The post Dogecoin (DOGE) Poised for Massive Rally? Bullish Pattern Spotted appeared first on Coinpedia Fintech News

The sentiment across the cryptocurrency landscape appears confusing due to huge price fluctuations. Amid this, Dogecoin (DOGE) the popular and the world’s largest crypto meme coin formed a bullish price action pattern and is poised for massive upside momentum.

Dogecoin (DOGE) Technical Analysis and Upcoming Levels

According to expert technical analysis, DOGE has formed a bullish inverted head and shoulder price action pattern in a four-hour time frame with a sharing a neckline at the $0.178 level.

Based on the recent price momentum and historical patterns, if the meme coin breaches the neckline and closes a four-hour candle above the $0.18 level, there is a strong possibility it could soar by 18% to reach the $0.212 level in the coming days.

This $0.21 level is the horizontal resistance level and is further supported by the 200 Exponential Moving Average (EMA) on a daily time frame, which indicates that the asset is still in a downtrend and overall market conditions.

Traders Bearish Outlook

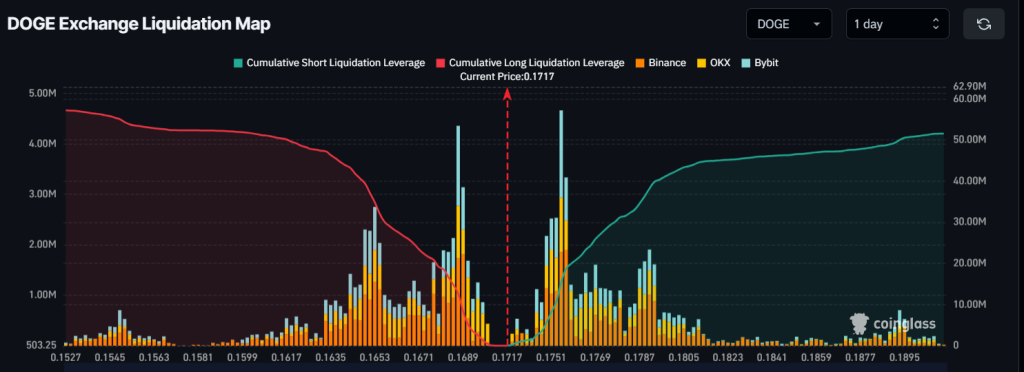

Despite bullish price action and patterns appearing on the chart, DOGE traders appear to have a bearish outlook, as reported by the on-chain analytics firm Coinglass.

Data revealed that traders are currently over-leveraged at $0.168 on the lower level and $0.1755 on the upper level.

Besides this data further revealed that traders have built nearly $12.70 million worth of long positions on the $0.168 level, while $19 million worth of short positions on the $0.1755 level, which potentially clears that intraday traders hold a bearish view on the DOGE meme coin.

Current Price Momentum

DOGE is currently trading near $0.173 and has experienced an upside momentum of 1.50% in the past 24 hours. However, during the same period, its trading volume jumped by 16%, indicating lower participation from traders and investors compared to the previous day.