Amidst a broader crypto market crash, the Dogecoin price is down more than 20% in the last 24 hours. Yet crypto analyst Kevin, who posts under the handle @Kev_Capital_TA on X, has reiterated his stance that Dogecoin still holds a critical “bull market line” and builds momentum higher if broader market conditions improve.

Dogecoin Must Hold Above This Price

In a new update, Kevin writes: “Nothing much has changed on Dogecoin since my last post on 3/22. Higher time frame indicators are mostly reset and we are holding the bull market line in the sand of support. This may not be the popular X take at the moment but engaging on people’s fears is not what we do here. As long as BTC cooperates and economic data comes in favorable I say send it higher within the next few weeks.”

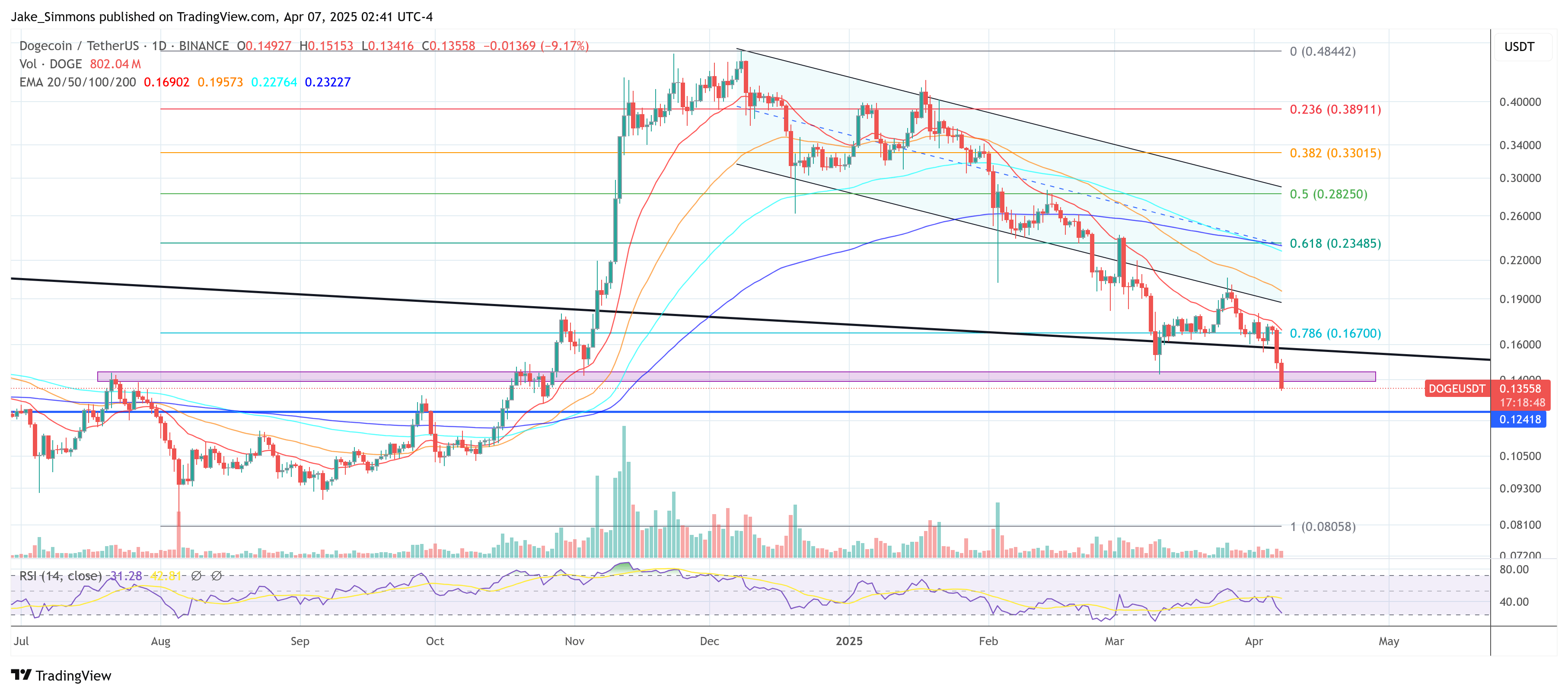

He references an older post from March 22 in which he laid out a comprehensive technical perspective on Dogecoin’s position. In that post, he pointed to the $0.139 price level as the coin’s “Last line of bull market support,” warning that a durable weekly close below the multi-year downtrend line could signal a profound shift in sentiment.

“My #Dogecoin Community it is about that time where I must provide you the Alpha you all desire,” he wrote in March. “If we take a look at DOGE on the weekly time frame we can see that we received a weekly demand candle last week at the ‘Last line of bull market support’ [which is at $0.139] that I pointed out a couple of weeks ago. It will continue to be absolutely vital that Dogecoin hold this level while it resets higher time frame indicators like the 3 Day MACD, Weekly Stoch RSI and 2W Stoch RSI all of which are getting very close to being fully reset.”

According to Kevin’s assessment, those particular indicators—which are commonly used to gauge momentum and potential overbought or oversold conditions—are crucial for traders looking to pinpoint when Dogecoin might next see an upward price swing. He also mentioned a target for Bitcoin not to fall below $70,000 if Dogecoin’s bullish framework was to remain intact, emphasizing that broader crypto market conditions often set the pace for high-beta altcoins like DOGE.

DOGE Vs. Global Liquidity

In yesterday’s post, Kevin delved deeper into the macroeconomic context, overlaying the Global Liquidity Index onto Dogecoin’s price chart. In his words, “If we take a look at #Dogecoin with the Global Liquidity Index overlaid you can see we are at a very interesting point here. On the LOG chart DOGE is back testing the breakout point of what was the entire bear market range that lasted from May of 2021 to October of 2024.”

This reference to a prolonged bear market range underscores the extent to which Dogecoin’s price has traveled between its 2021 peaks and subsequent declines. He further explains that this region coincides with the “macro .382” at $0.142 when measuring from the previous bull market highs to the bear market lows, which he regards as a major inflection point and a potential springboard for a renewed rally, provided the market cooperates.

Kevin attributes a large share of crypto price direction to broader liquidity conditions, writing that “Global liquidity has shown to be throughout all of history a major driver of risk asset prices especially #Altcoins and we can see here that it has been trading perfectly in this downward channel since May of 2022 which lines up with central bank tightening of monetary policy across the globe as inflation was sky rocketing.”

As global monetary authorities begin to wind down or at least slow the pace of interest rate hikes, liquidity levels may start to edge higher again. In his assessment, this easing, even if gradual, could supply the necessary fuel for a breakout in both market liquidity and Dogecoin’s price. “Based on history I believe it will likely start to breakout here. If the correlation remains true as it has through the years then this back test on Doge specially is providing one of the best risk reward ratios you can ask for in a long term hold entry or swing play,” he says, while making clear that a failure to hold $0.139 “durably below” would be his invalidation point.

At press time, DOGE was just below Kevin’s last “bull line” and was trading at $0.13558.