DAOs – Natural Evolution of Digitization

To illustrate, for the vast majority of content creators on YouTube, there’s just as much of a battle against a complex algorithm as there is with creating interesting content. Just like with Facebook or Twitter, creators are at the mercy of the platform’s algorithms, which are constantly tweaked behind the scenes by a centralized entity.

The same applies to the financial sector. The GameStop short squeeze suggests that the path between placing a stock trade and it being executed, is laden with centralized mines—from brokerages and market makers to clearinghouses.

This lack of transparency and immediate redress is why DAOs—Decentralized Autonomous Organizations—are becoming increasingly popular. Similar to how lending protocols Aave or Compound use smart contracts to recreate banking without banks, DAOs use smart contracts to automate human interaction in organizations.

Not to be confused with companies, DAOs are protocols that determine how a collectively owned organization is governed. Despite its moniker, depending on a DAO’s token allocation for voting, they range across a spectrum, from centralized to fully decentralized and autonomous, to somewhere in between. Most importantly, DAOs are typically independent from their creators, unless their smart contract code specifically states otherwise.

Combined with censorship-resistant blockchain technology, DAOs are becoming the preferred funding vehicle for online communities. But, how exactly do they work?

DAOs In Action

The world’s largest bank, JPMorgan, recently published Opportunities in the metaverse, a report for investors. The bank noted how DAOs have a prominent role in developing Web 3.0 internet as community-governed. That governance is enabled through tokenized voting that leads to consensus, which is then executed by a smart contract built up from the IF-THEN logic fundamentals.

Because these executions take place on a transparent and immutable blockchain network, DAOs open the door to unprecedented levels of oversight and user confidence.

Here is how that works in practice. Let’s say you want to crowdfund the purchase of a rare copy of the US Constitution. This happened with the Johan Erlich-led ConstitutionDAO. Although it ultimately proved unsuccessful, it did demonstrate that DAOs can work as envisioned.

With social media activism, and the promise of voting on what to do with that particular copy of the Constitution, the organization raised 11.6k ETH. At the time, this amounted to around $47.4 million worth of crypto funds.

The ConstitutionDAO then became a governed entity that could link up with other entities—Sotheby’s. The auction house could easily verify the funds as it had already integrated NFT sales into its service.

Although ConstitutionDAO overshot its funding goal by 137%, a single individual trumped 17.4k unique addresses. Kenneth Griffin ultimately outbid ConstitutionDAO and bought a copy of the constitution for $43.2 million. Although ConstitutionDAO did have more funds, its token holders gave up the bidding process after realizing they wouldn’t have enough money to ensure and safeguard the precious document.

— ConstitutionDAO (

,

) (@ConstitutionDAO) November 19, 2021

Nonetheless, the venture did showcase three important points a DAO can achieve:

- Remove reliance on centralized crowdfunding platforms. Case in point, GoFundMe is currently under investigation by four states for blocking recent donations to Canadian protestors.

- Create a transparent, verifiable, and conflict-free method of tokenized voting.

- Return funds if the project fails. Although 55% of the ConstitutionDAO’s funds have been returned, there is no time limit or expiry. Because it has to be manually requested, many funders opted to wait out Ethereum’s high gas fees.

The revolutionary implication is that, with turnkey solutions like DAOMaker, Aragon, or Moralis, nearly anyone can create their crowdfunding platform.

DAOs that have a consistent investment strategy are even more interesting. PleasrDAO pioneered DeFi,,,, protocols and NFTs into a single DAO-hedge package. Last summer, they made headlines by using NFTs as collateral for a $3.5 million loan. Commonly, loans have to be overcollateralized in the crypto space due to the inherent volatility of the assets.

However, using something akin to ‘blue-chip’ NFTs is a way to get around this. In particular, PleasrDAO paid $8 million for the four NFTs they collected and used as collateral: the Tor Project’s Dreaming at Dusk, Edward Snowden’s Stay Free, and two NFTs from Apes Together Strong by artist Pplpleasr.

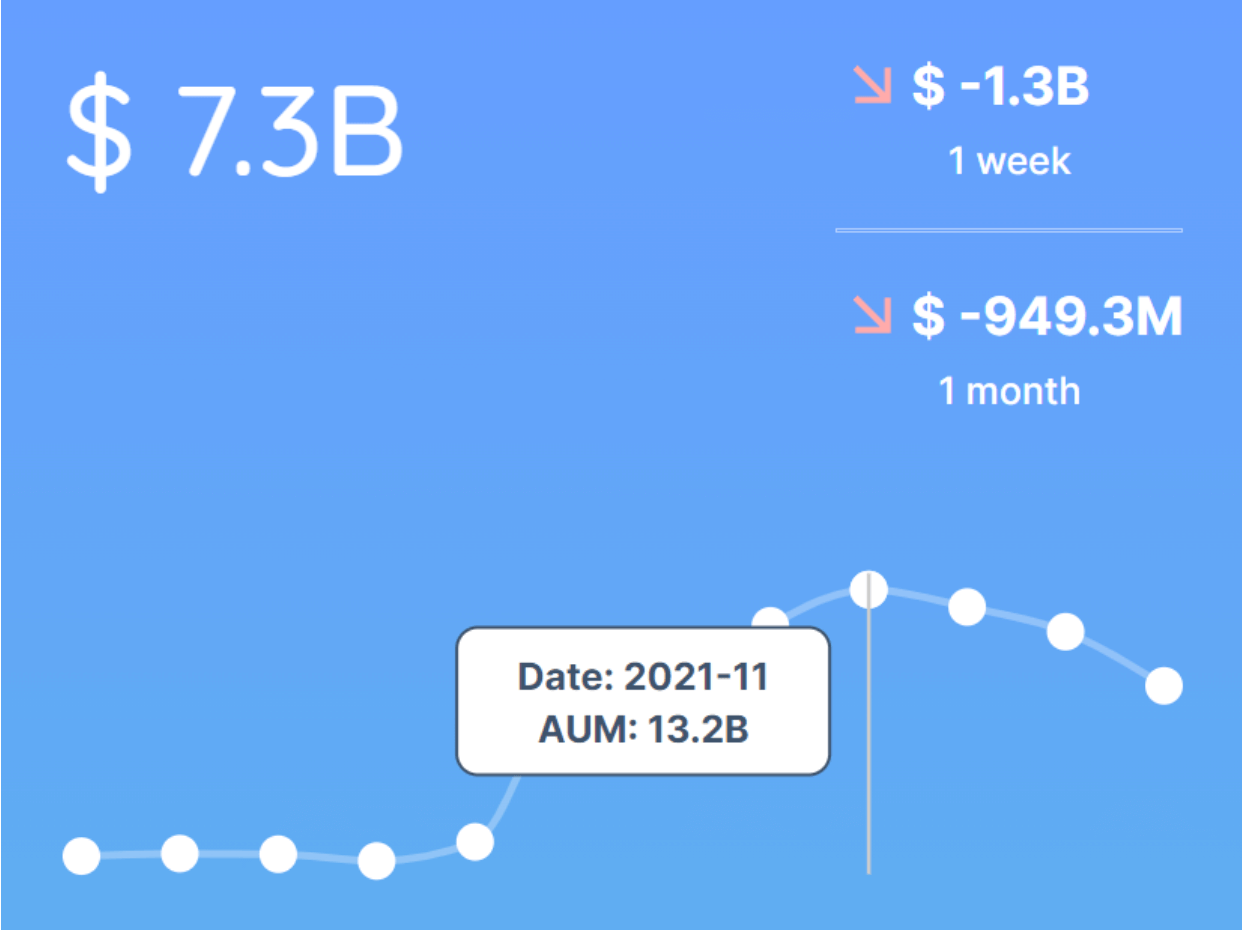

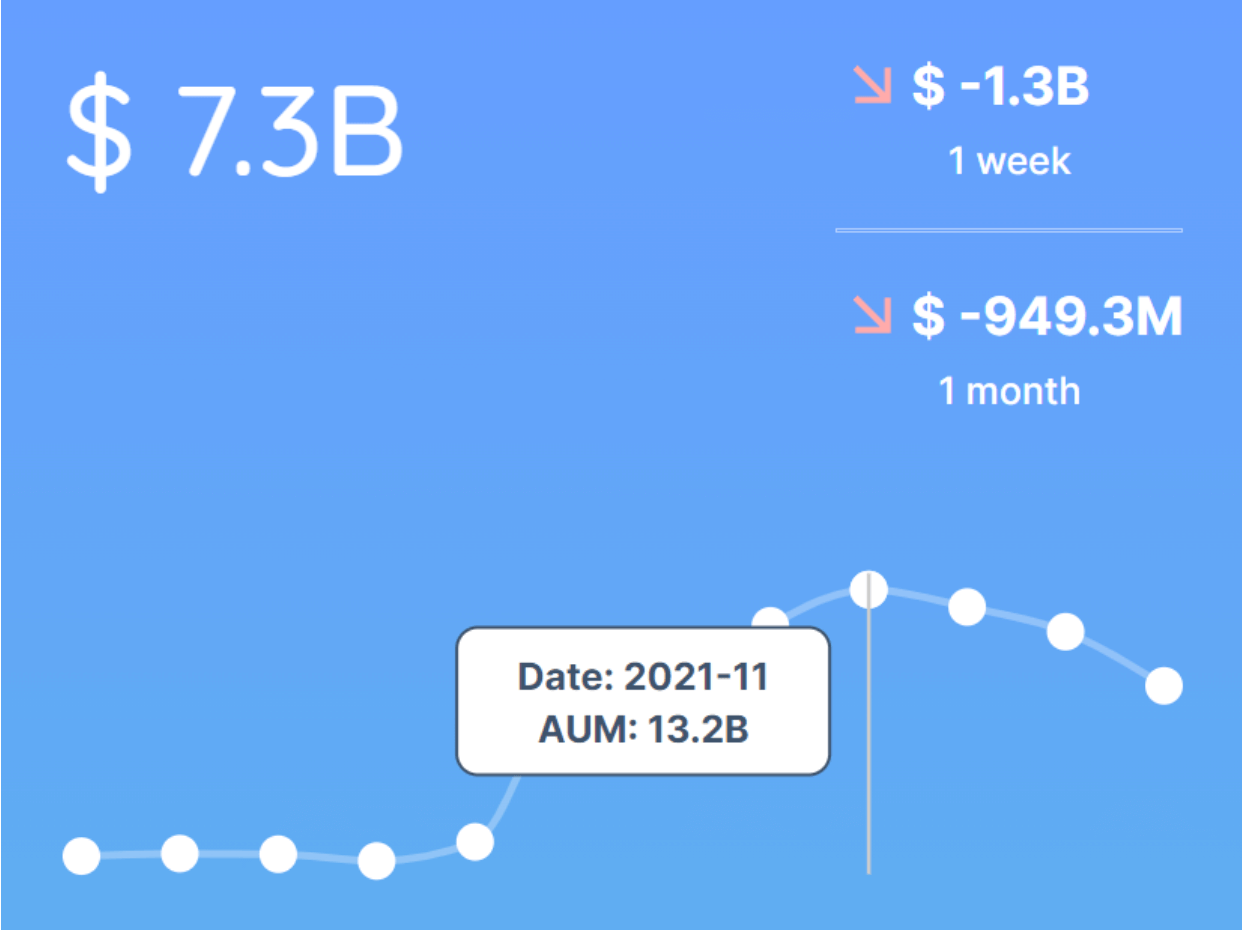

PleasrDAO is currently ranked 18th by size, with $85.1 million at disposal in its treasury. The question is, can these DAO treasuries be violated?

Governance Convenience Means Greater Susceptibility to Scams

Code-dependency serves DAOs both as a strength and a weakness. Case in point, CityDAO was formed to buy 40 acres of land in Wyoming, using smart contracts to start building a blockchain city through communal governance. Effectively, CityDAO fractioned the real estate into NFTs as its treasury assets.

Unfortunately, a cybercriminal compromised CityDAO’s Discord channel and used one of the moderator’s accounts to pilfer $95k worth of funds, by issuing a fake land NFT drop.

Yesterday, my account and the CityDAO server was exploited and as a result members lost funds.

Multiple large servers have been exploited in this same way over the past few weeks.

Below I have shared what I believe is the exact route to the exploit:

— lyons800.eth (@Lyons_800) January 11, 2022

While the code itself wasn’t violated in this case, the ease of DAO governance provided the attacker with an in for the scam. By the same token, code exploits themselves can be used to create DAOs in the wake of costly failures.

For example, Qubit Finance protocol suffered a catastrophic $80 million loss when a hacker exploited the shaky Ethereum-BSC bridge and used $185 million collateral to steal $80 million worth of tokens from Qubit’s liquidity pools.

As a result, Bunny Finance and Qubit disbanded the protocol, turning it into, a DAO instead. Because the team cannot support the current number of employees, they are giving the control to all token holders, with team members on equal footing among other DAO members.

— Qubit Finance (@QubitFin) February 11, 2022

The question is, if that were to happen to a company, how would regulatory agencies respond? How would DAOs be treated any differently?

Walking on an Unregistered Securities Tightrope

Many DAOs already serve as something along the lines of a tokenized hedge fund. Native to the internet, they hold funds as tokens, either fungible or non-fungible. It is then a matter of determining how these tokens are viewed by federal agencies.

In a note to Aspen Security Forum last August, the Securities and Exchange Commission (SEC) Chair Gary Gensler made a telling remark, saying that:

“Certain rules related to crypto-assets are well-settled. The test to determine whether a crypto asset is a security is clear.”

We have seen what this means when BlockFi settled with the SEC, agreeing to pay a $100 million fine after allegedly offering unregistered securities. Under the SEC’s interpretation of the 15 U.S.C. 77b legal code, any asset that is in some way tied to a profit-sharing agreement is security.

To illustrate, when you deposit Bitcoin into BlockFi’s account, your funds receive yields as if you had deposited them into a traditional savings account. In turn, BlockFi can use them as collateral for profit-taking.

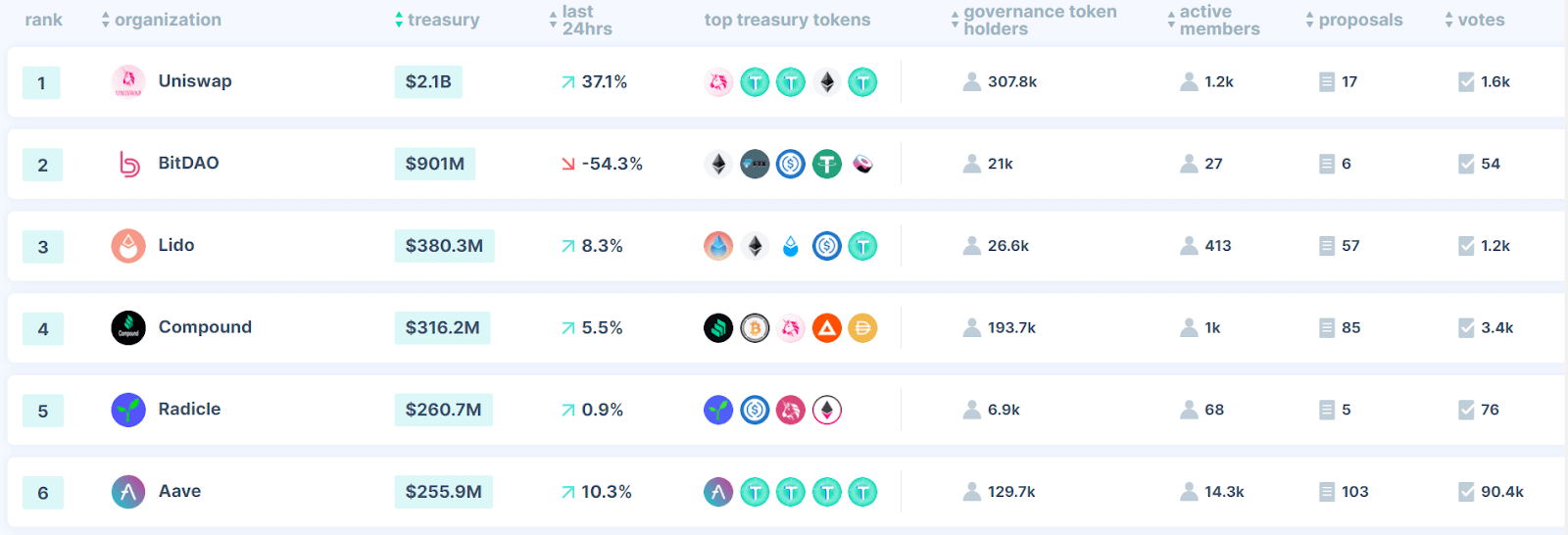

Therefore, both parties could potentially be interpreted as engaging in profit-sharing. This puts DAOs in a precarious position, best demonstrated by Uniswap. Although most crypto traders see Uniswap as a decentralized exchange (DEX), it is technically a DAO governed by its UNI token. As such, it tops the list of DAOs as number one in terms of treasury size.

Uniswap’s governance token UNI gives users voting rights to influence the protocol’s development and fee structure. UNI holders can also stake them to provide liquidity to the protocol, resulting in passive income.

In other words, the mechanism isn’t very different from buying a company’s stake—such as a stock—and then expecting yields—dividends—from that stake. It is then easy to see why the SEC would make a case that such DAOs are dealing with unregistered securities. It is for this reason that DAOs like Uniswap avoid mention of any benefits (profit-sharing) in their token airdrops.

Instead, when they talk of community treasuries, it is framed as a way to provide permissionless access to finance. In other words, a service is being provided through decentralized technology, rather than through a centrally operated company.

The post DAOs: The Financial Revolution Skimming the Outskirts of Regulations appeared first on CryptoSlate.