There was a good level of optimism in the crypto market heading into the past week, with many investors speculating on a potential “Xmas Rally” for Bitcoin. While the premier cryptocurrency did make a play for the $100,000 mark on Christmas day, it didn’t take long for the bears to resume control.

It was pretty much the same story for most of the other large-cap assets, including Ethereum, Solana, and the in-form XRP. The recent bearish climate of the crypto market has pushed a cloud of skepticism over the digital asset sector as the historic year 2024 draws to a close.

Why Is Trading Activity Dwindling In The Market?

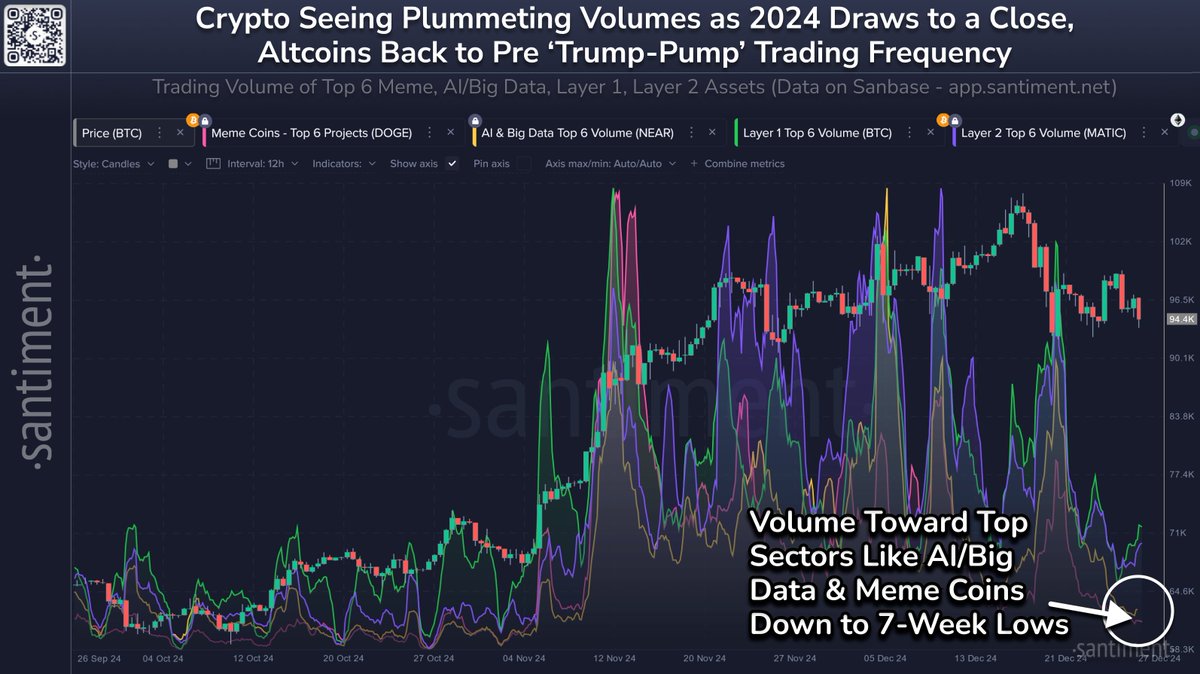

In its latest post on the X platform, market intelligence firm Santiment shared an interesting insight into the crypto market in the final days of 2024. According to the blockchain company, market trading volume is steadily dropping across various cryptocurrency sectors.

Data from Santiment shows that the trading volume is down by 64% in the past week, with sectors like AI/Big Data and meme coin reaching new weekly lows. This seems like a complete turnaround from a positive market trend considering that the price of Bitcoin only just set a new record high of $108,135 in the previous week.

At the same time, Santiment believes that everyone should have anticipated the downturn of trading volume, especially that of speculative altcoins. “With the holidays here and traders getting their year-end finances in order, the final week of December is often one of the least active times of each year,” the analytics firm explained.

Similarly, a Quicktake analyst with the pseudonym Grizzly mentioned that the Coinbase Premium Index, which tracks the percent difference between Coinbase Pro price (USD pair) and Binance price (USDT pair), has been on a decline due to similar reasons. Grizzly said reduced market participation during the holiday season, alongside limited cash flow, has likely contributed to the price decline.

However, Santiment noted that the crypto market could see at least “one final big unexpected” rally before 2024 ends if whales continue to exhibit their strong accumulation tendency. This market pump could happen even with the current lack of retail attention and participation.

Total Crypto Market Capitalization

As of this writing, the total cryptocurrency market capitalization stands at around $3.43 trillion, reflecting a 2.2% decline in the past 24 hours. With the crypto market cap up by more than 100% year-to-date, there is no question that, regardless of how the year ends, 2024 has been an excellent period for the digital asset sector.