In December, bitcoin miners garnered the highest monthly revenue of the year, amassing $1.51 billion. Additionally, this month marked a record in fee collection, with miners securing $324.83 million in onchain transaction fees.

Bitcoin Miners Smash Records — Highest Monthly Haul of $1.51 Billion in December 2023

December 2023 has set a new benchmark for monthly revenue garnered by bitcoin (BTC) miners through block discovery and transaction verification. By Dec. 31, 2023, a total of $1.51 billion was amassed, including $324.83 million in onchain fees. This surpasses the former monthly revenue record set in May, where miners collected a total of $919.22 million, with $125.92 million from onchain fees.

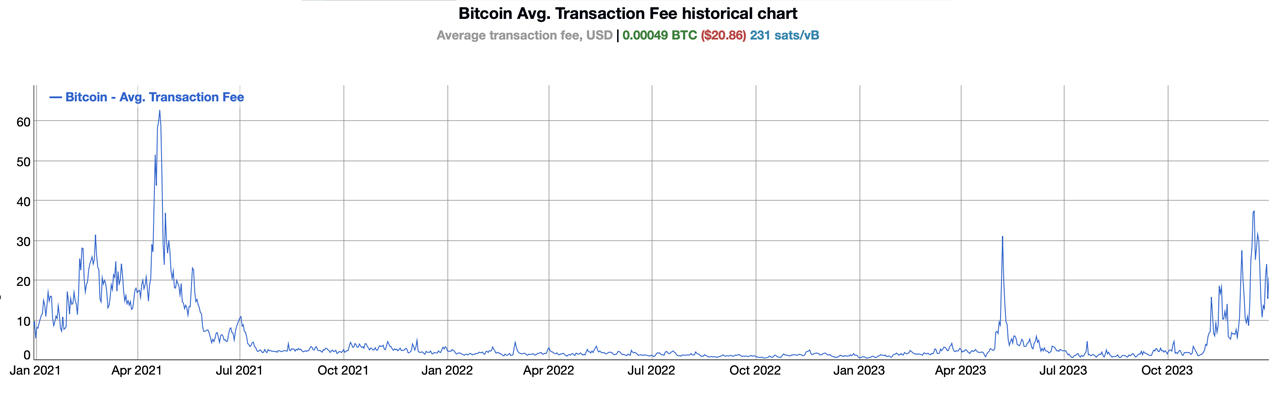

In July, miners collected a total of $865 million, with $19.21 million from fees. December, however, marked a significant increase, standing 1.64 times greater than May’s record, representing a growth of 64.27% or an additional $590.78 million. At the moment, according to bitinfocharts.com, December’s onchain transaction rates are soaring, with the average fee at 231 satoshis per virtual byte (sats/vB) or $20.86 per transaction.

On Dec. 31, 2023, the median-sized fee is noted at $9.60 per transaction or 106.3 sats/vB. Moreover, on Dec. 17, 2023, fees spiked to as much as $40 per transfer, averaging around $37.43 per transaction — the year’s peak in on-chain fees, surpassing the previous high of $31 on May 8, 2023.

Also, on Dec. 17, the hash price of Bitcoin — the value of a single petahash per second (PH/s) produced daily — hit a 2023 zenith of $133.62 per PH/s, exceeding the earlier record of $125.64 per PH/s on May 8. Despite the high onchain fees, miners face a backlog of over 496,000 unconfirmed transactions and congestion of 430 blocks.

What do you think about the record-breaking haul bitcoin miners gathered in December 2023? Share your thoughts and opinions about this subject in the comments section below.