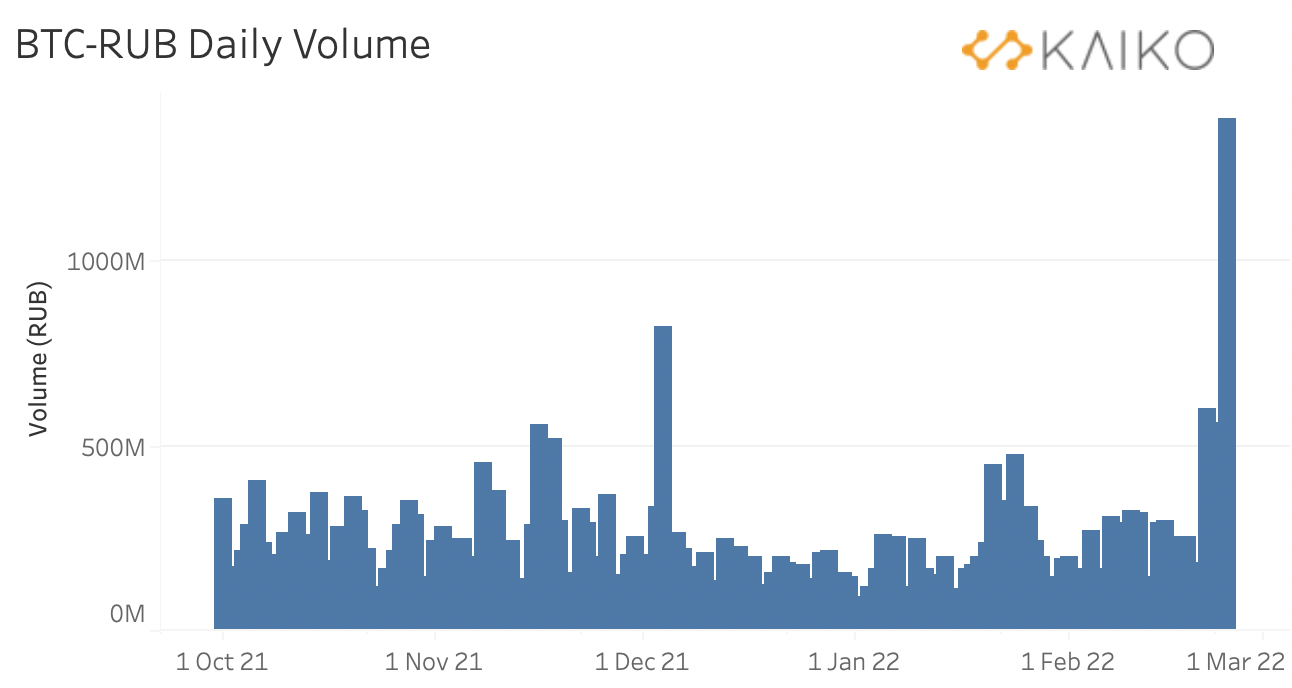

Amid the conflict in Ukraine with Russia, bitcoin trade volumes tied to Russian ruble pairs have surged in recent days. Metrics recorded by the crypto analytics provider Kaiko indicate that ruble (RUB)-denominated bitcoin volume reached close to 1.5 billion rubles four days ago, on February 24. Data also shows that bitcoin-ruble pairs saw a significant premium on February 28, jumping 16% higher than the global average.

Russian Demand for Bitcoin Surges Causing BTC-RUB Premiums

Statistics show that there’s been a lot of demand for bitcoin (BTC) stemming from Russia during the last 96 hours. It started almost immediately after Russia invaded Ukraine’s borders and while the warfare between the two countries escalated.

Data from the crypto analytics provider Kaiko shared with the crypto-journalist Omkar Godbole shows that ruble-denominated BTC trade volume has spiked a great deal. Kaiko’s data showed that ruble-denominated BTC volume tapped a nine-month high reaching nearly 1.5 billion rubles on Thursday.

“The activity was concentrated on Binance,” Kaiko analyst Clara Medalie told the reporter. “Bitcoin-Ukrainian hryvnia volume has also spiked, but not as high as October levels. BTC-UAH only trades on [two] exchanges – Binance and Localbitcoin.com,” Medalie added.

In addition to the BTC-RUB volume increase, bitcoin has seen a premium in contrast to the recorded global average prices. Currently, via Sberbank transfers, Localbitcoins.com traders are selling bitcoin (BTC) for 3.69 million rubles ($39,656) or $1,206 above the current $38,450 global average. Data derived from Coingecko.com indicates that BTC-RUB prices went as high as 4.33 million rubles ($46,453) on Monday.

The all-time high premium was $7,853 higher than the global average on Monday and BTC-RUB premiums are $6,797 lower, but still higher than the global average at the time of writing. Bitcoin.com News reported on February 26 that Kuna, a cryptocurrency exchange that provides trades in hryvnia, has also seen significant premiums and higher trade volumes.

Data from Kuna shows premiums still exist for hryvnia trading pairs with BTC, USDT, and ETH. Kuna recently told the publication Forklog that ruble (RUB) pairs have been closed and data shows there have been zero RUB swaps in the last 48 hours. In terms of the Ukrainian hryvnia (UAH), however, tether (USDT) is trading for $1.10 per unit. BTC-UAH is trading at $42,026 per unit and ETH-UAH is $2,903 per ether.

What do you think about the trading activity taking place in Russia and Ukraine during the wartime conflict? Let us know what you think about this subject in the comments section below.