Robinhood, a popular American financial services company, is finally out of the woods. In its third-quarter filing ending September 30th, 2024, the company disclosed its revenues were up by 165%, and its overall year-to-date (YTD) net deposits increased to $34 million.

It’s a promising development for Robinhood Markets this quarter after facing plenty of challenges in the past. The company took a hit in early 2021 after it decided to restrict trading in GameStop and other meme stocks during a market frenzy. In a separate statement, Robinhood shared that it’s inching closer to a settlement with investors and traders.

Q3 Filing Is Company’s Second-Best Revenue

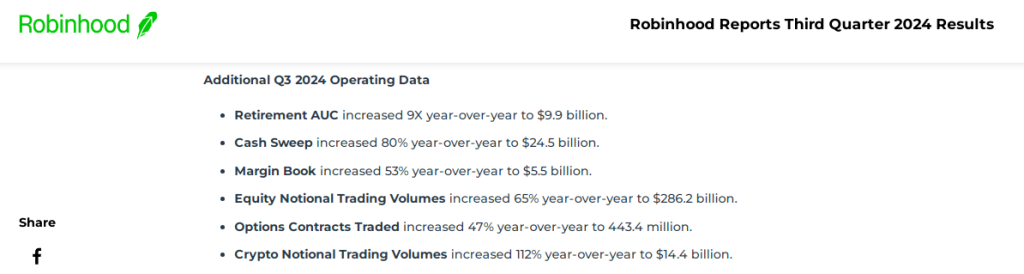

Despite its challenging backstory and the SEC’s regulatory pressures, Robinhood Markets found its rhythm to post a solid third-quarter performance. The company shared that its net deposits grew to $34 billion, and revenue increased 36% yearly to $367 million, with its cryptocurrency unit leading the surge.

In its filing, Robinhood stated that its cryptocurrency revenue increased to $61 million over the quarter or 165%. Market observers expected this growth after the company completed its takeover of Bitstamp, thus pushing its trading volume.

Robinhood Surprises With Impressive Growth

Robinhood’s growth story impressed many market observers and analysts, given its recent experience with FTX, the ‘meme frenzy,’ and run-ins with the SEC. Last year, the company bought back its shares from Alameda Research for $605 million.

At the time of the transaction, many observers expected that Robinhood would avoid cryptocurrency investments. However, the company surprised analysts by making crypto a critical investment through its Robinhood Crypto unit. For its Q3 filing, Robinhood’s Asset Under Custody (AUC) surged by 76% year-over-year to more than $152 billion.

The firm reported that its holdings increased due to higher equity, better crypto valuation, and sustained deposits. The company has a portfolio heavy on Bitcoin, and the recent rise in the top crypto bodes well for the firm, which will continue to earn as long as the trend remains bullish for BTC.

Robinhood Finally Moving Ahead After Regulatory Pressures

Robinhood Markets is finally moving away from the challenges and issues. As mentioned, the company was embroiled in a trading scandal in early 2021 over the hype on GameStop and meme stocks. Last May, the Securities and Exchange Commission (SEC) issued a Wells Notice to the company.

The agency argued that some of Robinhood’s cryptocurrency services violate securities laws. Interestingly, the SEC has not filed a case against the company.

In the meantime, Robinhood Markets is business as usual. Based on reports, Robinhood has listed several tokens and allowed transfers for assets like SOL. However, access to the service is limited to EU customers.

Featured image from Omar Marques/SOPA Images/LightRocket via Getty Images, chart from TradingView