Following the record 7.5% high for January, the U.S. Labor Department’s Consumer Price Index (CPI) data shows February’s CPI metrics rose to 7.9%. The CPI data published on Thursday is a new 40-year high and month over month, inflation jumped by 0.8%. President Joe Biden is blaming the inflation spike on Russia’s invasion, as he previously warned “there will be costs at home.”

February’s CPI Data Jumps to 7.9%, US Stocks Suffer

In the U.S., there’s been a significant increase in the prices of goods and services in the American economy every single month. American citizens continue to see a decrease in purchasing power when leveraging U.S. dollars for a number of goods and services. The Consumer Price Index (CPI) is a government-crafted metric that records a market basket of consumer goods and services Americans purchase on a regular basis. The data is published on a monthly basis by the U.S. Labor Department, an entity that is responsible for governing occupational safety and publishing economic statistics.

Last month, Bitcoin.com News reported on the CPI’s jump to 7.5% and this month’s CPI numbers continue to highlight a dismal outlook. “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in February on a seasonally adjusted basis after rising 0.6 percent in January,” the U.S. Bureau of Labor Statistics reported. “Over the last 12 months, the all items index increased 7.9 percent before seasonal adjustment.” After the Bureau of Labor published the report, all four major equities indexes (Dow, Nasdaq, NYSE, S&P 500) shuddered.

Biden Blames Russia, Calls Inflation Spike ‘Putin’s Price Hike’

Most of the stock market rout on Thursday has been blamed on the Russia-Ukraine war. Despite the fact that data shows inflation was broadening into a myriad of sectors across the U.S. well before the war, president Joe Biden and his administration are blaming Vladimir Putin.

“Today’s inflation report is a reminder that Americans’ budgets are being stretched by price increases and families are starting to feel the impacts of Putin’s price hike,” Biden explained on Thursday. “A large contributor to inflation this month was an increase in gas and energy prices as markets reacted to Putin’s aggressive actions,” the U.S. president added.

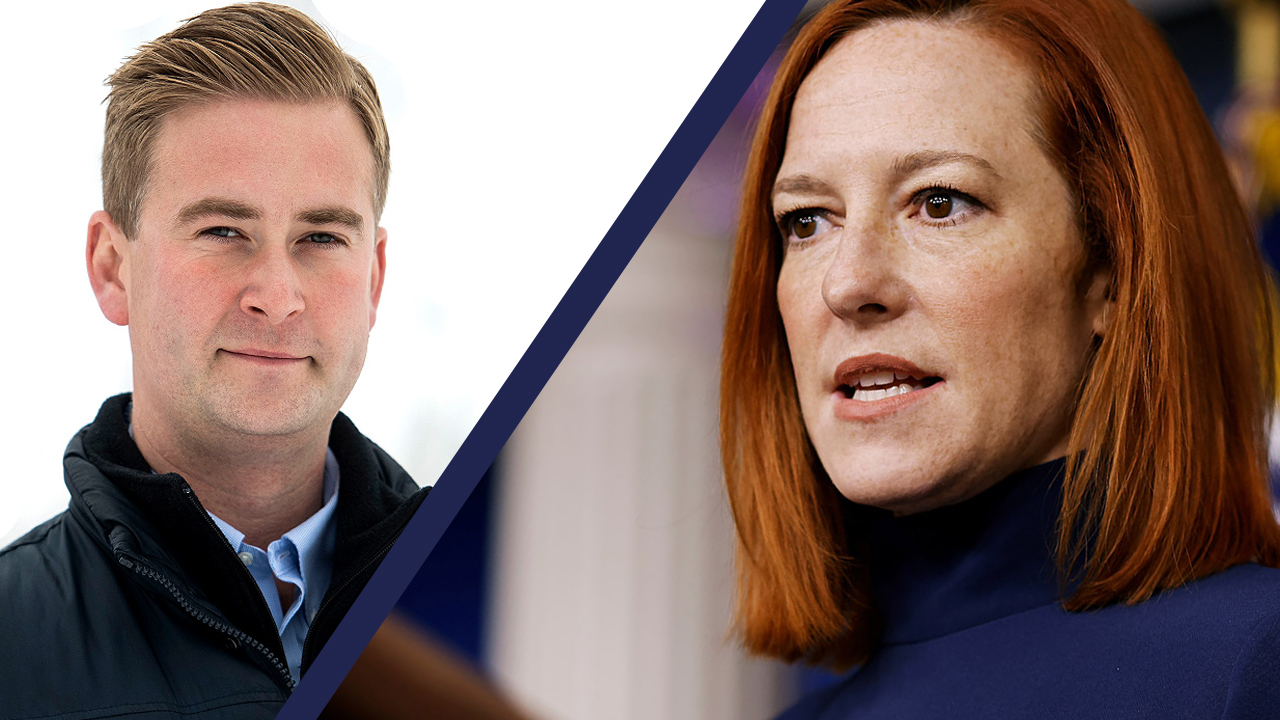

Doocy Asks Psaki: ‘Are You Guys Going to Start Blaming Putin for Everything Until Midterms?’

Meanwhile, gold bug and economist Peter Schiff criticized the method the U.S. Labor Department uses to calculate the CPI. “Consumer prices jumped .8% in Feb, bringing the YOY rise to 7.9%, the highest since Jan. 1982,” Schiff tweeted. “If the CPI still measured prices the same way it did then the YOY gain would be over 15%, higher inflation than any year during the 1970s and this stagflation decade has just started.”

Doocy to Psaki: “Are you guys going to start blaming Putin for everything until the midterms?” pic.twitter.com/OSWwOBWZLc

— The Post Millennial (@TPostMillennial) March 10, 2022

Additionally, the Biden’s administration blame game toward Putin has been denounced by a number of analysts and journalists. White House correspondent for Fox News, Peter Doocy, asked the 34th White House press secretary Jen Psaki how long the administration planned to blame Russia for everything? “Are you guys going to start blaming Putin for everything until midterms?” Doocy asked the press secretary.

Biden’s statements concerning the latest inflation report, explain that he warned about Russia’s invasion putting pressure on the American economy. “As I have said from the start, there will be costs at home as we impose crippling sanctions in response to Putin’s unprovoked war,” Biden remarked on Thursday.

What do you think about the rising inflation in the U.S. and the Biden administration blaming the Russia-Ukraine war and “Putin’s aggressive actions?” Let us know what you think about this subject in the comments section below.