A crypto trader with a keen eye for artificial intelligence (AI) projects has reportedly amassed profits of more than $17 million from several AI-focused tokens, and on-chain data now points to a pivot toward fresh memecoins. According to an analysis shared by Lookonchain on X, the trader’s largest gains stem from early positions taken in GOAT, ai16z, Fartcoin, and ARC.

Crypto Trader Turns AI Coins Into $17 Million

Lookonchain reports via X, “What a smart AI coin trader! Profits exceeded $5.14M on GOAT. Profits exceeded $4.5M on ai16z. Profits exceeded $4M on Fartcoin. Profits exceeded $4M on arc. Let’s take a look at which tokens he is buying.”

The trader’s most significant win reportedly came from GOAT. He entered the token at a time when its overall market cap was below $2 million dollars, spending around $62,000 to purchase approximately 11.1 million GOAT tokens. After riding GOAT’s rapid ascent, he sold all GOAT with a total of about $5.2 million, netting an estimated $5.14 million.

His performance with ai16z – a decentralized AI-powered trading fund on the Solana blockchain – is similarly impressive, as he spent one $123,000 to acquire 6.17 million tokens at a market cap of $22 million. Lookonchain’s data indicates that he sold 4.67 million ai16z tokens at around $1.78 each and still retains 2.65 million tokens currently valued near $2.9 million. According to Lookonchain, this amounts to a total ai16z profit of more than $4.5 million.

The analysis also highlights significant gains from Fartcoin, which the trader bought at a market cap of under $7 million, paying $121,000 for around 9.46 million tokens. He sold 6.81 million of those tokens for $610,000 while keeping 2.65 million tokens that are collectively valued at $3.55 million, bringing his net profit on Fartcoin to roughly $4 million.

A similar pattern emerged in his ARC position, where he invested $212,000 to acquire 11.6 million ARC tokens when the project’s market cap was approximately $15 million. After selling 1.6 million tokens for $212,000, he currently holds 10 million arc tokens worth about $4 million, resulting in another $4 million profit.

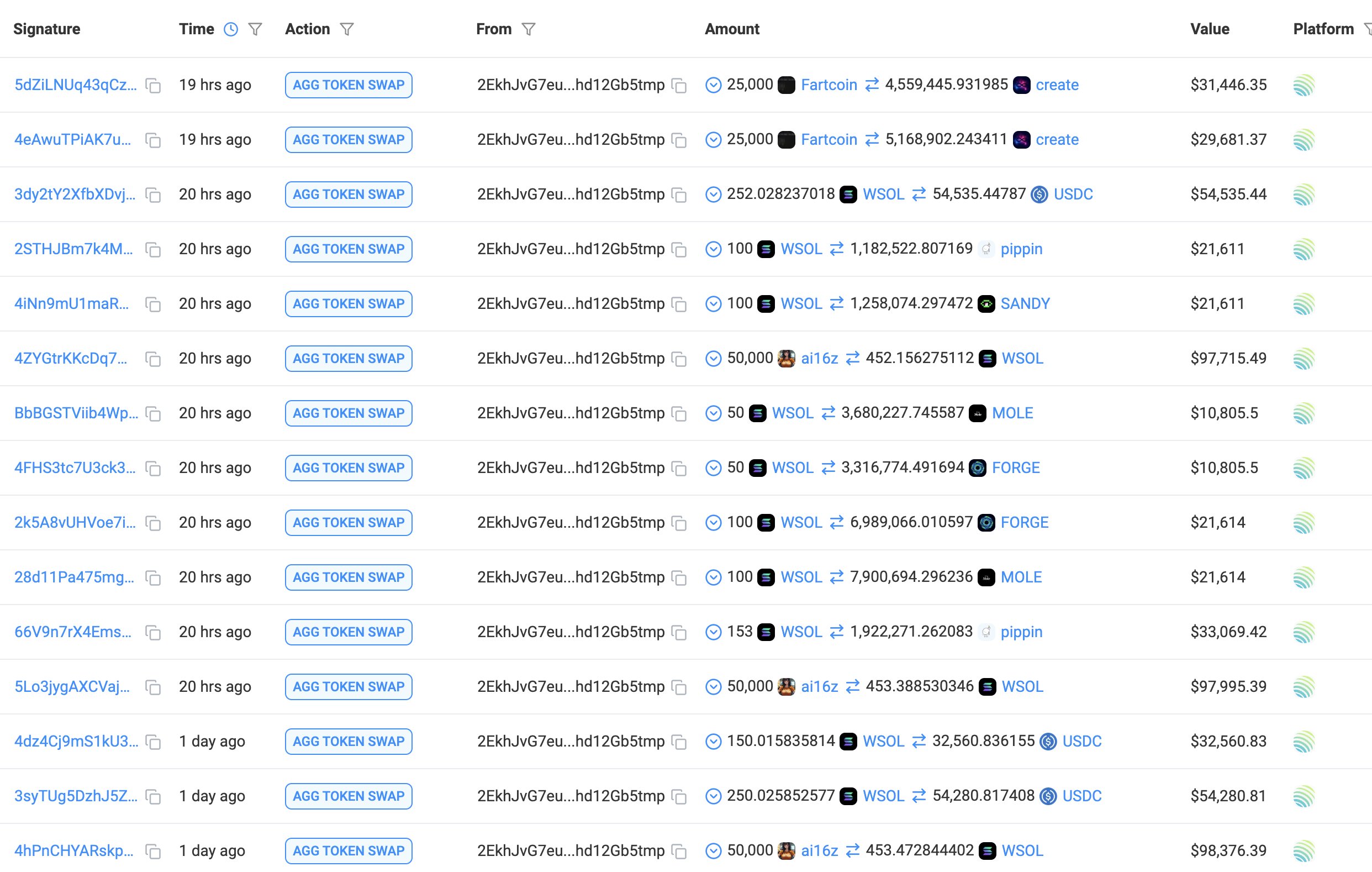

Lookonchain’s post also details the trader’s recent moves into several smaller-cap memecoins, including CREATE, PIPPIN, SANDY, MOLE, and FORGE. A screenshot provided by Lookonchain shows that he financed part of these purchases by selling Fartcoin in two batches of 25,000 units for $31,446.35 and $29,681.37, respectively.

Additional funding appears to have come from selling Wrapped SOL (WSOL) in multiple transactions, including 100 units for $21,611, 50 units for $10,805.50, and 153 units for $33,069.42.

The distribution of these WSOL sales suggests a methodical approach to securing liquidity before deploying funds into CREATE, PIPPIN, SANDY, MOLE, and FORGE. In total, he allocated $202,255 to acquire stakes in the memecoins. He spent $61,127 on CREATE, $21,611 on PIPPIN, $21,611 on SANDY, $65,486 on MOLE, and $32,420 on FORGE.

At press time, GOAT traded at $0.52.