Prominent crypto market commentator and former BitMEX CEO Arthur Hayes predicts a “harrowing dump” in the digital assets market around President-elect Donald Trump’s inauguration. However, Hayes adds that the anticipated market crash will likely be followed by a strong bullish trend reversal.

Hayes Warns Against Overblown Expectations From Trump

Renowned crypto market analyst Hayes shared a new blog post outlining his views on the crypto market’s trajectory for the coming year. According to Hayes, the disconnect between the crypto market’s high expectations for Trump’s incoming administration and the political reality will likely spook investors, triggering a significant market sell-off.

Hayes points to the market’s unrealistic expectations from Trump, saying that it is “almost impossible for Trump to appease his base sufficiently to prevent the Democrats from retaking both legislative bodies in 2026.” As a result, Trump will have, at best, one year to enact any policy changes.

The crypto entrepreneur warned that the market’s realization of these limitations will trigger a “vicious sell-off” in digital assets. He revealed that his investment fund, Maelstrom, plans to book profits ahead of the anticipated sell-off and re-enter the market at lower prices during the first half of 2025. However, Hayes noted that he is open to “admitting defeat” if no market correction occurs by January 20.

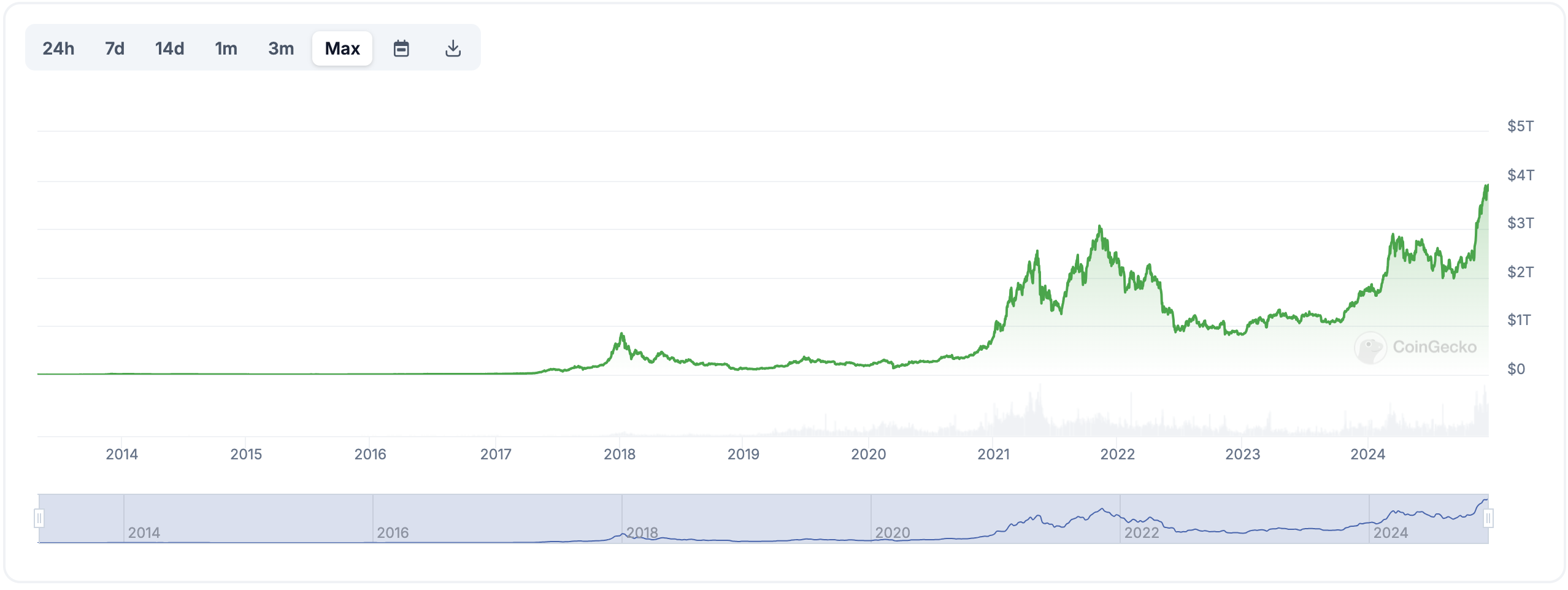

Trump’s victory in the US presidential election has sparked fresh hope in the crypto market, resulting in BTC rising past $100,000 price level for the first time ever. At the time of writing, the total crypto market cap stands at $3.81 trillion.

Trump’s victory has also fuelled speculation about the creation of a potential national strategic Bitcoin reserve, a move that could spur competitive sovereign purchases by other nations. However, Hayes does not expect such a reserve to materialize anytime soon. He explained:

While I don’t believe the US government will purchase Bitcoin, it doesn’t affect my positive price outlook. At the end of the day, a gold devaluation creates dollars which must find a home in real goods/services and financial assets.

Contrasting Projections For BTC Price Action

While Hayes foresees an impending crypto market dump in early 2025, crypto financial services firm Matrixport predicts otherwise. According to a recent X post, the firm expects a “strong start” for BTC going into 2025.

Similarly, Standard Chartered bank estimates that BTC may climb up to $200,000 by 2025 as more institutions continue to accumulate the top digital asset. A recent report by crypto exchange Bitfinex also predicts further upside potential in BTC after its consolidation around the $100,000 price level.

Even more ambitious price targets were shared by Bitwise’s Matt Hougan, who said that buying BTC before it reaches $500,000 would still be considered “early.” At press time, BTC trades at $104,002, down 2.8% in the past 24 hours.