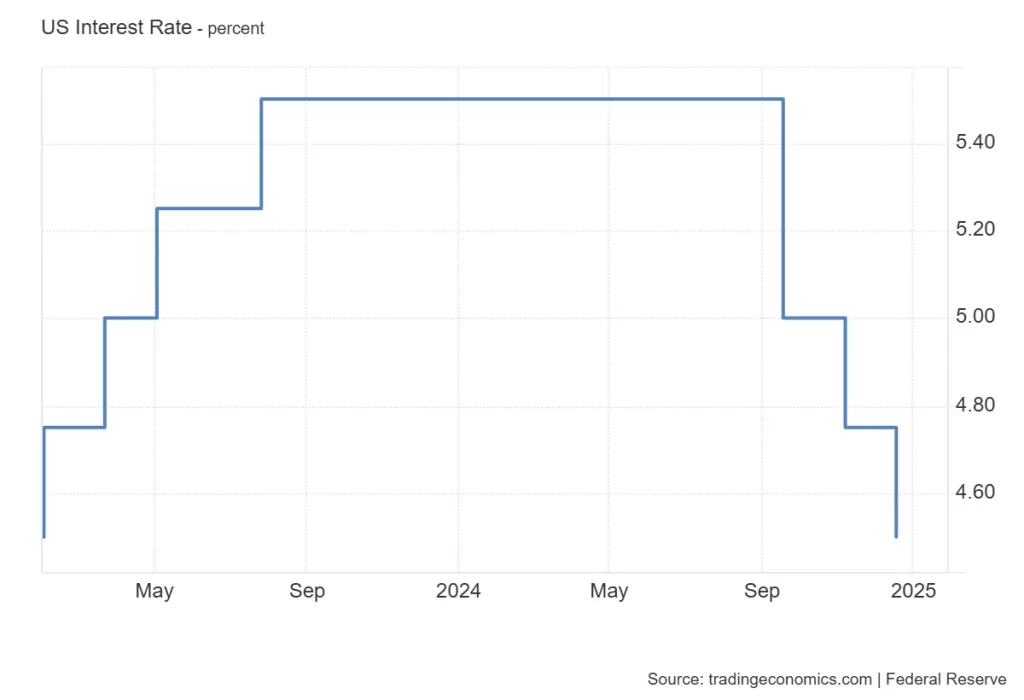

Reports suggest that the US Federal Reserve is likely to make no change in its interest rates during the January 29 meeting.

The US Fed announced a 25 bps rate cut in December, bringing the interest rates to the range of 4.25% to 4.5%. It even signalled at least two rate cuts in 2025, totaling at least 50 bps.

However, given the weakening macro scenario of the US, the Fed is less likely to introduce any rate cuts this year.

US Dollar Index and Treasury Yields

On the day of the US election, the US dollar index was 103.901. Since November 5, the US dollar index has surged by around 4.16%. As of now, it stands at 108.227.

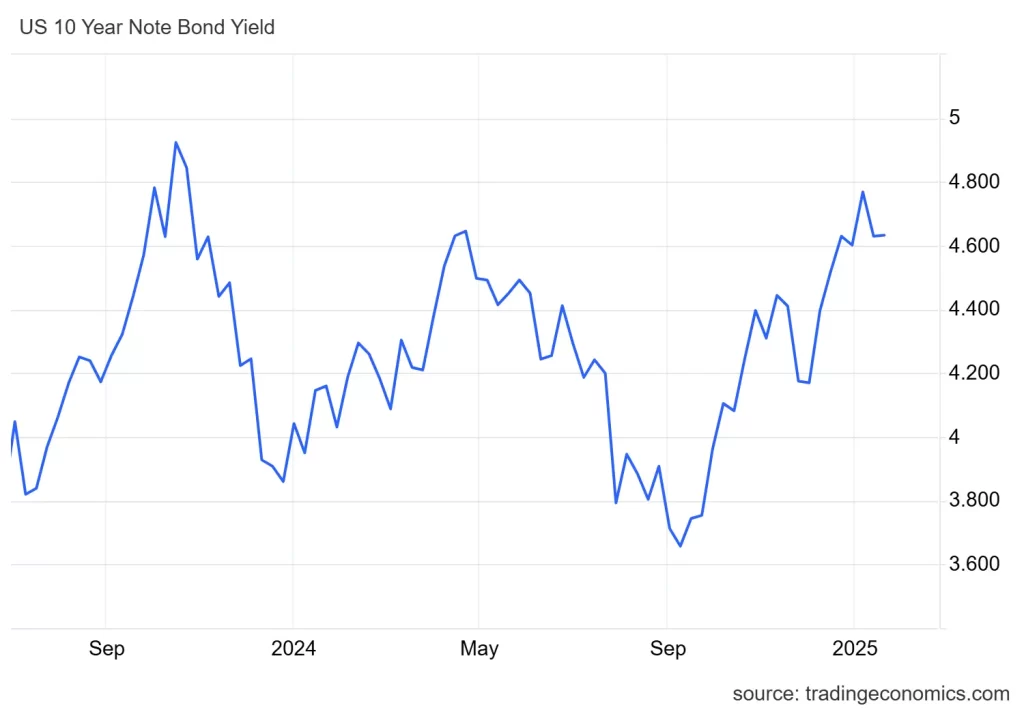

On January 6, the US 10 Year Treasury Bond Note Yield reached its highest level since April, 2024. Though between January 6 and 13, it faced downward pressure, since January 13, it has grown steadily. Currently, it stands at 4.6357%.

BTC and ETH Options Expiry

Data shows that 29K BTC options (notional value $3 billion) and 169K ETH options (notional value $0.5 billion) are set to expire soon.

In conclusion, the crypto market selloff underscores the combined impact of macroeconomic factors, disappointing political developments, and technical factors like options expiry. While BTC and ETH struggle and global uncertainties, investors must closely monitor regulatory moves, rate changes, and market trends to make informed decisions. Stability might return only when macro conditions improve or institutional confidence revives.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.