Dogecoin (DOGE) has become one of the most popular cryptocurrencies after a 112% growth in the past week. DOGE leads another meme currency craze with this move, proving it can still steal the show and top the crypto scene.

Memecoins Performing Well

According to Santiment data, meme-based cryptocurrencies are doing better than most assets partly because of speculation and the explosion of social engagement on X, Reddit, Telegram and other similar platforms.

DOGE has had record bull market gains, reaching 30,700% in 2021. However, parabolic increases often result in strong corrections, like its 80% plunge after its 2017 rally. Dogecoin is approaching major resistance levels that could affect its short-term trend, so traders should be cautious.

Dogecoin Price Prediction: How High Can It Go?

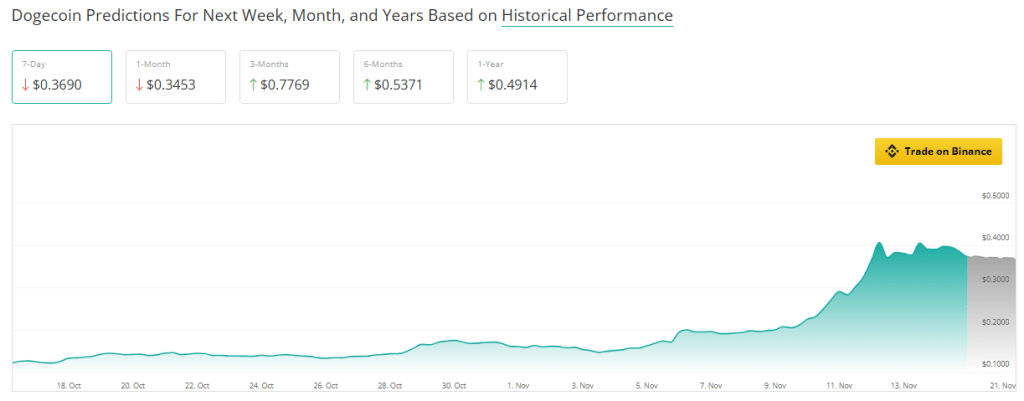

Taking into account the present pace of market trends and expanding demand, recent estimates indicate that the price of DOGE is anticipated to record an appreciation of 107% over the course of the three-month period, according to data provided by CoinCheckup.

Longer-term projections show more modest increase; the price is predicted to rise by 43% over six months and by 31% over a year. This slow stability implies DOGE could keep its increasing speed even when the excitement fades.

Crypto Kaleo states that DOGE’s cyclical behavior exhibits a readiness for a breakout. If it breaks its resistance at $0.10, then the price – which is currently at $0.37 – may head all the way up to $0.15 and beyond, just as in its historical patterns of impulsive growth. The support remains strong at $0.075. This level should provide a safety net for investors in case of a pullback.

From a cyclical perspective, Dogecoin is in the process of making the massive impulse move to new All Time Highs at the early stages of a new bull market that its known for.

200+ days after each $BTC halving, DOGE made swift moves with massive multiples. Even the timing… pic.twitter.com/1iSINqSY3j

— K A L E O (@CryptoKaleo) November 13, 2024

What Factors Are Propelling Dogecoin’s Momentum?

The rally of DOGE corresponds with an increase in social dominance, as Santiment research indicates that meme-related debates are prevalent in cryptocurrency forums. This increase in community engagement highlights the speculative characteristics of the current market while also indicating a revitalized retail presence. An increase in trade activity strengthens the narrative for continued momentum in the near term.

Dogecoin’s rise in value shows that it will remain famous and be appealing to investors. As the memecoin gets closer to important resistance levels, traders need to be careful and use a mix of hope and caution.

Featured image from WSJ, chart from TradingView