The post Dogecoin (DOGE) Price Prediction Today appeared first on Coinpedia Fintech News

Dogecoin (DOGE), the popular and largest meme coin in the cryptocurrency space, appears to be shifting towards a bullish trend after several days in a downtrend. As of January 30, 2025, along with other major assets, DOGE seems to be recovering, forming a bullish price action.

DOGE Price Momentum

With a positive market outlook, DOGE is currently trading near $0.33 and has experienced a price surge of over 4.05% in the past 24 hours.

Following a price reversal from the crucial support level of $0.31, traders and investors have shown strong interest and confidence in the meme coin, resulting in an 8.5% increase in trading volume compared to the previous day.

Dogecoin (DOGE) Technical Analysis and Key Levels

According to expert technical analysis, DOGE appears to be forming a bullish double-bottom price action pattern on the daily time frame. However, the meme coin’s bullish price action is still in formation, and it is currently at a support level of $0.31, which has a history of strong bullish price reversals.

Based on the recent price action, if DOGE holds this support level, there is a strong possibility it could soar by 25% to reach the $0.41 level in the coming days.

On the positive side, DOGE’s Relative Strength Index (RSI) currently stands at 45, indicating strong potential for the meme coin to rally further.

Bullish On-Chain Metrics

Looking at the bullish price action and market sentiment, traders and investors have been betting on and accumulating the meme coin, as reported by the on-chain analytics firm Coinglass. Data from spot inflow/outflow revealed that exchanges have witnessed an outflow of a significant $11.50 million worth of DOGE.

In the cryptocurrency landscape, outflow refers to the movement of assets from exchanges to wallets, suggesting potential accumulation. This can create buying pressure and lead to a further upside rally.

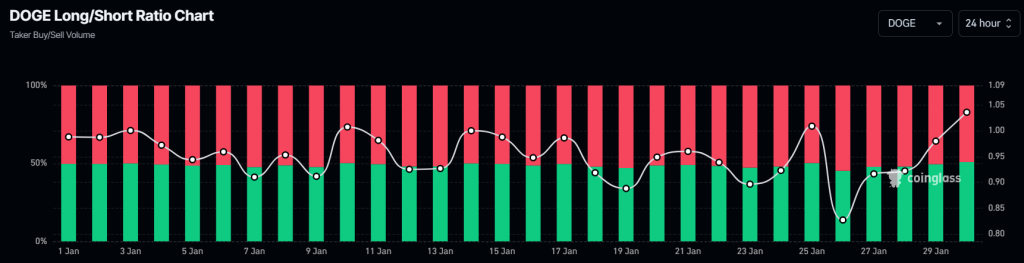

Apart from this, traders seem to be strongly betting on the long side. Currently, the DOGE Long/Short ratio stands at 1.056, indicating strong bullish sentiment among traders, the highest since the beginning of December 2024.

Data further revealed that 53.5% of top traders hold long positions, while 46.5% hold short positions.

When combining these on-chain metrics with the technical analysis, it appears that bulls are strongly supporting and dominating the meme coin and could help it achieve the predicted level in the coming days.