The growing prominence of cryptocurrencies in the financial environment has made them a major point of interest for voters as the 2024 US presidential election draws near.

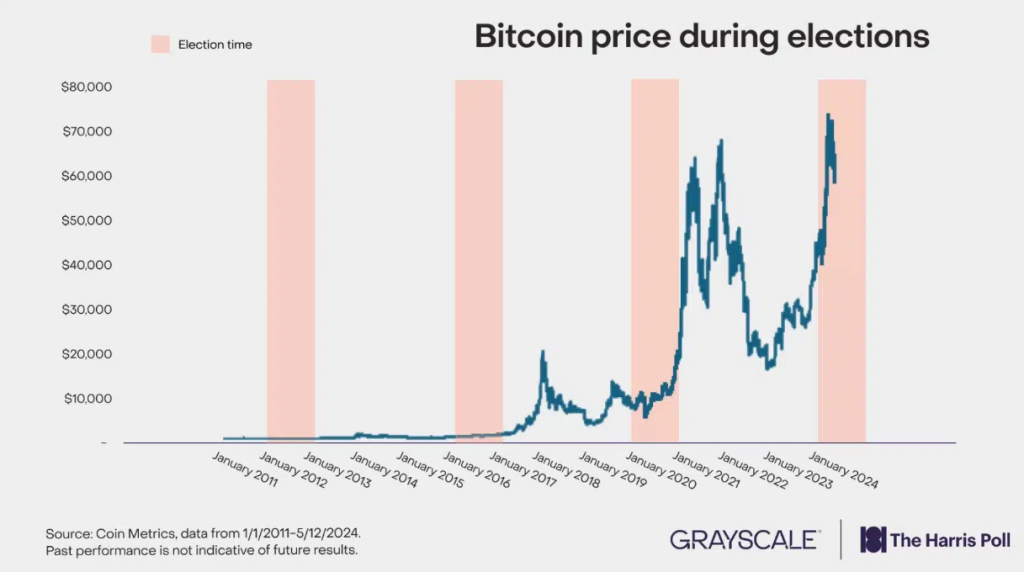

A recent survey conducted by Harris Poll on behalf of Grayscale reveals a surge in public interest and investment sentiment towards cryptocurrencies, particularly Bitcoin, signaling a potential shift in electoral dynamics.

Crypto Acceptance On The Rise

Between April 30th and May 2nd, 1,768 adults participated in an online survey that underscored an increased openness to cryptocurrency investments.

Since the beginning of the year, nearly a third of voters have become more receptive to learning about or investing in cryptocurrencies.

This growing interest is attributed to the maturation of Bitcoin as an asset and recent macroeconomic developments that have bolstered its credibility and appeal.

The survey also highlighted a notable rise in the perception of cryptocurrencies as favorable long-term investments. Currently, over 20% of respondents view crypto positively for long-term gains, up from 18% last November.

This trend reflects the broader acceptance and integration of digital assets into mainstream financial portfolios.

The political landscape mirrors this rising interest, with a balanced distribution of crypto ownership among Republicans and Democrats.

Regulation And Sentiment Shift

Voters are equally split on which party holds a more favorable stance on crypto policies, indicating that cryptocurrency has become a bipartisan issue. This balanced interest could make cryptocurrency a unifying topic that transcends traditional party lines.

Regulatory advancements, such as the approval of a Bitcoin Exchange-Traded Fund (ETF), have further fueled interest. The Bitcoin ETF has particularly resonated with retiree voters, with almost 10% indicating increased interest in investing in Bitcoin or other crypto assets following its approval.

This suggests that regulatory clarity and institutional adoption are pivotal in shaping public sentiment towards cryptocurrencies.

Candidates’ Crypto Stances Emerge

In terms of the candidates’ positions, Donald Trump has openly embraced cryptocurrency, incorporating it into his campaign through crypto donations.

Conversely, incumbent President Joe Biden has maintained a more reserved stance but has shown some support through legislative actions such as the FIT21 and SAB 121 bills.

These varied approaches could influence the electoral landscape, especially as younger voters, who show significant interest in crypto, head to the polls. The increasing traction of cryptocurrency among voters suggests that the next administration’s approach to crypto regulation and policy will be crucial.

As the political debate intensifies, candidates’ stances on digital assets could become a decisive factor in swaying voter preferences and turnout.

Cryptocurrency, once a niche topic, is now at the forefront of the electoral agenda, reflecting its profound impact on the financial and political fabric of the nation.

Featured image from EY, chart from TradingView