The crypto landscape is witnessing a notable shift in strategy among hedge funds, with Bitcoin exposure at its lowest since October 2020.

Particularly, the ETC Group’s latest research highlights these funds’ significant decrease in Bitcoin holdings, marking a strategic shift that could have broader implications for the cryptocurrency market.

Towel Thrown For Bitcoin

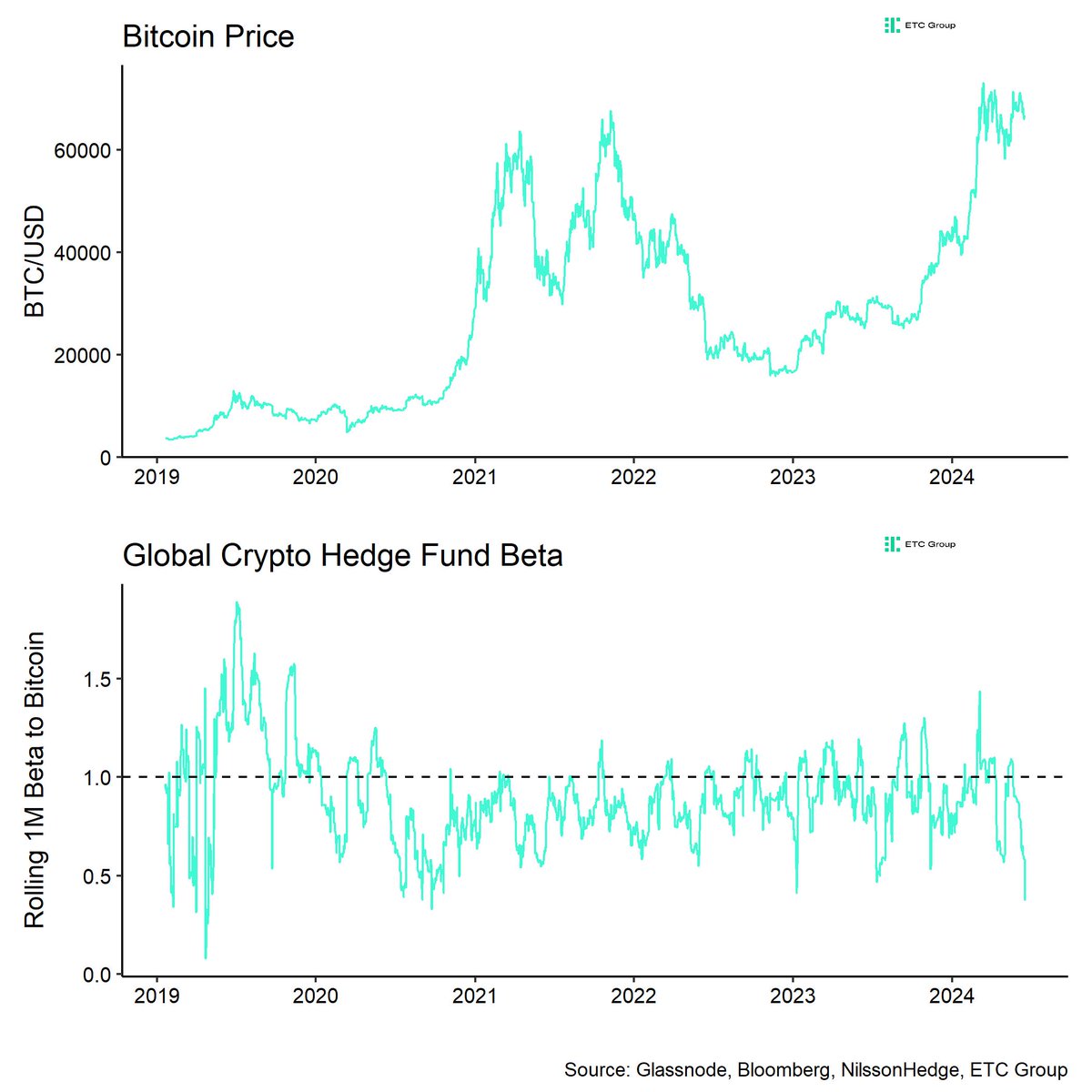

André Dragosch, Head of Research at ETC Group, points out that crypto hedge funds have dramatically scaled back their BTC exposure. Over the past 20 trading days, exposure has fallen to a mere 0.37, the lowest since October 2020, Dragosch revealed.

This reduction reflects a cautious or bearish sentiment towards Bitcoin within the professional investment community amid the asset’s current struggle to rally.

This cautious approach from hedge funds coincides with continued outflows from crypto exchange-traded products, suggesting a broader trend of reduced confidence among institutional investors.

Dragosch also noted that hedge funds typically exhibit pro-cyclical behavior—tending to invest in line with market trends—which could mean a slow return to Bitcoin if the market rallies.

BOOM: Crypto hedge funds have really thrown in the towel on #Bitcoin lately.

They have reduced their $BTC market exposure to only 0.37 over the past 20 trading days.

Lowest since October 2020. pic.twitter.com/WZCRK9QlMG

— André Dragosch | Bitcoin & Macro

(@Andre_Dragosch) June 19, 2024

Bitcoin’s Resilience Amidst Headwinds

On the flip side, BTC has shown signs of resilience, flirting with the $66k mark earlier today before retracting slightly to $65,142 at the time of writing, though still maintaining a modest daily gain of 0.4%.

A broader market downturn and several key factors drive this activity. CryptoQuant analysts have identified miner capitulation, a lack of new stablecoin issuance, and significant ETF outflows as primary drivers behind the recent market declines.

Specifically, reducing miner revenues has increased BTC sales to cover operational costs, exacerbating the downward pressure on its price.

At the same time, the slowdown in the issuance of major stablecoins like USDT and USDC has diminished new money entering the market, thus affecting liquidity and heightening volatility.

The backdrop to these dynamics includes speculative actions such as the German government’s alleged sale of BTC holdings, which have added to market jitters.

The German Government is now on Arkham.

The German Federal Criminal Police Office (BKA) seized almost 50,000 BTC ($2.12B) from the operators of https://t.co/ck07DiJUAf, a film piracy website that was active in 2013.

The BKA received the Bitcoin in mid-January after a ‘voluntary… pic.twitter.com/0kC5tOPq6e

— Arkham (@ArkhamIntel) January 31, 2024

Despite these pressures, the CryptoQuant analyst reveals a silver lining: the current price levels are close to significant support zones, which historically have offered strong rebound potential.

Featured image created with DALL-E, Chart from TradingView