The post Crypto Market Trends: Why Prices Are Up but Activity Slows appeared first on Coinpedia Fintech News

Various cryptocurrencies keep making certain moves in the market that bring them into the headlines. This time, Bitcoin, Ethereum and Solana are taking the stage. Some crypto people might be thinking why prices are up despite slow activities, Let’s try to understand why this is happening.

Bitcoin Steady, Ethereum Gains, Solana Keeps Climbing

Bitcoin (BTC) is sitting comfortably at $101,088. It’s just a little below its recent peak of $101,356. Prices are strong, but the trading volume isn’t following the same path. In fact, it’s down 17.31%, now at $67 billion. Even with the drop, Bitcoin’s market dominance is undeniable—55.08% share and a market cap near $2 trillion. That’s massive.

Ethereum (ETH) is doing its own thing. It’s trading at $3,913, which is slightly up from $3,875. Over the past week, Ethereum has climbed an impressive 17%. That’s a big win for traders who stayed optimistic. But like Bitcoin, its trading volume isn’t keeping pace. It’s dropped by 29.33% to $24 billion. Even so, the bullish vibes around Ethereum seem stronger than ever.

Then there’s Solana (SOL), which keeps grabbing attention. It’s now priced at $230.01, continuing its upward streak. Enthusiasm for Solana is real, but its trading volume also took a hit—down 32.28%, leaving it at $3.4 billion. Still, Solana’s consistent growth shows how much potential people see in it, especially with its role in decentralized finance (DeFi).

XRP is definitely a crypto token worth talking about. Despite a sharp drop in trading volume – 45.24%, XRP reached $2.44. The current recorded trading volume is $12.96 billion.

What’s Driving the Price Hikes?

It might feel strange at first—prices rising as volumes fall. But the reasons behind this trend are clearer when you dig a little deeper.

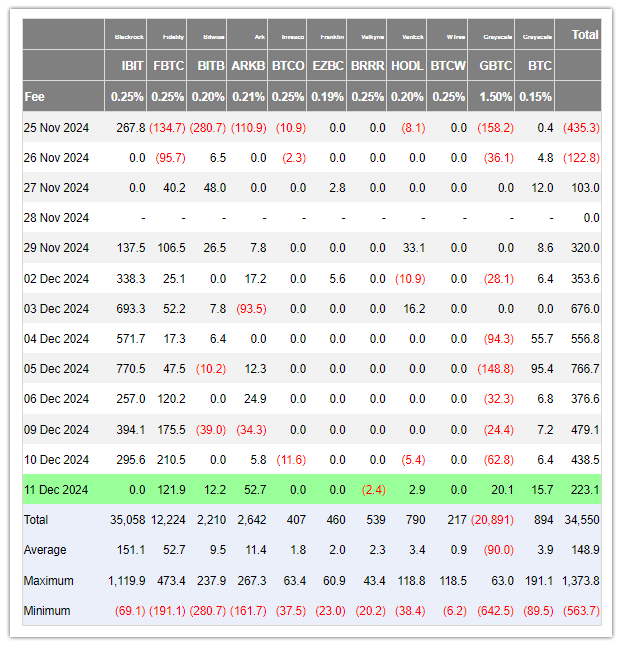

Institutional investors are stepping in more than ever. Bitcoin ETFs have seen massive inflows, with Fidelity alone adding $121 million. These funds make it easier for large investors to join the market, driving up prices even when overall trading looks quieter. Even the retail investors are not stopping to invest in. As the economic conditions are stable, they are getting the courage and seeing crypto as a smart investment. As the U.S. inflation is at 2.7%, the digital currencies are becoming a hedge against the uncertainty.

Trading habits are changing in interesting ways. Instead of seeing lots of frequent, smaller trades, the trend is leaning toward fewer but larger transactions. This shift seems to be driven mainly by institutional investors, who are playing a bigger role in the market. It’s part of why trading volumes are down, even though prices keep climbing. You could see it as a sign of the market maturing—moving toward long-term investments rather than short-term speculation.

Technology is having a big impact too. Ethereum and Solana are gaining from improvements in decentralized finance and scalability. These upgrades make them more attractive for people looking at the bigger picture. Even meme coins are bringing some excitement back into the market. Take Solana-based PNUT, for example. It jumped 35% recently, thanks to getting listed on major exchanges. It shows there’s still plenty of energy and interest in crypto.

And don’t overlook the bigger economic backdrop. With inflation easing and markets stabilizing, riskier assets like cryptocurrencies are becoming more appealing. Many investors now see crypto as a way to protect themselves from future uncertainty. This growing confidence, from both everyday investors and big institutions, is a major reason why prices are holding strong.

What to Expect

So, what’s next for the crypto market? If things stay on this path, we might see prices going even higher. Institutional investors seem likely to keep driving growth, especially if the economy remains stable. Crypto could become even more established as a go-to investment option, attracting both seasoned traders and curious newcomers.

That said, the market is unpredictable as ever. Prices can change quickly, and unexpected factors could shake things up. For now, though, the focus seems to be shifting toward long-term value rather than quick wins. With all the ongoing developments in technology and adoption, the market feels like it’s heading into an exciting new phase. Who knows what’s around the corner but it is now clear why prices are up despite the low trading volume.

Bitcoin, Ethereum, Solana—they’re all part of a story that’s far from over. The question isn’t whether things will change. It’s how soon and how much. Stay tuned because this space never stays quiet for long.