Dogecoin is currently testing a crucial demand level after experiencing a 23% decline from its local highs of $0.13. As the meme coin navigates this turning point, the broader crypto market anticipates a potential rally in the coming weeks, driven by the Federal Reserve’s recent decision to cut interest rates.

However, October kicked off with increased selling pressure, leaving investors searching for signs of strength in Dogecoin’s price action.

Top analyst Mister Crypto has shared a bullish outlook, stating that Dogecoin could begin its next rally “any time now.” His technical analysis highlights key support levels and suggests that the current price could be a launchpad for significant upside movement.

Despite the recent dip, many traders remain optimistic that DOGE could soon recover and enter a new bullish phase. All eyes are now on whether Dogecoin can hold its critical demand level and break out shortly.

Dogecoin Testing Crucial Demand

Dogecoin is currently surrounded by speculation as investors and analysts offer varying opinions on its future price action. After several weeks of significant ups and downs, the meme coin has seen massive volatility, reflecting the broader market’s uncertainty. Some analysts remain optimistic about Dogecoin’s prospects, while others caution against getting too bullish too soon.

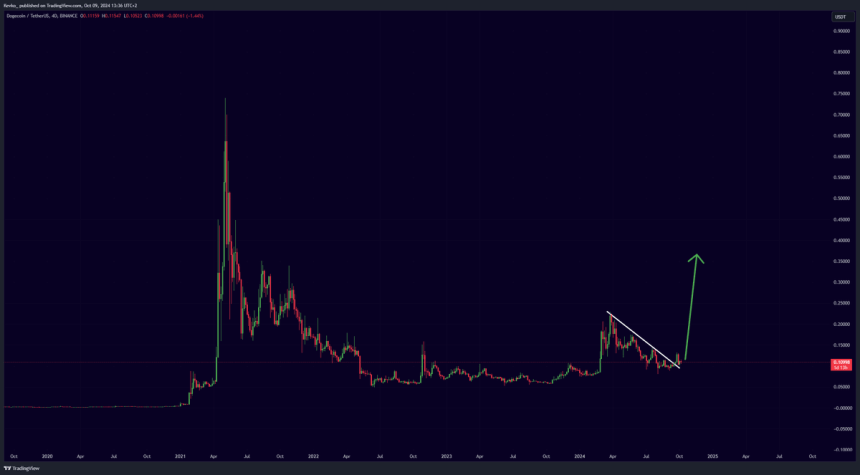

A technical analysis shared by prominent analyst Mister Crypto on X suggests a potentially bullish scenario for DOGE. His analysis highlights a 4-day (4D) price chart, where a bullish triangle pattern has just been broken.

This breakout signals a possible rally ahead, which, if realized, could lead to gains exceeding 100%. Mister Crypto’s forecast has sparked renewed hope among Dogecoin traders, who are now carefully managing their risk in anticipation of this potential move.

However, despite the optimism, there is still no clear confirmation that Dogecoin has entered a new bull run. For this bullish scenario to be validated, the price must close above the current demand level and hold support.

Until then, the market remains cautious, and investors are waiting for further price action to confirm whether Dogecoin will break out or continue to trade sideways. With so much speculation and uncertainty, the coming days will be critical for DOGE’s trajectory.

Price Action: Technical Levels To Hold

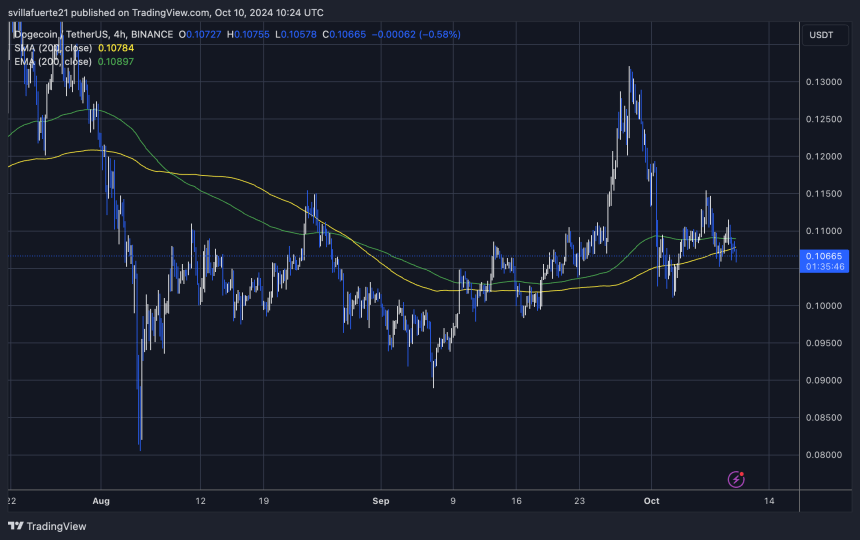

Dogecoin (DOGE) is currently trading at $0.106 after experiencing an 8% dip since Monday. The price has lost both the 4-hour 200 moving average (MA) at $0.107 and the 200 exponential moving average (EMA) at $0.108, placing DOGE in a precarious position as it now tests crucial demand levels.

For bullish momentum to return, DOGE needs to break back above these key indicators and reclaim the $0.12 mark. A surge beyond this level could set the stage for a higher push, giving bulls the control they need to shift market sentiment. However, the current market environment remains fragile, and any failure to recapture the 4-hour MAs could signal further downside.

If DOGE fails to hold its current levels, analysts anticipate a deeper correction that could drive the price down to around $0.08, a key support zone.

Traders are watching closely to see if DOGE can stabilize or if more downside is ahead. This makes the coming days crucial for determining whether the meme coin can rebound or face further selling pressure.

Featured image from Dall-E, chart from TradingView