Bloomberg Intelligence’s chief commodity strategist, Mike McGlone, has issued a stark caution to Dogecoin holders and the broader crypto community by drawing comparisons to historical instances of market excess. In a series of recent posts published on X , McGlone invoked the years 1929 and 1999—the notorious eras of the stock market crash and the dot-com bubble—to underscore the risks of speculative “silliness” in digital assets.

Dogecoin Mirrors 1929-Style Risk

He singled out Dogecoin in particular, emphasizing its vulnerability to a potential market reversion, while also pointing to gold as a beneficiary if risk appetite continues to deteriorate. “Dogecoin, 1929, 1999 Risk-Asset Silliness and Gold – The ratio of gold ounces equal to Bitcoin trading almost tick-for-tick with Dogecoin may show the risks of reversion in highly speculative digital assets, with deflationary implications underpinning the metal,” he wrote.

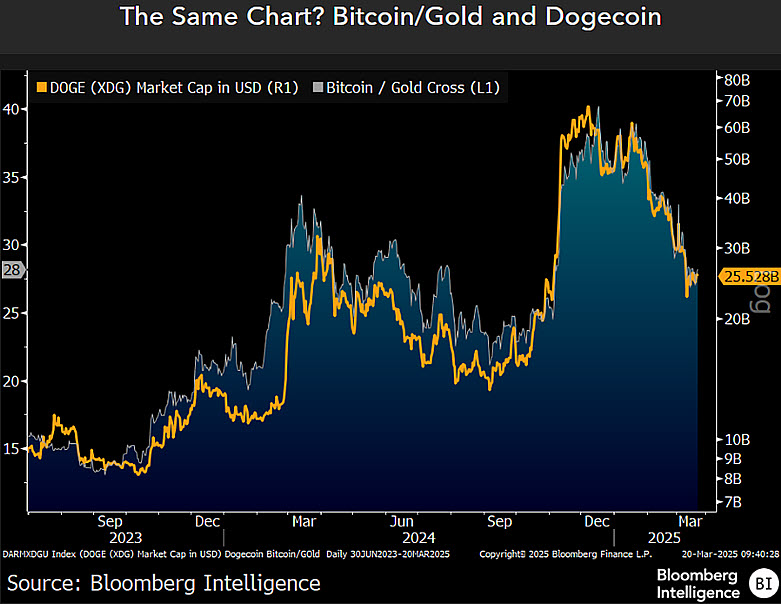

The chart below shows how closely the meme-inspired cryptocurrency’s market cap has mirrored the Bitcoin-to-gold ratio. The tracking of these two metrics suggests that whenever the relative value of Bitcoin to gold experiences a shift, Dogecoin’s trajectory pivoted sharply, exposing it to the same market forces that have historically challenged highly speculative assets.

McGlone’s broader thesis does not end with Dogecoin. In another post, he turned attention to the notion of gold reaching $4,000 per ounce, linking such a possibility to dynamics in the bond market and to potential declines across risk-on sectors, including cryptocurrencies.

“What Gets Gold to $4,000? 2% T-Bonds? Melting Cryptos May Guide – A path toward $4,000 an ounce for #gold could require something that’s typically a matter of time: reversion in silly-expensive risk assets, notably cryptocurrencies,” he stated.

He underscored that if the US stock market were to remain under pressure, bond yields might eventually be pulled lower by the comparatively meager 2% or lower yields seen in China and Japan. Such a scenario, in McGlone’s view, adds tailwinds for gold because a shift from relatively high-yielding Treasuries to lower-yielding government bonds abroad could drive investors toward alternative havens.

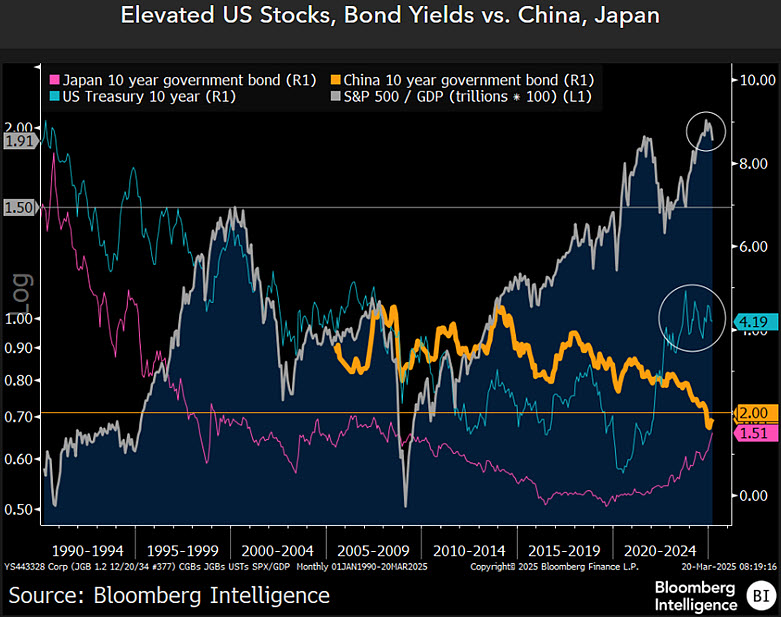

The chart shared by McGlone reinforces his analysis of decelerating demand for risk assets. One visual, titled “Elevated US Stocks, Bond Yields vs. China, Japan,” displays the persistent divergence between US Treasury yields, which hover around the 4.19% mark, and the comparatively subdued rates of Chinese and Japanese government bonds, situated closer to 2% and 1.51% respectively.

The graphic also portrays the S&P 500’s market cap-to-GDP ratio, which remains historically high despite recent volatility. McGlone’s conclusion is that continued pressure on equity markets, combined with global bond rates that sit well below US yields, could accelerate a rotation into gold if investors perceive a downturn in “expensive” asset classes, including risk assets like Dogecoin.

A third post addressed the broader altcoin market, with McGlone pointing to Ethereum as a leading indicator of whether the overall trend has turned bearish for digital assets. “Has the Trend Turned Down? Ethereum May Guide – Ether, the No. 2 cryptocurrency, is breaking down, with deflationary implications and gold underpinnings,” he noted.

At press time, DOGE traded at $0.16663.