Over the past week, blue-chip assets like Bitcoin (BTC) and Ethereum (ETH), have been major topics of discussion in the cryptocurrency space — and rightfully so — after a strong positive performance week. Meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) have also enjoyed a fair share of the attention in the last seven days.

According to the latest on-chain data, these asset classes have been topping the social charts in the past few days, with the majority of the crypto crowd talking about them, especially after price rallies. Here’s how the rising social sentiment can impact the prices of Dogecoin and Shiba Inu.

Will FOMO Sustain The Meme Coin Rally?

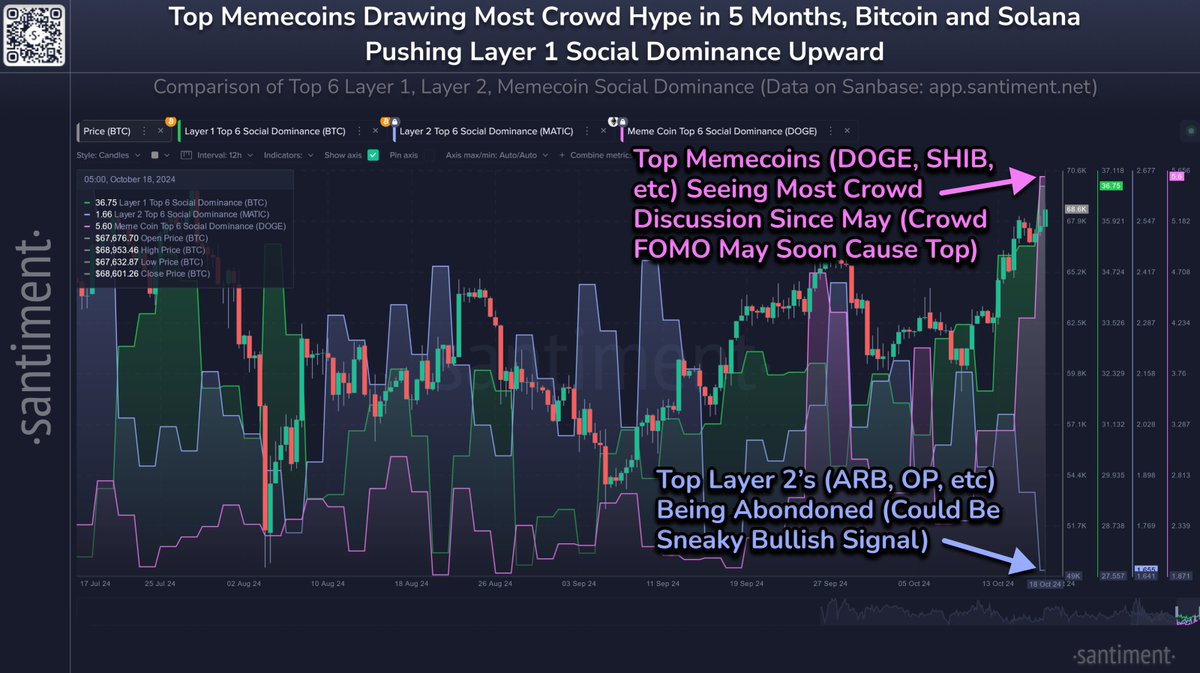

In a recent post on the X platform, Santiment shared that large-cap meme tokens have been drawing a great deal of social media attention in the past few days. According to the blockchain analytics firm, top meme coins like Dogecoin and Shiba Inu are seeing their most crowd discussion since May.

This on-chain observation is based on the Santiment Social Dominance metric, which reflects the share of the discussions in crypto media referring to a particular asset or phrase. Santiment said in the post on X:

Top meme coins (DOGE, SHIB, etc.) [are] seeing [their] most crowd discussion since May (crowd FOMO may soon cause top).

Indeed, this positive shift in investor sentiment might signal renewed faith in the meme coin market. However, the increasing crowd hype is often a warning sign of a potential price top, as rising FOMO (fear of missing out) can dampen the momentum of developing price rallies.

Fear of missing out, commonly called FOMO, is a phenomenon where investors hastily purchase assets in high demand out of fear of forfeiting potential gains. While FOMO has been known to drive a coin to a higher value in the short term, excessive FOMO often leads to unsustainable upward trends and subsequent corrections.

Furthermore, crypto prices historically tend to move in the opposite direction of the crowd. Hence, if the crypto crowd is paying this much attention to top meme coins, investors might want to approach the market with caution.

Interestingly, Santiment pinpointed top Layer 2 tokens, including Arbitrum and Optimism, as potentially lucrative investment alternatives due to their extremely low social dominance. “Speculative coins can certainly still pump a bit longer, but historical data shows that it pays to go where the crowd isn’t looking,” the on-chain firm added.

Dogecoin Price At A Glance

As of this writing, the price of Dogecoin has broken above the $0.14 level, reflecting an almost 6% increase in the past day.