Surging inflation and weak growth have been plaguing the global economy for months, but the rising CPI and a devaluating national currency first seen in the U.S. have now spread to Europe as well.

The European Central Bank (ECB) hiked its base interest rate by 75 bps for the second consecutive time, bringing its deposit rate to the highest level in over a decade. The ECB hopes the aggressive rate hike will be able to curb inflation in the Eurozone, which reached its ATH in October at 10.7%.

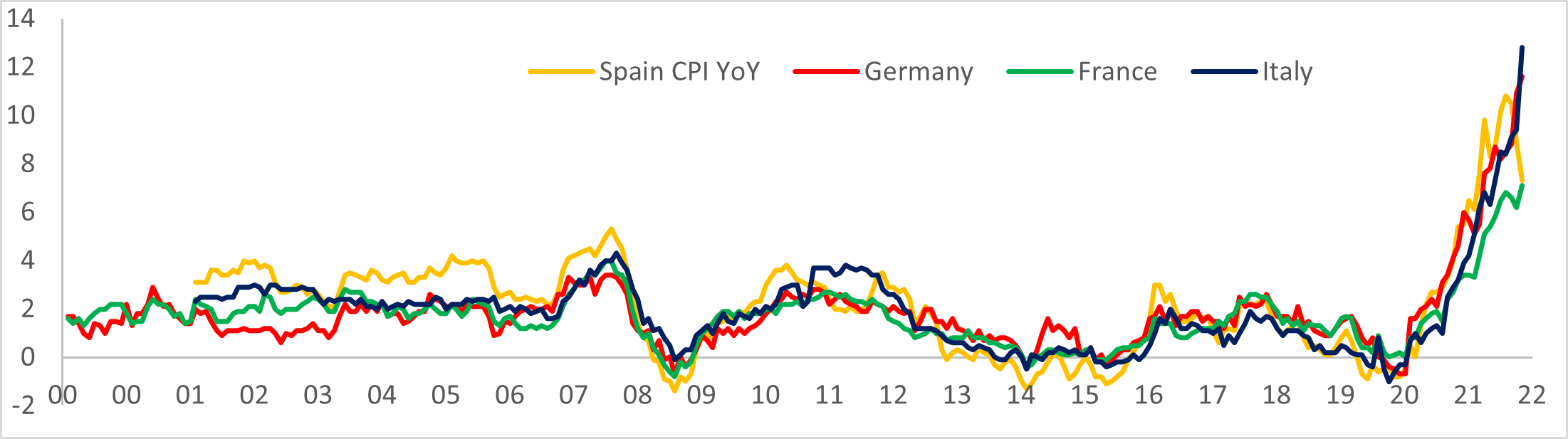

Europe’s four largest economies — Germany, France, Italy, and Spain — all delivered painful upside surprises. Inflation in Germany reached 11.6% last month, the highest it has been in over 70 years. Italy’s 12.8% inflation makes it a leader in the Eurozone, with France and Spain tailing behind with 7.1% and 7.3%.

While some countries in the Eurozone managed to post unexpected GDP growth in the past month and avoid an immediate recession, the danger is far from over.

Rising interest rates in the U.S. have been increasing the strength of the U.S. dollar and weakening both the euro and the British pound. With the Fed expected to increase the interest rate by 75 bps in its Nov. 1-2 meeting, Europe’s two largest currencies could continue declining even further.

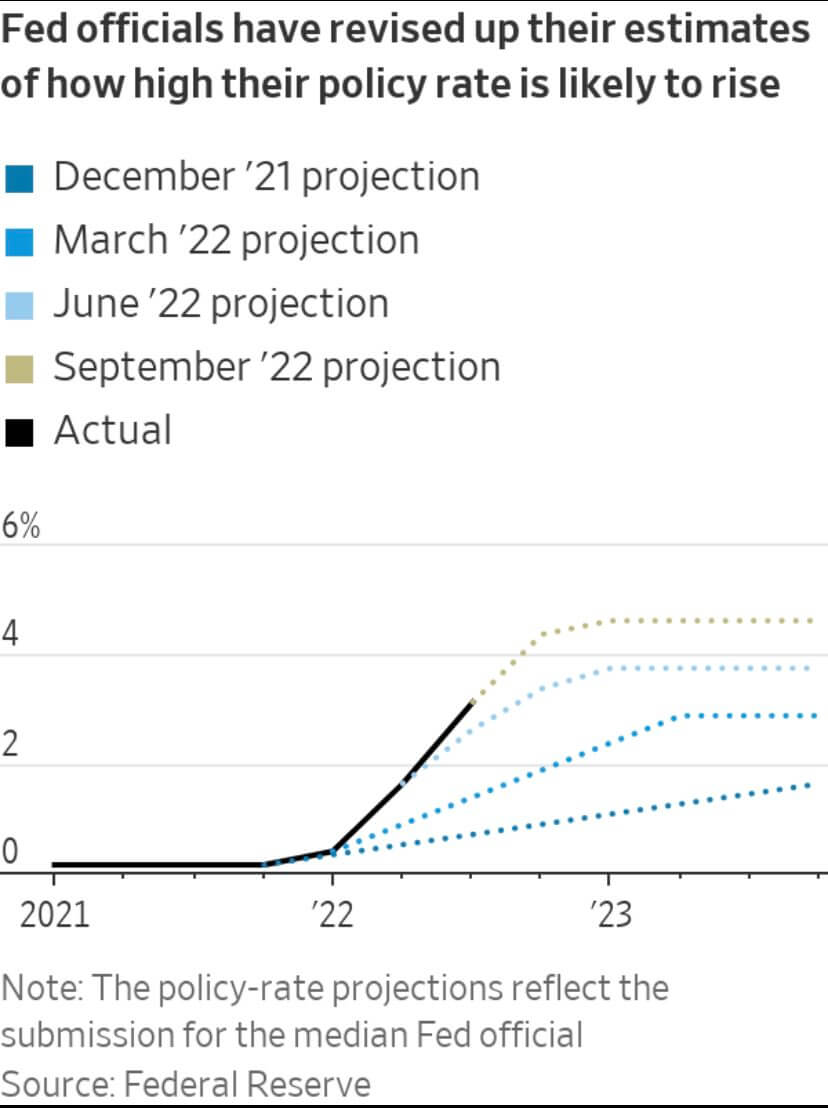

With a 75 bps hike in place, the Fed is expected to continue increasing interest rates until it reaches a target of 3.75% to 4%. However, some economists argue that the Fed could consider scaling back the pace of rate increases and announce a 50 bps hike in December.

Esther George, the President of the Federal Reserve Bank of Kansas City, believes that the rate hikes could continue well into next year. She believes that Jerome Powell, the chairman of the Federal Reserve, could indicate that the terminal rate may need to be higher than the 4.6% projected for next spring.

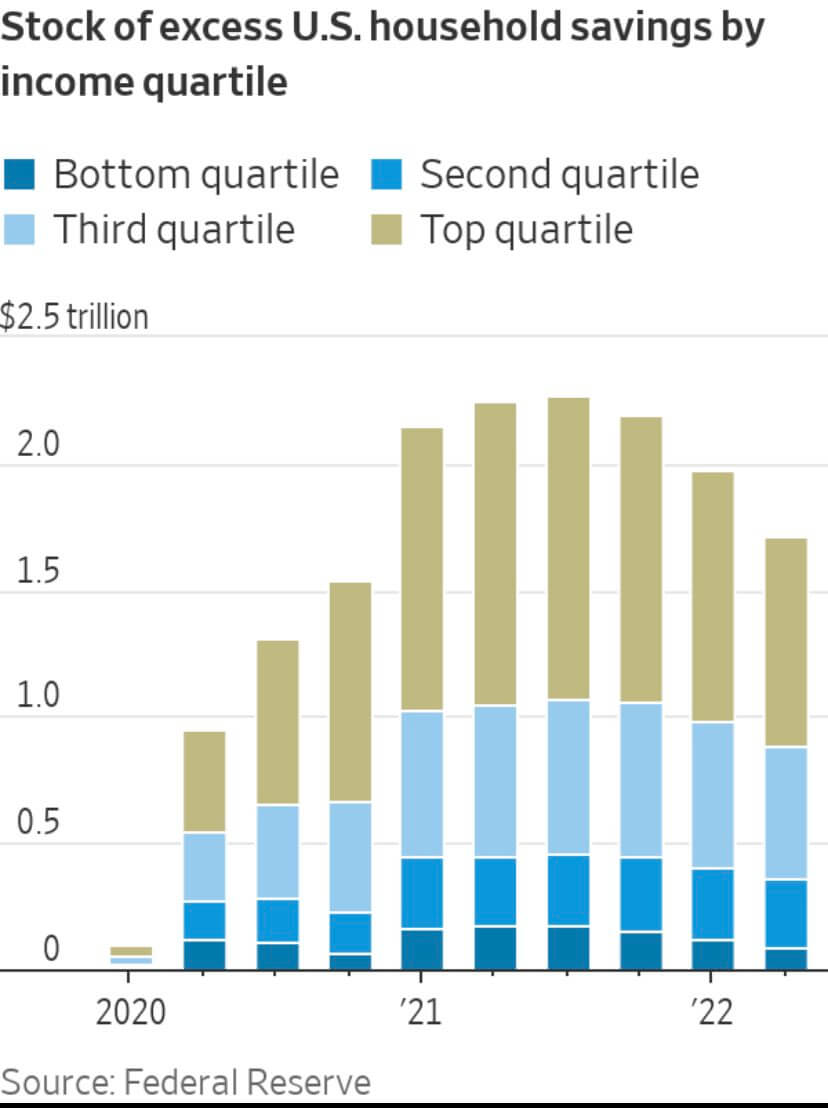

The high rates might be necessary to curb inflation that could increase even further as households tap into their cash savings. George noted that tapping into savings will allow households to spend in a way that keeps demand strong despite soaring rates, a move that could continue feeding the rising inflation.

According to a report from Stifel, consumer spending in the U.S. rose 0.6% in

September, more than the 0.4% gain expected according to Bloomberg, and following a similar rise in August. Year-over-year, consumer spending increased by 8.2%.

“That suggests to me we may have to keep at this for a while,” George said. “You may see the terminal Fed funds rate higher and have to stay there longer.”

According to the Federal Reserve, households in the U.S. had $1.7 trillion in savings at the end of the second quarter of 2022. While this is a decrease from the $2.3 trillion high recorded in the second quarter of 2021, it still represents an almost seventeenfold increase from the numbers recorded at the beginning of 2020.

The $1.7 trillion in household savings represents a significant bump in the Fed’s attempts to curb demand. Rising rates managed to deplete households’ savings by at least two trillion since the beginning of the year, but the numbers are still higher than the Fed would like.

The majority of that loss was taken by the top and bottom income quartile, meaning that the richest and the poorest were the ones who saw their savings wiped out by rising rates. the second and third income quartiles, representing the upper and lower middle class, kept their savings mostly intact since 2021.

We can expect the fight between solvency and rising rates to continue well into 2023.

The post Destroying demand: Fed will keep hiking interest rates longer than you can stay solvent appeared first on CryptoSlate.